Category: Markets

Investing fundamentals: A shift in winds

“A fundamental shift to a weaker dollar creates opportunities both here and abroad.”

Mid-2025: Foggy outlook, balance rules

Summer usually has clearer skies, but the financial forecast mid-2025 is clouded by tariff concerns, as Adam Baley explains.

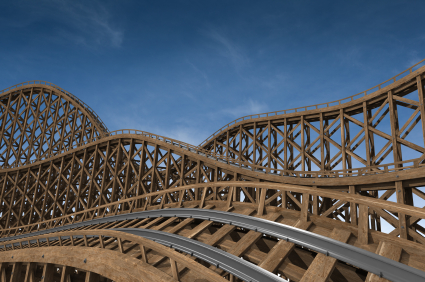

Summer forecast: Frenetic, volatile

Summer activities typically mean calmer markets, but unresolved questions this summer might shift the pattern.

Don’t fix the roof in the eye of a storm

After getting whipped about early in April, investors shouldn’t get lulled by the subsequent calm, Kyle Tetting advises.

Tariff volatility: Investor questions

Amid market volatility sparked by U.S. tariff announcements, Kyle Tetting advises three questions for long-term investors.

Seeking balance amid volatility

“Despite recent volatility,” Kyle Tetting writes, “we have not seen much change in the long-term fundamental outlook.”

Seeking deeper meaning from one sell-off

Investors recognized that we can’t always take reports such as DeepSeek’s at face value. I see a bigger issue at play.

My outlook for investing in 2025: 2-0-2-5

2024 largely came in line with what we had expected for a steady but solid economy. And 2025 looks to be more of the same.

Looking back on a fantastic 2024

Despite 2022 setbacks for nearly every investable asset, three-year returns are above average for broad measures.

Cautious optimism: A balancing act

As history has proven, “cautious optimism” works. But history is written across years and decades, not three quarters.