Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 20-24, 2025)

Significant Economic Indicators & Reports

Monday

The Conference Board said its September index of leading economic indicators was not available because of the government shutdown. The indicator from the business research group relies mostly on government data to show trends in the U.S. economy.

Tuesday

No major releases

Wednesday

No major releases

Thursday

The federal government shutdown delayed the Labor Department’s weekly report of initial unemployment claims, which gauges the job market and employers’ willingness to let go of workers.

The National Association of Realtors credited lower mortgage rates and improved affordability for helping to boost existing home sales in September. Sales rose 1.5% from the pace in August and were up 4.1% from the year before. At an annual rate of 4.06 million houses, sales were slightly below the 2024 final which was the lowest since 1995. The trade association said sales inventories rose to a five-year high in September but remained below the pre-pandemic level. The median sale price rose to $415,200, up 2.1% from the year before, the 27th consecutive year-to-year gain.

Friday

A 4.1% jump in gasoline prices led the cost increases that pushed inflation higher in September. Based on data collected before the government shutdown, the Bureau of Labor Statistics said the Consumer Price Index rose 0.3% from August and was up 3% from the same time last year. The year-to-year inflation rate was the highest since January and marked the 55th straight month above the Federal Reserve Board’s target of 2%. In that period, inflation ranged from 9.1% in mid-2022 to 2.3% in April. The core CPI, which strips out volatile costs for food and energy, rose 0.3% from August and was up 3% from September 2024.

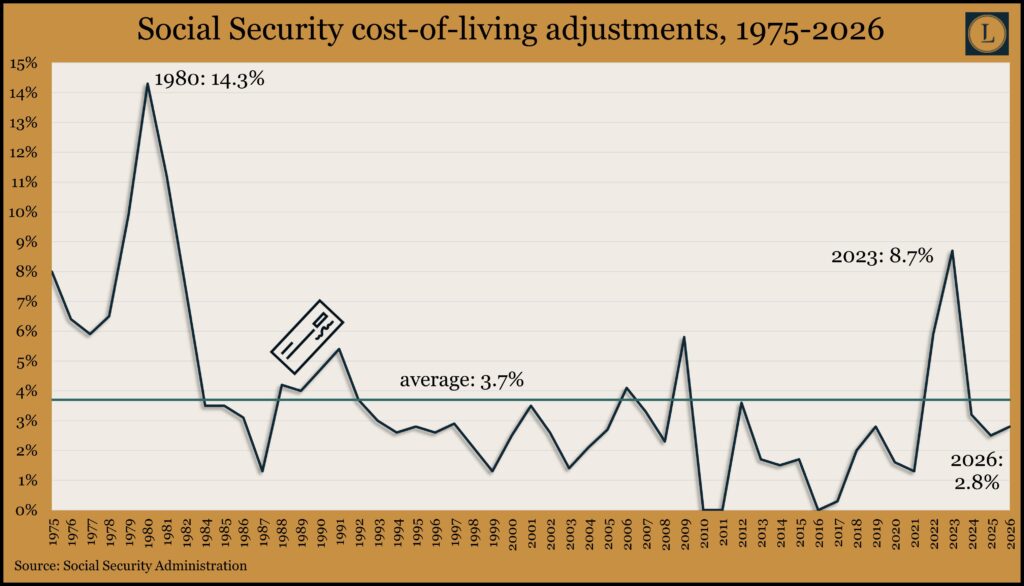

Based on CPI data, the Social Security Administration announced a 2.8% increase to benefits in 2026. That’s up from a 2.5% raise in 2025 and is on par with the average increase in the previous 10 years. The average cost-of-living adjustment since Social Security began adjusting benefits to inflation in 1975 was 3.7%. Social Security said the average retired recipient can expect an added $56 in their benefit checks, beginning in January.

Often a precursor to spending, consumer sentiment slid marginally in October amid ongoing concerns about prices and inflation. The University of Michigan reported that its survey-based index declined 2.7% from September and was down 24% from October 2024. University researchers said expectations for inflation remained well above the Fed target though below highs set earlier in the year after initial announcements of tariff increases. Just 2% of respondents made unprompted references to the government shutdown, down from 10% In the second month of the last shutdown, in 2019.

Market Closings for the Week

- Nasdaq – 23205, up 525 points or 2.3%

- Standard & Poor’s 500 – 6792, up 128 points or 1.9%

- Dow Jones Industrial – 47207, up 1017 points or 2.2%

- 10-year U.S. Treasury Note – 4.00%, down 0.01 point