By Joel Dresang

“In light of the recent volatility in the stock market, …” could be the start of any investment solicitation. But this was an email from the company administering my pension.

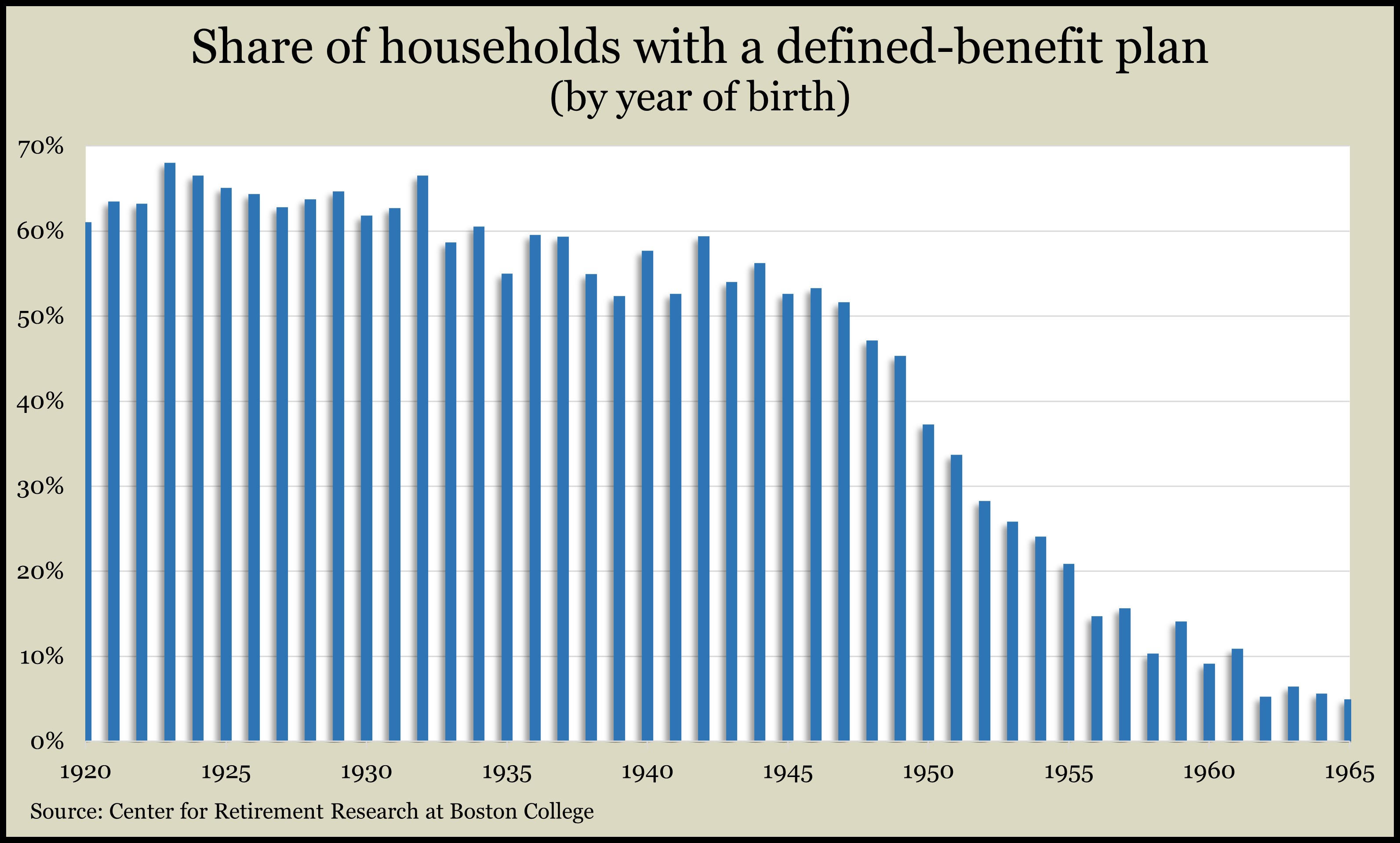

I am part of a vanishing class of workers with so-called defined-benefit plans—company-funded accounts guaranteeing set monthly payments in retirement. There used to be more of us.

My pension is from a former employer. In my age group, 1 in 10 households has a pension. That’s down from more than 6 in 10 in my father’s cohort.

For decades, the onus of retirement investing has been shifting from employers to workers, from a job benefit to a do-it-yourself project. Some economists are concerned about the fallout.

The Center for Retirement Research at Boston College has found that newer retirees without pensions are more likely to outlive their money. Researchers have associated defined-benefit plans (DBs) with a slower exhaustion of wealth.

“Retirees with a DB had less need to draw down financial assets in their retirement accounts to cover their spending and could reserve these assets for late-life medical expenses or bequests,” the report says.

Of course, that makes sense. Pensioners can rely on guaranteed monthly benefits to help pay for living expenses, whereas those without pensions must tap the money they saved and invested for retirement.

The research compared retirees who started with $200,000 in financial assets separate from any pension. Those with pensions spent down $28,000 less of their nest egg by age 70. By age 75, the pensioners drew down $86,000 less than their pension-less peers, providing that much more for later expenses and heirs.

Not only have pensions helped retirees afford to keep their fingers off their investments, but they also represent reliable fixed-income sources that aren’t exposed to the precariousness of the stock market.

One lump or no?

Often, pensioners get a choice between taking their benefits as monthly payments or as a one-time lump sum. As Isabelle Wiemero explains in this Money Talk Video, responses depend on individual circumstances.

“Your pension plan benefit is protected,” explained the email from my pension administrator. “The responsibility for managing the volatility in the stock market is borne by” us.

To that point, the Boston College researchers found that retirees spent less of their wealth the more they could rely on Social Security and commercial annuity payouts. Even home equity made a difference.

“They are more secure because of those pensions,” Art Rothschild explains. “And those with sufficient pensions who also have accumulated assets in different types of accounts have more flexibility in determining what to take from those other pockets in retirement.”

Fixed assets can give investors more confidence in leaving their stock investments alone, Art notes. That is why he balances portfolios to include a portion set aside in bonds and other fixed-income securities. He works with clients to determine post-retirement spending needs and arranges with them to set aside several years’ worth of expected withdrawals in bonds.

“Their fixed-income portfolios can be viewed like a pension, as they will be the source of their distributions,” Art says. “You can just have confidence that you have enough, based upon your draw rate, relative to the amount you have there.”

Feeling secure about short-term living expenses can free retirees from worrying about their stock investments, which are intended to outpace inflation over time. That’s particularly important when stock prices are unstable and trigger unadvisable investor behaviors.

“The downside to the responsibility that workers have when they have to put away for their own retirements,” Art says, “is that they don’t know what they are doing and oftentimes don’t get the help they need to be successful. They often sell and buy at the wrong times and add money to different asset classes in all the wrong amounts, times and places.”

Properly invested, most individuals should be able to manage their money better themselves than through a pension plan, Brian Kilb notes. The trouble is that researchers find individuals tend not to invest properly on their own. As a scholarly article in the Journal of Financial Economics bluntly put it, “Individual investors have a striking ability to do the wrong thing.”

Various research has found that retirees have benefited from pensions in part because they counter the common disinclinations to save enough and invest wisely. A Canadian study estimated that to replace 70% of the average worker’s income in retirement would require $1.2 million in lifetime savings for those without pension plans. Those with a proper pension, though, would need to save just $310,000.

Other findings from the Center for Retirement Research show pensions particularly helping retirees who weren’t uppermost earners. A study found the top 25% of earners held 35% of all defined-benefit wealth and 53% of defined-contribution wealth including 401(k)s and IRAs.

Other Money Talk articles from Joel Dresang

But no one is predicting a comeback for defined-benefit plans. That means retirees need to rely on Social Security and the bond portion of their investments to cover their spending needs so they can keep a cool head when the stock portion is volatile.

“If you can compartmentalize and look at the fixed-income portion of your portfolio as that source,” Art says, “It can give you that peace of mind.”

Joel Dresang is vice president-communications at Landaas & Company.

Drawdown

Most investors do not want to spend down their retirement funds. A 2021 survey found that only 43% of retirement-age Americans plan to draw down their accounts. Among those who hoped to keep money:

- 38% wanted assets for unforeseen costs later in retirement

- 37% viewed spending down assets as unnecessary

- 33% wanted to leave as much as possible to heirs

- 31% felt better with higher account balances

- 27% feared running out of money

Learn more

Not your parents’ investment plans, by Joel Dresang

Retirement spending: Safe rates, a Money Talk Video with Art Rothschild

Why investments outperform their investors, a Money Talk Video with Kyle Tetting

Investing for the long run can vary, by Joel Dresang

Retirement 101: Having a plan, a Money Talk Video with Tom Pappenfus

Talking Money: Pension payouts, a Money Talk Video with Isabelle Wiemero

(initially posted April 29, 2022)

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.