By Brian D. Kilb

A few years back, I visited with a prospect who asked (based on The Number from his accumulated savings) how much he might expect to draw in retirement. The figure I gave him was less than he hoped for, and the meeting ended right there.

When I walked him to the door, I asked when he was retiring. He said he’d been retired for three weeks. Ouch!

The latest Retirement Confidence Survey from the Employee Benefit Research Institute found that 70% of Americans feel they are behind schedule in planning and saving for retirement. Nearly half are not confident they will be able to save as much as they think they need.

So how do we avoid being that angry retiree lacking the necessary resources? In a word, planning.

Figure for confidence

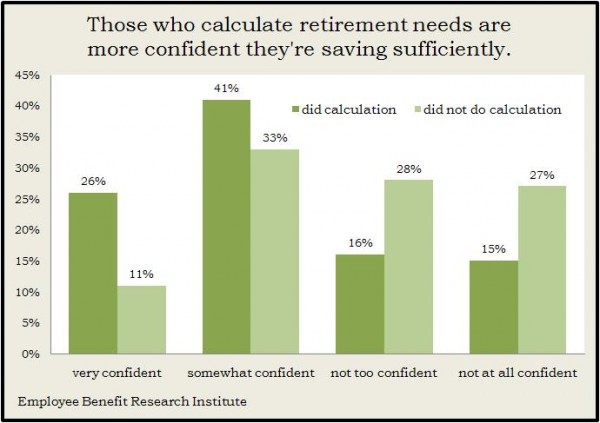

In more than 20 years of retirement surveys, the Employee Benefit Research Institute has found that “workers who have done a retirement needs calculation tend to be considerably more confident than those who have not about their ability to reach their goal, despite the fact that those doing a calculation tend to name higher retirement savings goals.”

I know from experience that planning leads to confidence, which breeds success. So let’s do some planning.

Many planners make this exercise overly complicated. I like to keep it simple and focus on only the key variables:

- The number of years until you retire

- How much you save annually

- How you invest that savings

- Your anticipated annual needs in retirement

Retirement planning begins and ends with The Number – how big your portfolio must be to provide for the difference between your annual spending needs in retirement and any pension and Social Security payments you receive.

Annual retirement needs

If you are close enough to retirement to have a fair idea of what you intend to spend per year, doing a budget would be time well spent.

If retirement is many years off, a quicker starting point would be using 80% of your current annual spending. But that is a rule of thumb. As you close in on retirement, you should do a budget to more accurately project your needs.

Withdrawal rate

Once you’ve determined your annual needs, the next step requires estimating The Number – how large a portfolio you’ll need to build to drive the targeted annual distribution.

A fair expectation for clients is a 4% annual withdrawal from their holdings. That’s based on historical rates of return of about 6% for a balanced portfolio (60% stocks, 40% bonds) minus inflation at a rate of 2%.

The Number

So to determine The Number – how big your investment portfolio needs to be to allow a proper annual distribution rate – divide your annual needs by 5%. As an example, let’s say you figure you need $50,000 per year in retirement from your portfolio. Using a 5% distribution rate suggests The Number for you is $1 million ($50,000 divided by .05) to support your annual needs.

Once you establish The Number, the other variables – how long until you retire, how much you’re saving regularly, how you’re investing it – come into play.

Unless you are retiring soon, The Number will need to be adjusted upward to factor in inflation. The longer out you are, the more uncertainty you face, but also the more time you have to set aside and invest to reach your inflation-adjusted goal.

Given your time frame, you can alter the variables and determine the results of many different scenarios. I always like to have a best-case and worst-case outcome to frame expectations. But the key is to have some expectations.

According to the Employee Benefit Research Institute, those who have tried to calculate The Number – even those who guessed – were “very confident” of their ability to retire comfortably at more than double the rate of those who had no clue.

You’ll find as the years pass that having a goal and having a plan will help you make decisions that lead to greater success.

Brian Kilb is president and chief operating officer at Landaas & Company.

initially posted May 11, 201; revised Feb. 10, 2016, May 21, 2018