Money Talk Podcast, Friday Nov. 17, 2023

Podcast: Play in new window | Download

Subscribe: iTunes | Android | Google Play | RSS

Landaas & Company newsletter November edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Steve Giles

(with Max Hoelzl and Joel Dresang engineered by Jason Scuglik)

Week in Review (Nov. 13-17, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

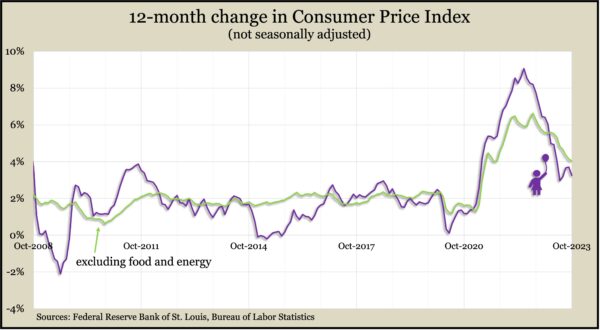

Inflation continued to slow in October, thanks in part to lower gas prices. The Bureau of Labor Statistics reported that the Consumer Price Index, the broadest measure of inflation, was unchanged from September and up 3.2% from the year before. That was the smallest 12-month increase in the index since March 2021. Although it continued to exceed the Federal Reserve long-range target of 2%, it was down from a four-decade high of more than 9% last summer. The core CPI, which strips out volatile food and energy prices, rose 4% from October 2022, the lowest gain in more than two years.

Wednesday

Inflation on the wholesale level declined in October, according to the Producer Price Index. The gauge fell by 0.5% from September, led by lower prices in goods, chiefly energy products, the Bureau of Labor Statistics reported. The one-year wholesale inflation rate was 1.3%, down from nearly 12% in the spring of 2022. Excluding volatile costs for food, energy and trade services, the so-called core Producer Price Index rose 2.9% from October 2022, down from almost 9% in the summer of 2022.

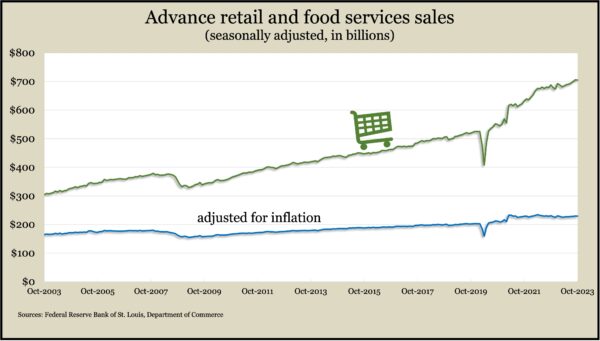

Retail sales receded in October for the first time in seven months. Sales fell 0.1% over all with seven of 13 categories reporting lower sales, including car dealers, gas stations, furniture stores and home-and-garden centers. Sales aren’t adjusted for price changes, so lower prices at gas stations factored in. Bars and restaurants added sales for the seventh month in a row. Since October 2022, total retail sales rose 2.5% while bars and restaurants increased by 8.6%. Adjusted for inflation, retail sales were down 0.2% from September.

Thursday

The four-week moving average for initial unemployment claims rose for the fourth week in a row to its highest point since September, according to the Labor Department. The measure was still 40% below the 56-year average, suggesting the relative tightness of the labor market. Total claims rose 0.2% in the latest week to more than 1.6 million, which was 27% higher than the year before.

The Federal Reserve reported a slight decline in industrial production in October, the first setback in fourth months. Strikes at automotive plants resulted in a 10% drop in that sector’s output from September, the Fed reported, accounting for much of a dip in manufacturing production. As a result, total industrial production declined 0.1% for the month. If not for the auto makers, total production would have gained 0.1%, according to the Fed. Industries’ capacity utilization rate, an early indicator of inflation, edged down to its lowest level since June, remaining below the 50-year average for the 12th month in a row.

Friday

More than a year and a half after the Fed began raising interest rates, housing construction data continued to show a pause in October. The annual pace of building permits and housing starts rose slightly, remaining near pre-pandemic levels but down from accelerations in 2021 and 2022. A report from the Commerce Department showed new authorizations and new construction for single-family houses outgaining multi-family projects. The rate of housing units under construction slowed marginally in October but stayed near the highest on record, based on data going back to 1970.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14125, up 327 points or 2.4%

- Standard & Poor’s 500 – 4514, up 99 points or 2.2%

- Dow Jones Industrial – 34947, up 664 points or 1.9%

- 10-year U.S. Treasury Note – 4.44%, down 0.19 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.