Podcast: Play in new window | Download

Advisors on This Week’s Show

with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik

Week in Review (Sept. 15-19, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

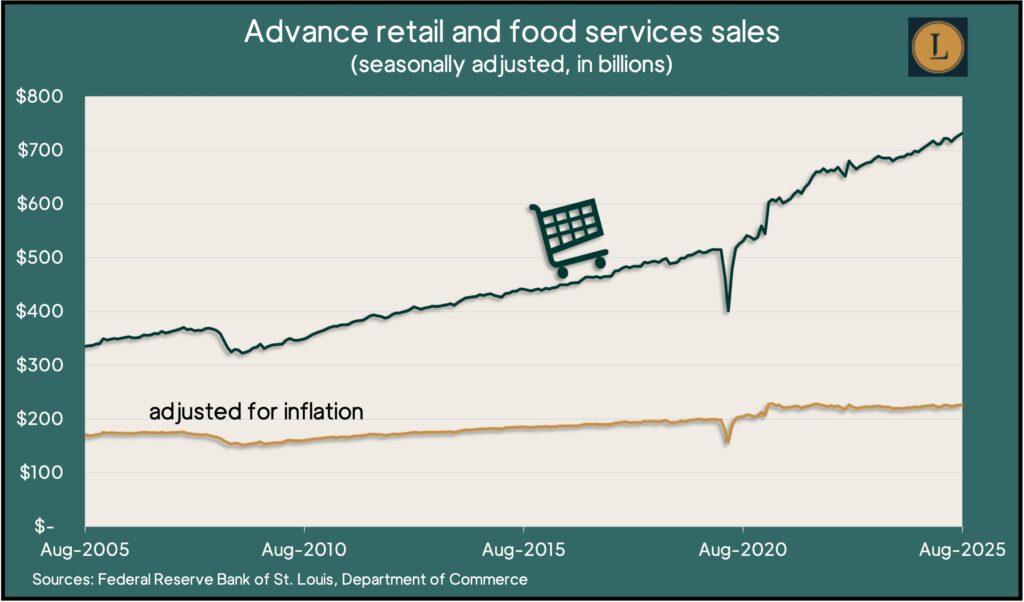

In a sign of consumer spending resilience, the Commerce Department reported a 0.6% rise in retail sales in August. Sales fell in only four of 13 categories: Furniture stores, health-and-beauty centers, general merchandisers and miscellaneous retailers. Gainers were led by a 2% increase from online retailers. Excluding sales at car dealers and gas stations, retail revenue grew 0.7%. Adjusted for inflation, total retail sales rose 0.2% in August.

U.S. industrial output rose 0.1% in August, following a 0.4% setback in July. The auto industry was the chief driver, the Federal Reserve reported. Output at U.S. car makers increased 1.3% from July. Since August 2024, overall industrial production was up 0.9%, with manufacturing also up 0.9%. Meanwhile, capacity utilization – an early indicator of rising inflation – rose marginally but remained below the 53-year average, last reached in late 2022.

Wednesday

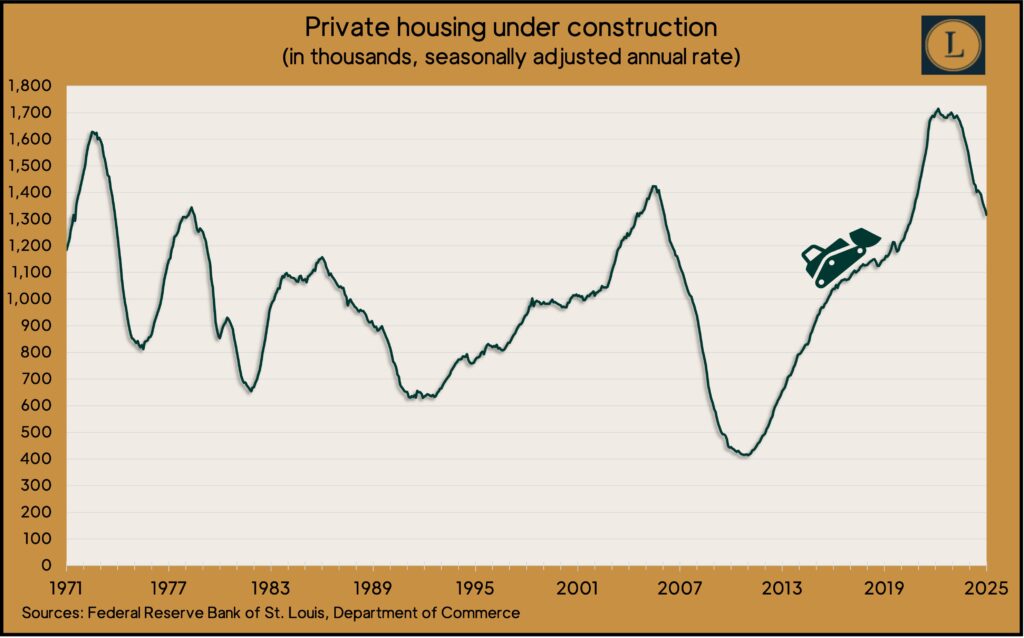

Rates of housing starts and building permits continued to slide in August, according to the Commerce Department. The annual pace of starts dropped nearly 8.5% from July and was off 6% from the year before, with critical single-family structures down nearly 12% from August 2024. For the 17th straight month, housing starts lagged the level set just before the COVID-19 pandemic, which was the fastest pace of building since late 2006. Meanwhile, permits – an indication of future housing construction – declined to the lowest level since May 2020, down almost 4% from July and 11% lower than August 2024. The pace of houses under construction continued falling from its all-time peak two years ago.

The policy-making body of the Federal Reserve Board reduced short-term lending rates by a quarter point and signaled more cuts possibly before the end of the year. The Federal Open Market Committee cited labor market risks as its chief reason to lower rates for the first time since December. It referred to “somewhat elevated” inflation, which could deter more aggressive rate reductions. The Fed has a dual mandate from Congress to keep prices stable and employment maximized.

Thursday

The four-week moving average for initial unemployment claims declined for the first time in six weeks. The measure was 34% below the all-time average and 16% above its low point just before the COVID-19 pandemic, according to data from the Labor Department. More than 1.8 million Americans were receiving jobless benefits in the latest week, down nearly 5% from the week before and up 6% from the same time last year.

The Conference Board’s index of leading economic indicators declined 0.5% in August following a revise increase on 0.1% in July. The six-month slide of the index worsened to 2.8% from a 0.9% decline in the previous six months. The business research group blamed tariffs for dampening U.S. growth and said only stock prices and credit indicators have made positive contributions to the index. Weaker factory orders, consumer expectations and labor market indicators were the biggest deterrents. The group forecast a 1.6% rise in gross domestic product for 2025, “a substantial slowdown” from 2.8% in 2024.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 22631, up 478 points or 2.2%

- Standard & Poor’s 500 – 6664, up 80 points or 1.2%

- Dow Jones Industrial – 46315, up 481 points or 1.0%

- 10-year U.S. Treasury Note – 4.14%, down 0.08 point