Podcast: Play in new window | Download

Landaas & Company newsletter December edition now available.

Advisors on This Week’s Show

Kyle Tetting

Dave Sandstrom

Tom Pappenfus

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Nov. 27-Dec. 1, 2023)

Significant Economic Indicators & Reports

Monday

New home sales declined in October, and prices fell as inventory increased slightly. The Department of Commerce said the annual sales rate dipped to 679,000, down nearly 6% from September’s pace and nearly 18% ahead of the same time last year. The pace for new houses was down 12% from when the Federal Reserve started raising interest rates in early 2022; the rate was 3% behind its level just before the pandemic. The number of new houses for sale rose from September but was below October 2022. The median sales price dropped to $409,300, down 18% from year before.

Tuesday

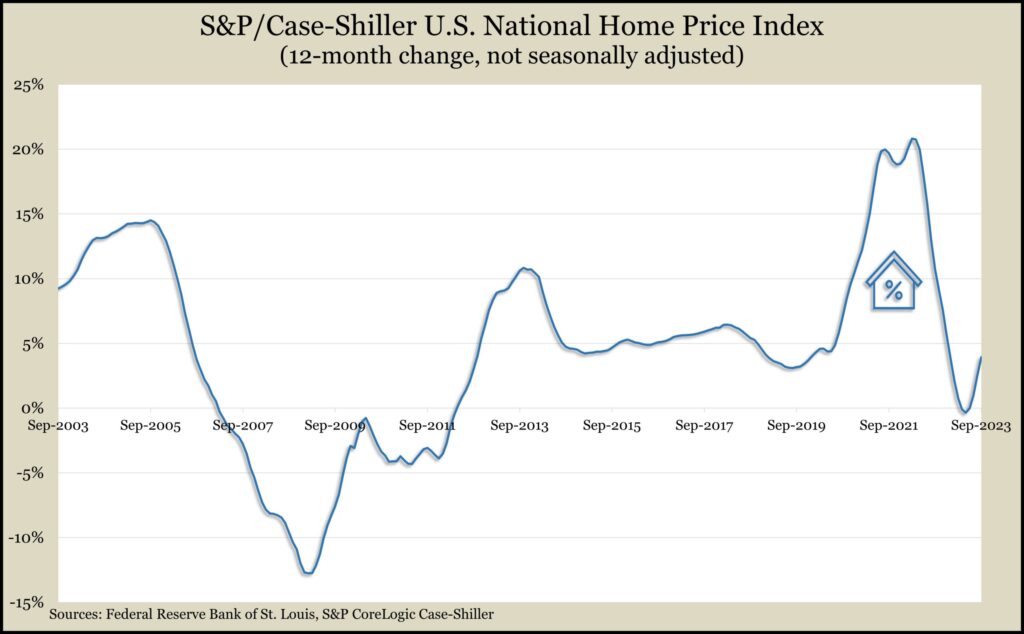

While higher mortgage rates continued to suppress housing sales, relatively low inventories kept pushing prices higher in September, according to the S&P CoreLogic Case-Shiller index. The September index, unadjusted for seasonal fluctuations, rose to a record high for the third month in a row, up 3.9% from September 2022. The index was nearly 7% higher than in January, which marked a turnaround in momentum following months of declines tied to higher mortgage rates. A spokesman for S&P said the breadth and strength in the “rally” in prices supports optimism toward continued gains.

The Conference Board said consumer confidence rose in November for the first time in three months. Opinions on current conditions inched down while expectations rose, though they remained low enough to suggest near-term economic recession. The business research group repeated its prediction of a short, shallow recession in 2024, but consumer expectations were the lowest so far this year. Among the concerns expressed by consumers were rising prices generally as well as war and interest rates.

Wednesday

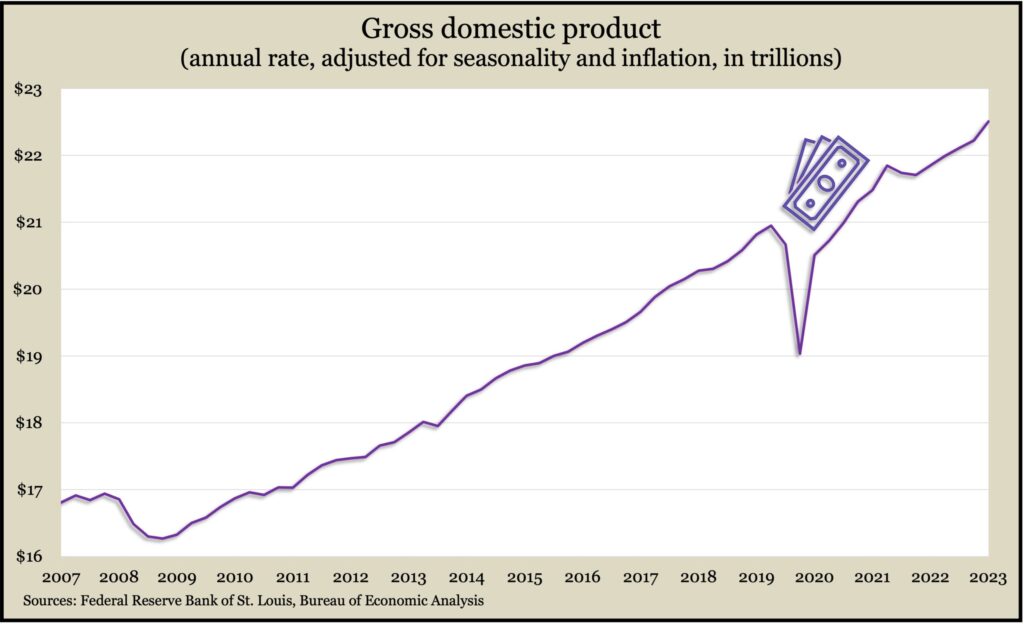

The U.S. economy grew faster than previously estimated in the third quarter, rising at an annual pace of 5.2.%, the Bureau of Economic Analysis reported. Stronger business investments and increased spending from state and local governments helped offset slower consumer spending since an earlier estimate of 4.9% growth in the gross domestic product. The 5.2% pace was the highest since the end of 2021 and compares with a 2.1% rate in the second quarter of this year. Without annualizing the figures, inflation-adjusted GDP climbed 3.4% from the third quarter of 2022. The Federal Reserve’s favorite measure of inflation, the personal consumption expenditure index, rose 3.4% from the year before, the slightest increase since the beginning of 2021.

Thursday

A key driver of the U.S. economy, consumer spending, rose in October at its slowest pace since March. The Bureau of Economic Analysis said personal spending and personal income both rose by 0.2% from September. Personal saving rose slightly but was about 40% lower than just before the pandemic. The same report showed the Personal Consumption Expenditures index rose 3% from October 2022, the lowest inflation rate since March 2021. That was down from a 41-year high of 7.1% in June 2022.

The four-week moving average for initial unemployment claims fell for the second week in a row, remaining around 40% below its 56-year average. The Labor Department also reported that total claims rose more than 4% from the week before to just under 1.7 million. That was up 23% from the same time last year.

The National Association of Realtors said its pending home sales index sank 1.5% in October, reaching the lowest point since it was created in 2001. The index of contract signings was down 8.5% from the year before. The trade group blamed higher interest rates for the record low and said that recent drops in rates won’t be enough to offset a chronic shortage of houses for sale.

Friday

Manufacturing contracted in November for the 13th month in a row, according to the Institute for Supply Management. The trade group’s survey of manufacturing managers showed companies experiencing continued soft demand while they tried to manage costs, including “more aggressively” tackling employment expenses. The trade group said, based on past history, its index suggests the U.S. economy is receding at an annual rate of 0.7%.

The Commerce Department said the annual pace of construction spending rose 0.6% in October. Residential spending, which accounts for more than 40% of the total, rose 1.2% from September, all because of increased expenditures on single-family housing. Compared to October 2022, total construction spending rose nearly 11%, including a 0.9% increase in residential spending and a 71% gain in manufacturing spending.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14305, up 39 points or 0.3%

- Standard & Poor’s 500 – 4595, up 35 points or 0.8%

- Dow Jones Industrial – 36245, up 855 points or 2.4%

- 10-year U.S. Treasury Note – 4.23%, down 0.24 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.