Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (May 5-9, 2024)

Significant Economic Indicators & Reports

Monday

The service sector of the U.S. economy continued to expand in April, though managers are reporting higher costs from tariffs, according to the Institute for Supply Management. The trade group said its index for the service sector showed new orders and supplier deliveries growing at a slightly faster rate than in March. Employment declined for the second month in a row. The ISM’s survey of supply managers found that although business conditions overall were improving, tariff announcements resulted in higher prices, and federal budget cuts were hampering business. The group said the index implied 0.1% annual growth in the U.S. economy.

Tuesday

On the cusp of tariff wars, the U.S. trade deficit hit a record $140.5 billion in March, advancing 14% from February. The Bureau of Economic Analysis showed exports rising 0.2%, led by commercial aircraft and travel services. The value of imports, meantime, rose 4.4%, mostly because of pharmaceuticals, finished metals and automotive products. Through the first quarter, the trade gap widened 92% from the same time last year. Trade deficits detract from gross domestic product, the key measure of economic growth. The first quarter GDP, which contracted at an annual rate of 0.3%, was nearly 5 percentage points weaker because of the trade imbalance.

Wednesday

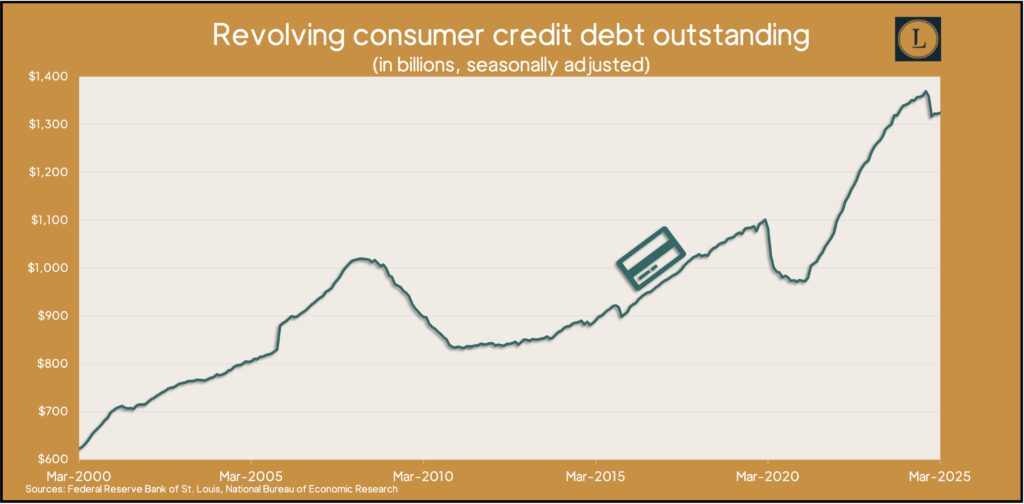

The Federal Reserve said consumer credit card debt rose by an annual rate of 1.7% in March. The pace of so-called revolving credit debt reversed a slight decline in February, following bigger slowdowns in November and December. Through the first quarter of 2025, revolving credit rose at a 2.3% annual rate. Consumer spending accounts for about 70% of U.S. economic activity, so economists keep an eye on credit card debt for signs of consumer demand and confidence. For March, total consumer debt outstanding, including loans for education and vehicles, rose at a 1.5% annual pace.

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row and the third time in five weeks, according to new data from the Labor Department. The measure of employer willingness to let workers go was 37% below the 58-year average, suggesting continued tightness in the labor market. Total claims for jobless benefits declined less than 1% in the latest week to 1.9 million, which was nearly 4% above the level the year before.

The Bureau of Labor Statistics said worker productivity sank at an annual rate of 0.8% in the first quarter, the first setback in nearly three years. Output grew at an annual pace of 1.3% while hours worked rose 1%. Since the first quarter of 2024, productivity rose 1.4%. Labor costs increased 1.3% from the same time last year. Worker compensation, corrected for inflation, was unchanged. Since the end of 2019, productivity has grown at a 1.8% annual pace, vs.1.5% in the previous business cycle, which began in 2007. Since 1947, productivity has grown at 2.1% per year.

Friday

No major releases

Market Closings for the Week

- Nasdaq – 17929, down 49 points or 0.3%

- Standard & Poor’s 500 – 5660, down 27 points or 0.5%

- Dow Jones Industrial – 41249, down 68 points or 0.2%

- 10-year U.S. Treasury Note – 4.38%, up 0.05 point