Podcast: Play in new window | Download

Advisors on This Week’s Show

- Kyle Tetting

- Art Rothschild

- Steve Giles

(with Max Hoelzl and Joel Dresang engineered byJason Scuglik)

Week in Review (Nov. 17-21, 2025)

Significant Economic Indicators & Reports

Monday

The Commerce Department reported a 0.2% rise in construction spending in August, in its first release of economic data since the six-week federal government shutdown, which ended Nov. 12. Spending on housing construction accounted for 43% of the total and rose 0.8% from July. Total construction spending was 2.1% lower than its May 2024 peak. Compared to August 2024, overall construction spending fell 1.6% and dropped 1.8% for housing.

Tuesday

The Federal Reserve reported that it could not release its scheduled report on industrial production and capacity utilization because it relied on data from other agencies that had been affected by the federal government shutdown.

Factory orders rose in August for the first time in three months, according to the Commerce Department. Led by orders for commercial aircraft, demand for manufactured goods was up 3.3% from August 2024. Excluding the volatile transportation category, orders rose 0.1% from July and gained 0.6% from the year before. Core capital goods orders, a proxy for business investments, advanced 0.4% for the month and 2.3% from August 2024.

Wednesday

The U.S. trade deficit narrowed by 23.8% in August to $59.6 billion. The Bureau of Economic Analysis reported the gap shrank because of a 0.1% rise in exports and a 5.1% decline in imports. Travel services led the slight gain in exports while sales abroad of U.S.-made goods fell, led by computers and pharmaceuticals. Through the first eight months of 2025, the trade gap widened by 25% from the year before, with a 5.1% gain in exports and a 9.2% advance in exports. Trade deficits detract from economic growth, as measured by the gross domestic product.

Housing construction data on building permits and housing starts were not available as scheduled from the Commerce Department.

Thursday

The four-week moving average for initial unemployment insurance claims declined for the third time in four weeks as the Labor Department resumed reports following the six-week government shutdown. Initial claims were 38% below the all-time average and 8% above where they were just before the COVID-19 pandemic. Levels of unemployment among those covered by insurance were at four-year highs. Total claims rose slightly to just under 1.8 million, up nearly 7% from the same time last year.

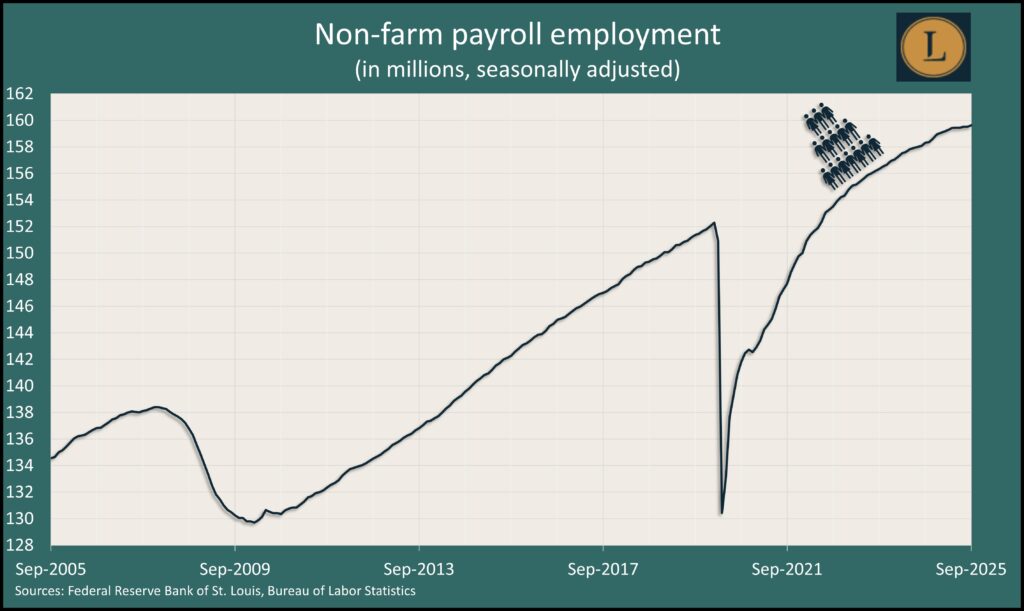

U.S. employment gained in September amid more signs of labor-market weakening. The Bureau of Labor Statistics issued a shutdown-delayed report of employers adding 119,000 jobs in September, on par with the 12-month pace. But revisions from recent months showed a net loss of jobs in August, the second setback in three months. Temporary-help employment, considered a harbinger of hiring, fell to its lowest level since early 2012. Average pay stayed above the overall inflation rate. The unemployment rate – determined separately from household surveys – rose to 4.4%, the highest in four years. The government said the shutdown precluded it from conducting household surveys in October, meaning it will fail to deliver that monthly report for the first time in 77 years.

Because of the federal government shutdown, the Conference Board could not report on its October index of leading economic indicators.

The National Association of Realtors reported a 1.2% rise in existing home sales in October. The annual sales rate was up 1.7% from the year before to 4.1 million houses and condos. That’s level with what the trade group reported for all of 2024, marking the lowest level in 30 years. The association credited lower mortgage rates for improving sales recently, but inventories remained below historically sustainable rates. The median sales price rose to $415,200, up 2.1% from October 2024, the 28th consecutive year-to-year gain.

Friday

Considered a precursor to spending, consumer sentiment, sank again in November, dropping 4.9% from October and 29% from where the index was in November 2024. The longstanding report from the University of Michigan noted a slight gain after the federal government shutdown ended, but consumers expressed continued concerns about high prices and weakened incomes. The university said recent market sell-offs particularly dimmed the view of stockholders. Expectations for inflation inched down but remained higher than they were to start the year.

Market Closings for the Week

- Nasdaq – 22273, down 628 points or 2.7%

- Standard & Poor’s 500 – 6603, down 131 points or 1.9%

- Dow Jones Industrial – 46246, down 902 points or 1.9%

- 10-year U.S. Treasury Note – 4.06%, down 0.09 point