By Joel Dresang

I can think of once when I was overconfident. And it bit me.

I was a preschooler and had just grown into a pair of blue denim shorts handed down from one, if not all four, of my brothers. Knowing that the older boys wore those pants, I felt all grown up as soon as I fit into them.

Those shorts gave me the courage to march up to the menacing dog behind a neighbor’s house and let him know that he could no longer terrorize me. That’s when the dog lunged up and bit me on the lip.

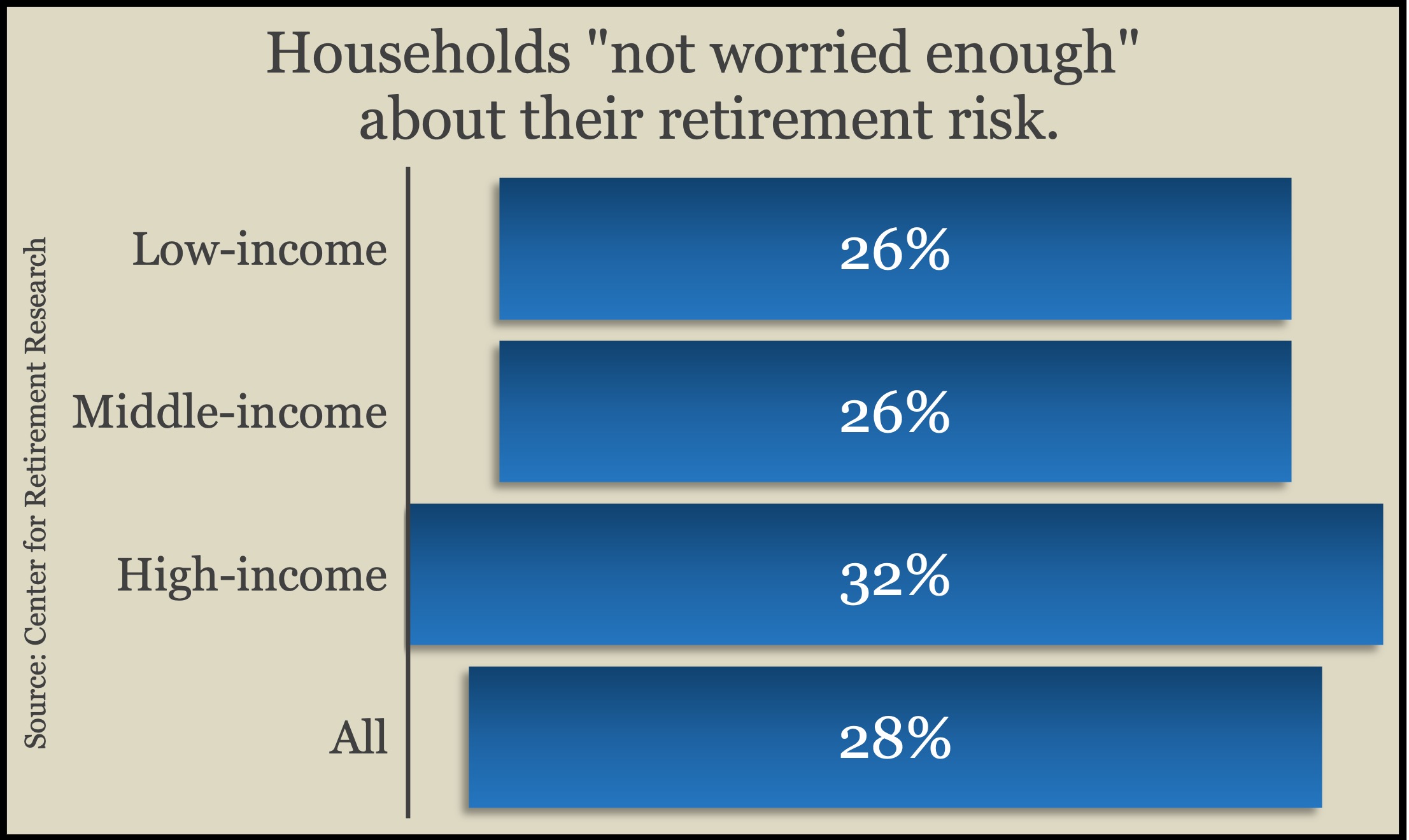

Overconfidence can be hazardous to investors. Research economists at Boston College have found that nearly half of all households are at risk of not affording their retirement. But only about one third acknowledge it. Most at risk: High earners.

“Households that were overly optimistic about the economic recovery or overestimated how much income their assets could provide may be more likely to be ‘not worried enough.’ Their overconfidence may lead them to underestimate possible risks,” according to a report from the Center for Retirement Research.

Researchers analyzed years of data from the Federal Reserve Board’s Survey of Consumer Finances to determine how much Americans risk outliving their assets and how attuned they are to the risks they face.

Among the conclusions: Households with higher incomes — especially those with expensive homes and two-income families where only one earner saved — had a higher propensity to not worry enough about their retirement risks.

Understandably, while two earners can spend more, they can’t afford to maintain their lifestyle on the retirement savings of one.

Also, the wealth effect — a false sense of financial wellbeing bloated by higher stock prices and home values — exacerbates overconfidence among upper earners, according to the researchers. Like a brash little boy in his brothers’ old pants, investors who feel wealthier than they are would be less inclined to plan ahead and consider consequences.

A runup in market prices also might be stoking overconfidence among older investors, according to a recent article in The Wall Street Journal. The Journal reported that above-average stock returns have emboldened older investors to be imprudent with their allocations.

Conventional wisdom holds that as investors age, they can afford volatility less, so they should embrace more fixed-income allocations. Instead, the Journal reported, older investors show a surprising tilt toward stocks. At one large national brokerage, 20% of customers 85 and older have nearly all their money in stocks. The same goes for 25% of customers between 75 and 84.

As the article explained: “Having significant exposure to stocks later in life can be risky, advisers and economists say, if only because if the market were to tumble, retirees needing cash might have no choice but to sell their shares at bargain prices.”

Discussing the matter on a recent Money Talk Podcast, Art Rothschild noted that investors have varying tolerance to risk and although some may have the aggressiveness of “gunslingers,” stocks are an important source of long-term growth for balanced portfolios.

The point is not being too confident and risk getting bit on the lip.

It’s one thing to know the risk and take it anyway, but it’s another if you don’t realize the risk you’re taking because you can’t see past your own hubris.

The good news is that 60% of Americans have a handle on their finances and are aware of the risk they face, according to the Center for Retirement Research. The study shows that 28% are not worried enough about their risk of running out of money.

Then there’s the 15% researchers identified as too worried. Those individuals are underestimating their ability to afford retirement. That means they’re not enjoying their money as much as they can afford or they’re making needless sacrifices.

Other Money Talk articles from Joel Dresang

Whether it’s my nature, my upbringing or that bout with bravado in my big-boy britches, I tend not to be overconfident. If anything, I have to worry about being too worried.

To make sure we’re on track for retirement, my wife and I have been checking in with our investment advisor once a year. In addition, I occasionally tally our retirement accounts and calculate a 4% annual withdrawal rate. Then I add that estimate to what we expect from pensions and Social Security and compare the sum to how much we’ve been living on.

That exercise keeps me worrying just enough to stay humble but not too much to keep me up at night. Confidence is comforting, but I equate overconfidence with cockiness – like the hare that raced the tortoise. Remember how that ended.

Joel Dresang is vice president-communications at Landaas & Company.

Learn more

The importance of humility in investing, a Money Talk Video with Art Rothschild

Is My Money Going to Run Out in Retirement? from Investor.gov

Knowing The Number, by Brian Kilb

(initially posted July 28, 2023)

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.