Each week in the Money Talk Podcast, Landaas & Company advisors offer insights for long-term investors by discussing the ever-changing circumstances of the financial markets. Try to answer the following questions, based on some of those conversations.

1.

In the Dec. 2 Money Talk Podcast, Dave Sandstrom tried to clear up a common misunderstanding about inflation. Based on his explanation, when indicators show inflation is going down, what is happening with prices?

(Choose one.)

- More prices are declining than increasing.

- Prices are going down at a faster rate.

- Price increases are getting lower.

- Prices are getting lower.

(See answer below.)

2.

Also in the Dec. 2 Money Talk Podcast, Kyle Tetting talked about Series I savings bonds, which had record sales in 2022. In response, Tom Pappenfus used I bonds as an example of which of the following?

(Choose one.)

- How a portfolio with diversified assets can lower risk

- How higher inflation is helping fixed-income investors

- How short-term uncertainty can increase volatility

- How some investments might not look as good in the long term

(See answer below.)

3.

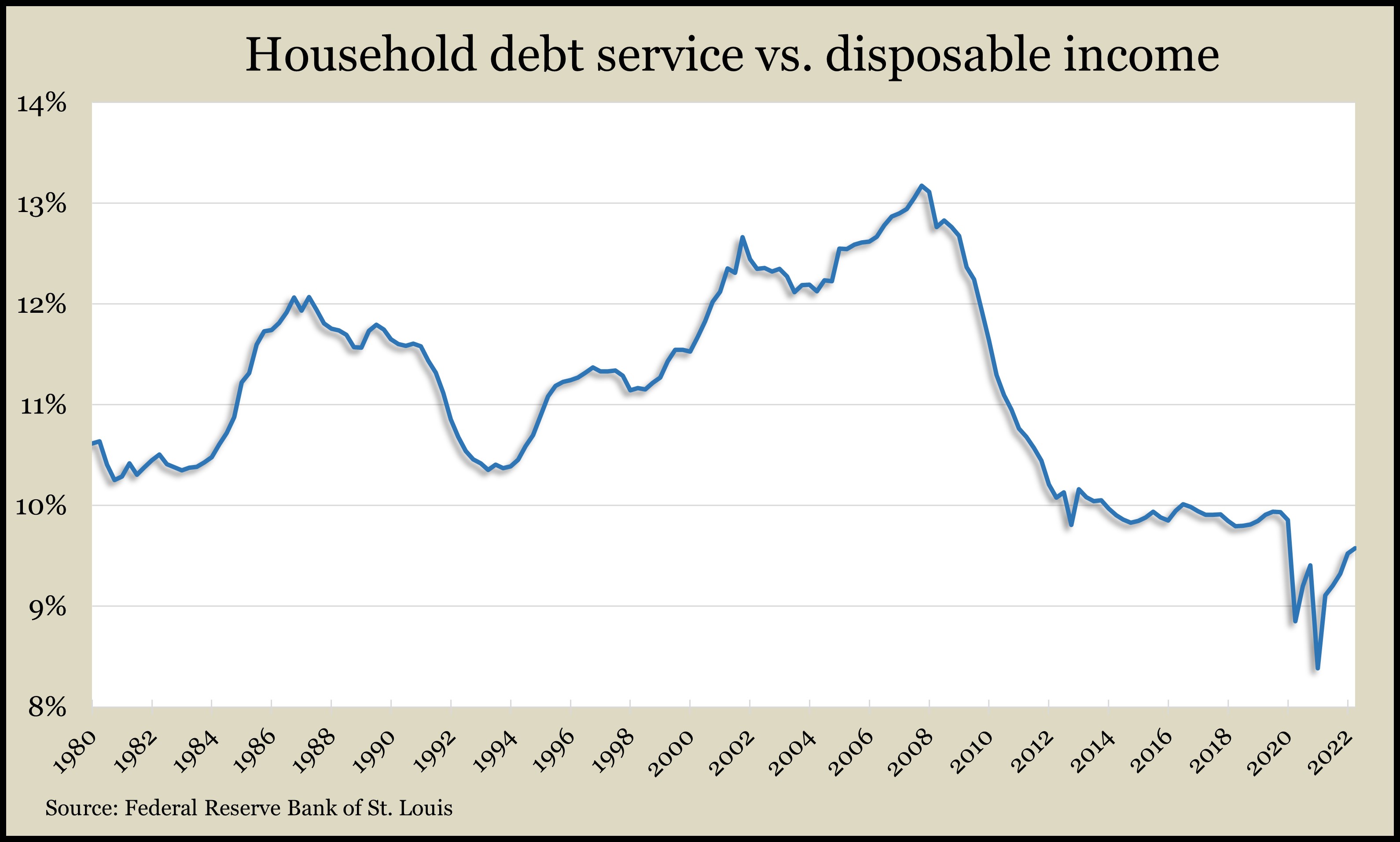

The graphic above charts an economic indicator that Adam Baley said suggests U.S. consumers remain in relatively good shape. Which of the following indicators was Adam referring to in the Dec. 9 Money Talk Podcast?

(Choose one.)

- Personal bankruptcy filings

- Debt service ratio

- Continued claims for unemployment insurance

- Reverse mortgage applications

(See answer below.)

4.

Also in the Dec. 9 Money Talk Podcast, Steve Giles talked about “some of the most difficult conversations we have.” Which of the following was he referring to?

(Choose one.)

- Spouses trying to balance careers and family time

- Survivors who have no advance knowledge of a loved one’s estate plans

- Young investors experiencing their first bear market

- Recent retirees contemplating relocation

(See answer below.)

5.

In the Dec. 16 Money Talk Podcast, Kendall Bauer listed some of the extraordinary developments in 2022, including sharp increases in gas prices and mortgage rates, 40-year high inflation and Russia’s invasion of Ukraine. Which of the following was a positive sign for investors that Kendall identified?

(Choose one.)

- The Fed may be closer to easing up on interest rate hikes

- New prime ministers in the United Kingdom, Israel and Italy

- The launch of COVID-19 boosters targeting both the original and Omicron strains

- The shift of consumer spending toward services away from goods

(See answer below.)

Answers

1.

c. Price increases are getting lower.

Learn more

Inflation can cut both ways for retirees, by Joel Dresang

Talking Money: Inflation, by Adam Baley

Inflation: Nuances matter for investors, by Kyle Tetting

2.

d. How some investments might not look as good in the long term

Learn more

I bonds, from TreasuryDirect.gov

Investor upsides as interest rates rise, a Money Talk Video with Kendall Bauer

Bonds also face investment risks, a Money Talk Video with Tom Pappenfus

Get the total picture of your investments, a Money Talk Video with Paige Radke

3.

b. Debt service ratio

Learn more

Key economic indicators every investor should know, from the Financial Industry Regulatory Authority

Holiday shopping with inflation, by Joel Dresang

Yuletide logjams: Economy hits holidays, by Joel Dresang

4.

b. Survivors who have no advance knowledge of a loved one’s estate plans

Learn more

Wishes for sharing, safekeeping, by Joel Dresang

Estate Planning FAQs, American Bar Association

Estate Planning: Power of Attorney, Financial Industry Regulatory Authority

Naming beneficiaries: Communicate clearly, a Money Talk Video with Mike Hoelzl

When Should I …check my beneficiaries? by Art Rothschild and Isabelle Wiemero

When a loved one passes, what happens to their accounts?, by the Financial Industry Regulatory Authority

5.

a. The Fed may be closer to easing up on interest rate hikes

Learn more

The Fed: What investors should know, a Money Talk Video with Dave Sandstrom

Over the river and through the Fed, by Kyle Tetting

Recessions: Uncertainty suggests balance, a Money Talk Video with Kyle Tetting

PREVIOUS MONEY TALK QUIZZES

(initially posted Dec. 29, 2022)

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.