Category: Investing

Investing fundamentals: A shift in winds

“A fundamental shift to a weaker dollar creates opportunities both here and abroad.”

Mid-2025: Foggy outlook, balance rules

Summer usually has clearer skies, but the financial forecast mid-2025 is clouded by tariff concerns, as Adam Baley explains.

Rebalancing: Too important to ignore

Once you find your balance, you need to maintain it. As Steve Giles explains, that doesn’t happen by standing still.

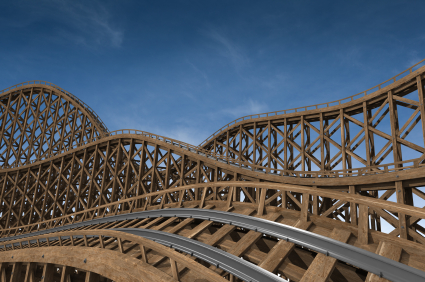

Summer forecast: Frenetic, volatile

Summer activities typically mean calmer markets, but unresolved questions this summer might shift the pattern.

Don’t fix the roof in the eye of a storm

After getting whipped about early in April, investors shouldn’t get lulled by the subsequent calm, Kyle Tetting advises.

Tariff volatility: Investor questions

Amid market volatility sparked by U.S. tariff announcements, Kyle Tetting advises three questions for long-term investors.

One thing that’s certain: Uncertainty

We take comfort in certainty. Uncertainty, we shun. At the same time, emerging research finds there is wisdom in uncertainty.

Seeking balance amid volatility

“Despite recent volatility,” Kyle Tetting writes, “we have not seen much change in the long-term fundamental outlook.”

5 reasons to watch the dollar

With the U.S. dollar at record levels, it’s a good time for investors to think about their portfolios’ international exposure.

Seeking deeper meaning from one sell-off

Investors recognized that we can’t always take reports such as DeepSeek’s at face value. I see a bigger issue at play.