Podcast: Play in new window | Download

Landaas & Company newsletter October edition now available.

Advisors on This Week’s Show

Kyle Tetting

Adam Baley

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 2-6, 2023)

Significant Economic Indicators & Reports

Monday

Manufacturing continued its slump in September, according to the Institute for Supply Management’s manufacturing index. The index signaled contraction for the 11th month in a row, although at the highest level in that period. Purchasing managers surveyed by the trade group said that along with a slowdown in demand for manufactured items, their production execution and supply chains have improved. The index also reported an expansion in hiring.

The Commerce Department said the annual rate of construction spending rose in August for the eighth month in a row. The rate of $1.98 trillion was 7.4% above the year-ago pace. Residential expenditures, which accounted for 45% of total spending, increased from the August pace but were 3% slower than the year before because of a drop in multi-family housing construction. Spending on manufacturing construction (about 10% of all expenditures) rose 66% from the year before.

Tuesday

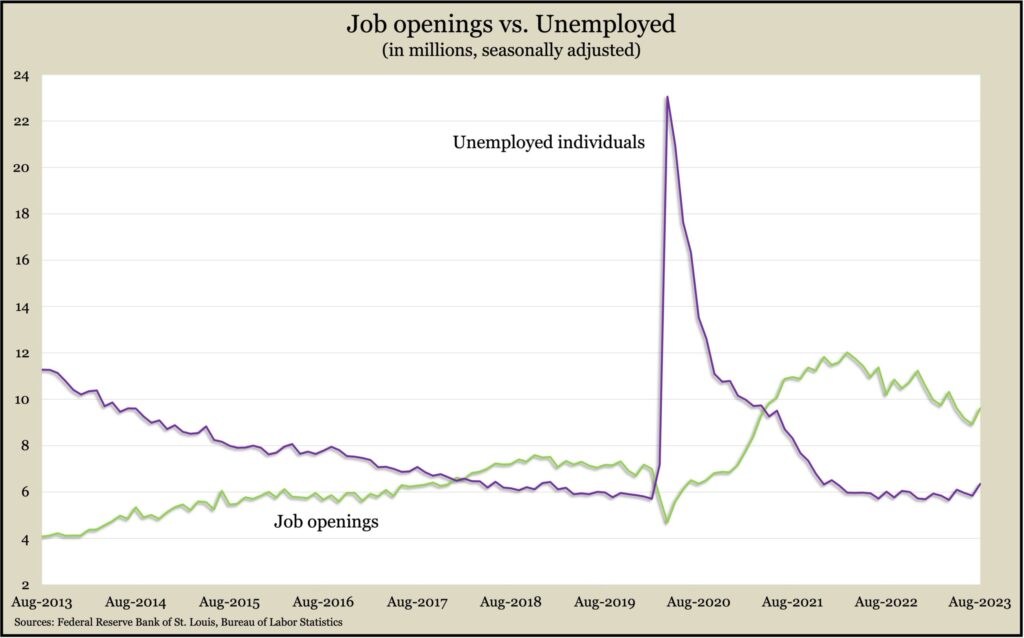

Employers expanded job openings in August for the first time in four months. According to the Bureau of Labor Statistics, the number of help-wanted posts rose nearly 8% to 9.6 million openings. Employers in professional and business services showed the biggest need for workers. Demand for employees has slid from an all-time high of 12 million openings in March 2022 but remained above the pre-pandemic level of 7 million. Data showed little change in the numbers of hires or separations. The level of employees quitting their jobs – a sign of worker confidence – was on par with both July and February 2020. Quits peaked in late 2021 and early 2022.

Wednesday

Orders for factory goods rose in August for the fifth time in six months, the Commerce Department reported. Manufacturing orders were up 1.2% from July, following a 2.1% decline from June. Compared to August 2022, orders were up 0.5%. Excluding volatile orders for transportation equipment, demand for factory goods rose 1.4% from July and was down 1.5% from the year before. Core capital goods orders, a proxy for business investments, rose 0.6% for the month and were up 2.1% from August 2022.

The U.S. services sector continued expanding in September, though at a slightly slower pace, according to the Institute for Supply Management. The trade group’s services index showed the ninth consecutive month of expansion, with signs of slower movement in new orders and hiring. The ISM said based on past history, the index suggested the entire U.S. economy was growing at a 1.3% annual pace.

Thursday

The U.S. trade deficit shrank 10% in August to $58.3 billion. The deficit, which detracts from gross domestic product, resulted from a 0.7% decrease in the value of imports bought and a 1.6% rise in exports sold. The decline in imports was led by crude oil and cell phones, while crude oil, cars and travel services helped exports grow. Through the first eight months of 2023, the trade gap narrowed nearly 21% from the year before as imports fell by 4% and exports increased by 1%.

The four-week moving average for initial unemployment claims sank for the fifth week in a row, reaching the lowest level since February. Data from the Labor Department showed average new applications for jobless benefits dipped 43% below the 56-year average, underscoring employers’ reluctance to let workers go. More than 1.6 million Americans were receiving unemployment benefits in the latest week, down 3% from the week before and up 29% from the same time in 2022.

Friday

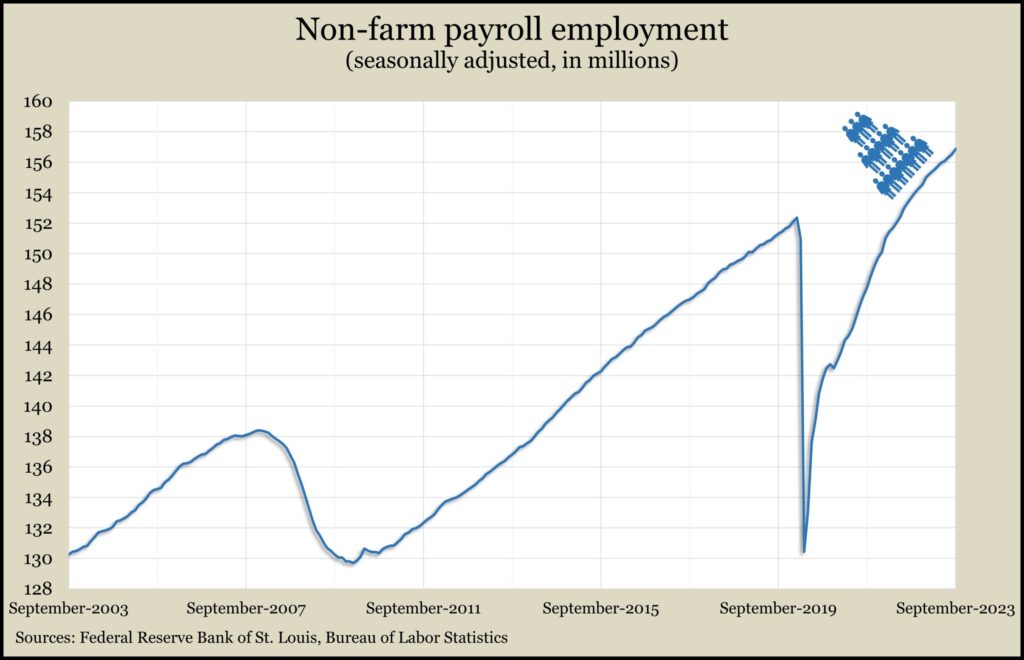

Employers added 336,000 jobs in September, above the 12-month average of 267,000 and the 33rd consecutive month of gains. The Bureau of Labor Statistics reported broad increases in payroll jobs, led by the leisure and hospitality industry, with bars and restaurants finally regaining their pre-pandemic staffing level. Average hourly wages rose 4.2% from the year before, a slight decline for the third month in a row. Wage rates have outpaced inflation since May. A separate household survey showed the unemployment rate staying at 3.8% in September, the 19th consecutive month below 4%, which hasn’t happened since the 1960s.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13431, up 212 points or 1.6%

- Standard & Poor’s 500 – 4309, up 20 points or 0.5%

- Dow Jones Industrial – 33408, down 100 points or 0.3%

- 10-year U.S. Treasury Note – 4.78%, up 0.21 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.