Show Notes

Subscribe: Spotify | Amazon | Apple Podcasts | Google Podcats | RSS

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter May edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

John Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 29-May 3, 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

Housing demand, buoyed by anticipated cuts in interest rates, resulted in continued gains in residential prices in February, according to the S&P CoreLogic Case-Shiller home price index. The national index rose by 6.4% from the year before, the fastest growth since November 2022. The year-to-year gain accelerated for the third month in a row for every market in the 20-city composite index.

The Conference Board said its consumer confidence index declined in April for the third month in a row, though it remained relatively steady with measures from the past two years. The business research group said consumer optimism toward current economic conditions outweighed concerns about the near-term future. Economists keep an eye on consumer confidence because consumer spending accounts for about two-thirds of U.S. economic activity.

Wednesday

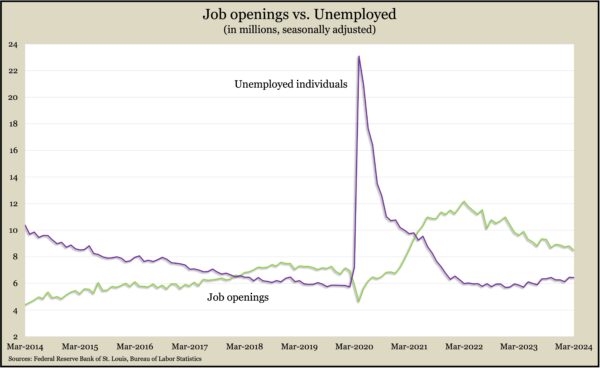

Employers listed slightly fewer job openings in March, but longer comparisons show the hiring market loosening. The Bureau of Labor Statistics said openings shrank to 8.5 million, the lowest in three years. Openings peaked at 12.2 million in 2022 and were below 7 million just before the COVID-19 pandemic. Despite fewer openings over the last couple of years, job posts continued to outpace the number of unemployed workers looking for a job by about 2 million. The number and rate of workers quitting their jobs – a sign of employment confidence – remained below the pre-pandemic level for the fifth month in a row.

The manufacturing sector continued contracting in April for the 17th time in 18 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of supply managers, showed the sector slipping from a slight expansion in March. While the index’s employment component contracted for the seventh month in a row, production grew, and other indicators suggested manufacturing demand is in the early stages of recovery.

The Commerce Department said construction spending declined 0.2% in March while gaining nearly 10% from March 2023. Residential expenditures, accounting for 43% of all construction spending, slowed 0.7% from the seasonally adjusted annual rate in February and were 4.5 % ahead of the year-ago pace, driven mostly by single-family housing. Spending on manufacturing construction led private-sector gains. Government outlays for construction rose 0.8% for the month and 18% over the year, led by power structures and public safety facilities.

Thursday

The U.S. trade deficit shrank 0.1% in March to $69.4 billion as the value of exports dropped 2% while imports declined 1.6%. Leading the decline in exports were commercial aircraft, industrial products and soybeans. Cars, pharmaceutical preps and cell phones, led imports lower. The Bureau of Economic Analysis said the first-quarter deficit widened 6.5% from the year before as exports rose 1.2% while imports gained 1.6%. Trade deficits detract from gross domestic product, the key measure of economic growth.

The four-week moving average for initial unemployment claims dipped for the second week in a row, reaching its lowest level in seven weeks, which was 43% below the all-time average. The Labor Department said 1.8 million Americans claimed jobless benefits in the latest week, down 2% from the week before but up 3% from the same time last year.

The Bureau of Labor Statistics said worker productivity rose at an annual rate of 0.3% in the first quarter, as the pace of output gained 1.3% while hours worked rose 1%. The 0.3% productivity rate compared to 3.2% in the last quarter of 2023. Hourly compensation rose 5% in the first quarter, placing employment costs at an annual rate of 4.7%. Since the end of 2019, productivity has grown at a 1.5% annual pace, down from the 2.1% average since 1947.

The Commerce Department said factory orders rose 1.4% in March, led by demand for commercial aircraft and automotive products. Excluding orders for transportation equipment, demand for manufactured goods rose 0.5%. Compared to March 2023, the dollar amount for total orders rose 0.3%, vs. a 0.7% gain excluding transportation. A proxy for business investments rose 0.6% from its year-earlier level.

Friday

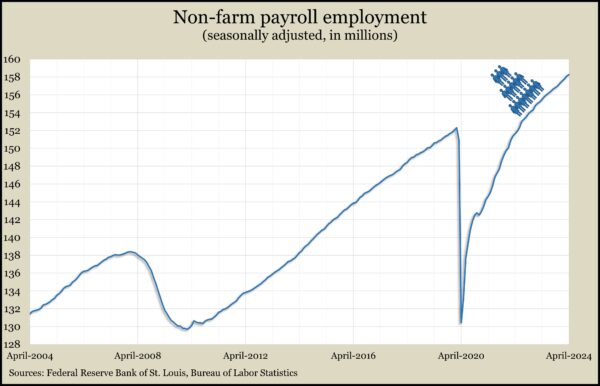

U.S. employers added 175,000 jobs in April, the 40th consecutive boost. According to payroll data from the Bureau of Labor Statistics, the additional jobs were short of the 242,000 12-month average. Broad gains were led by health care and social assistance. Temporary help positions – sometimes a harbinger of overall employment movements – fell to their lowest level since December 2020. The average hourly wage rose 3.9% from the year before, the slowest increase since May 2021. A separate survey of households showed the unemployment rate bouncing back to 3.9%, where it was in February. Unemployment has ranged narrowly between 3.7% and 3.9% since August.

The service sector of the U.S. economy contracted in April for the first time since the end of 2022, according to the Institute for Supply Management. The trade group said its index for the service sector showed a reversal even though new orders expanded for the 16th month in a row. Employment cuts accelerated for the third month. The ISM noted an overall slowdown expressed by supply managers interviewed, though responses varied by business. The group cited ongoing business concerns about inflation and geopolitical issues.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16151, up 288 points or 1.4%

- Standard & Poor’s 500 – 5128, up 28 points or 0.5%

- Dow Jones Industrial – 38676, up 436 points or 1.1%

- 10-year U.S. Treasury Note – 4.50%, down 0.17 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.