Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, and Joel Dresang, engineered by Jason Scuglik)

Week in Review (October 6-10, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The scheduled release of August data on the U.S. trade deficit did not occur because of the federal government shutdown. The deficit detracts from U.S. economic output, as measured by the gross domestic product.

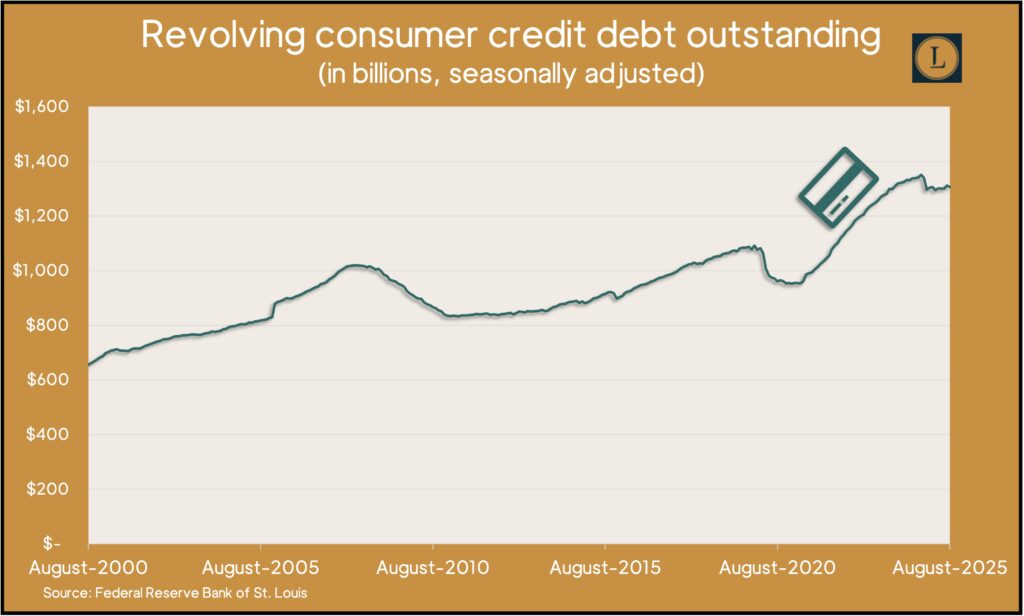

Consumers showed more caution about spending in August, as the amount of credit card debt outstanding fell for the third time in four months. The Federal Reserve Board reported that so-called revolving debt declined at an annual rate of 5.5% from July. The rate sank 3.3% from its peak last October. Economists watch revolving debt as a sign of confidence among consumers, whose spending accounts for about 70% of gross domestic product. Total consumer debt outstanding, including car financing and student loans, rose in August at a 0.1% annual rate.

Wednesday

No major announcements

Thursday

A scheduled report on unemployment insurance claims was not released because of the federal government shutdown. The claims measure job cuts by U.S. employers.

Friday

A preliminary reading of consumer sentiment in October showed no meaningful change in the dour outlook of Americans. The University of Michigan reported that its longstanding survey-based index remained more than 20% below where it was a year ago. Consumers continued to express concerns over high prices and weakened job prospects. The government shutdown Oct. 1 appeared to have little effect on their sentiment. Survey respondents said they expect inflation to reach 3.7% in the next 12 months and 4.6% longer term, ranging above the Federal Reserve’s long-term target of 2%.

Market Closings for the Week

- Nasdaq – 22204, down 576 points or 2.5%

- Standard & Poor’s 500 – 6553, down 163 points or 2.4%

- Dow Jones Industrial – 45480, down 1279 points or 2.7%

- 10-year U.S. Treasury Note – 4.05%, down 0.07 point