Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Sept. 1-5, 2025)

Significant Economic Indicators & Reports

Monday

Markets and government agencies closed for Labor Day

Tuesday

The manufacturing sector contracted in August for the sixth month in a row and the 32nd time in 34 months. The Institute for Supply Management reported that the rate of decline slowed slightly from July with key components in its index – new orders and supplier deliveries – expanding. Hiring contracted for the seventh straight month. The trade group said based on past experience, the index suggested the U.S. economy is growing at an annual rate of 1.8%.

The Commerce Department said construction spending fell 0.1% in July and was down 2.8% from the same time last year. After cresting in May 2024, such expenditures have suffered their longest slowdown since the housing collapse of the Great Recession. Spending on residential construction, accounting for 42% of total expenditures, rose 0.1% from June but was down 5.1% from the year before. Manufacturing, representing more than 10% of all construction spending, was nearly 7% below its July 2024 level.

Wednesday

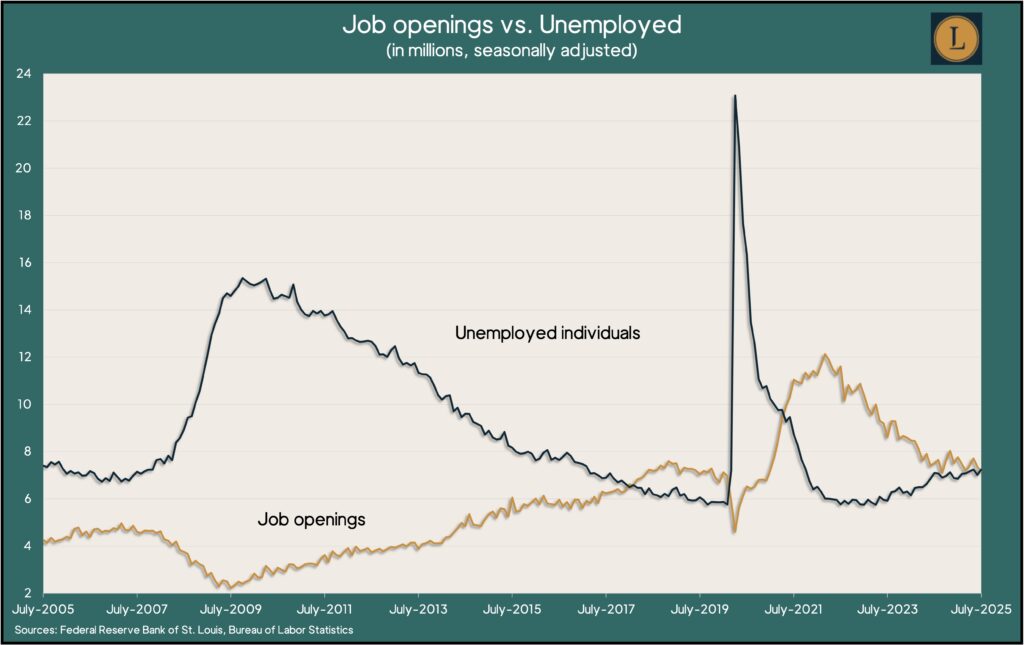

Employer demand for workers slowed in July with job openings declining below to 7.2 million, below the number of unemployed job seekers for the first time since 2021. July’s job openings still exceeded the number of unemployed workers looking for work, but it was down from a record 12 million posts in the spring of 2022, according to the Bureau of Labor Statistics. In a sign that workers continue to lack confidence in the labor market, the number of workers quitting their jobs to seek other positions stayed below the pre-pandemic level for the 20th month in a row.

The Commerce Department said factory orders sank in July for the third time in four months. The measure of demand for manufactured goods fell 1.3%, led by sales of commercial aircraft. Through the first seven months of 2025, orders were up 3.5% from the year before. Excluding requests for transportation equipment, orders rose 0.6% from June and were up 0.7% from July 2024. Orders for core capital goods, a proxy for business investments, rose 1.1% for the month and were up 2.3% from the year before.

Thursday

The U.S. trade deficit widened by 32% in July to $78.3 billion. Exports rose 0.3% from June, led by non-monetary gold and computer accessories. Imports increased 5.9%, led by non-monetary gold and computers. The Bureau of Economic Analysis reported that through July, the trade gap widened almost 31% from the year before with a 5.5% gain in exports and a 10.9% rise in imports. Trade deficits detract from U.S. economic growth, as measured by the gross domestic product.

The four-week moving average of initial unemployment claims rose for the fourth week in a row, reaching 12% above the pre-pandemic level, though it was 36% below the 58-year average. The Labor Department reported that total claims dipped 1% from the week before to 1.9 million, which was up more than 5% from the year before.

Worker productivity rose at an annual rate of 3.3% in the second quarter, reflecting a 4.4% uptick in output and a 1.1% increase in hours worked. The Bureau of Labor Statistics report was up from a previous productivity estimate of 2.4%. Labor costs rose at an annual rate of 1% Since the second quarter of 2024, productivity rose 1.5%, and labor costs increased 2.5%. According to the report, average annual productivity has grown 1.8% since the end of 2019, ahead of the 1.5% pace during the previous economic cycle, which started in 2007. Since 1947, productivity has averaged 2.1%.

The U.S. service sector expanded in August for the third month in a row and the 13th time in 14 months. The Institute for Supply Management said its survey of purchasing managers showed continued concerns about the effects of tariffs. The trade group said the index suggested the U.S. economy was growing at an annual rate of 1.1%.

Friday

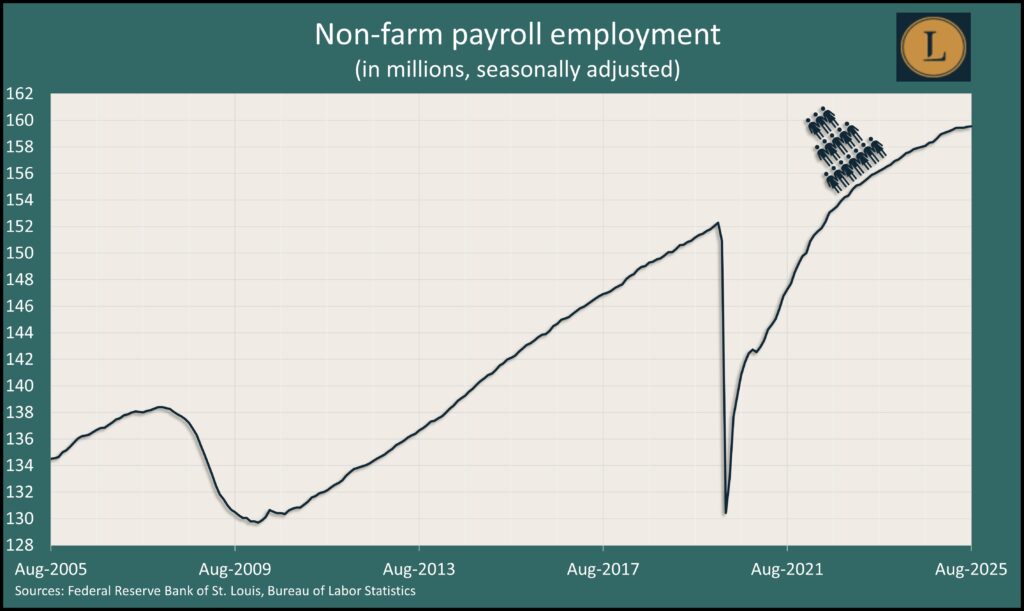

U.S. employers added jobs in August but at a continued slower rate, in another sign that the labor market is weakening. The Bureau of Labor Statistics said payrolls expanded by 22,000 jobs, barely advancing from their level in April. The agency also revised June and July job counts downward by 21,000, including a net loss of 13,000 jobs in June, the first setback since the end of 2020. Hiring of temporary help employees, an indicator of labor trends, fell to the lowest level since 2020 and was 21% below its peak two years ago. The average hourly wage rose 3.7% from the year before, still higher than overall inflation, but the lowest rate in 13 months. The unemployment rate for August rose slightly to 4.3%, the highest since 2021. A measure of underemployment also rose to its highest level in nearly four years.

Market Closings for the Week

- Nasdaq – 21700, up 245 points or 1.1%

- Standard & Poor’s 500 – 6482, up 21 points or 0.3%

- Dow Jones Industrial – 45401, down 144 points or 0.3%

- 10-year U.S. Treasury Note – 4.09%, down 0.14 point