Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (May 26-30, 2025)

Significant Economic Indicators & Reports

Monday

Markets and government closed for Memorial Day

Tuesday

The Commerce Department said durable goods orders fell 6.3% in April, the first drop in five months. A plunge in orders for aircraft led the decline. Excluding the volatile transportation sector, orders grew by 0.2%. Compared to April 2024, overall orders rose 1.9%; excluding transportation, orders advanced 1.2%. A proxy for business investments shrank 1.3% from March and was up 1.3% from April 2024.

Housing prices continued to decelerate in March, contracting 0.3% after seasonal adjustment. Reflecting a cooling trend that began mid-2024, the S&P CoreLogic Case Shiller home price index showed home prices up 3.4% from March 2024, down from a 4% growth rate in February. But steady demand and limited supply appeared to be combining for a spring revival in prices, with a shift “from mere resilience to a broader seasonal recovery,” the report said. An S&P analyst noted that demand persisted despite “severely constrained” affordability.

The Conference Board said its consumer confidence index rose in May for the first time in five months, largely influenced by the latest shifts in U.S. tariff policies, especially with China. The business and research group said expectations surged from April, though they remained at a level suggesting looming recession. More households intended purchases of houses, cars and appliances. Some 44% of those surveyed expected higher stock prices in the next year, up from 37.6% in April. On the other hand, confidence in the job market soured for the fifth month in a row.

Wednesday

No major releases

Thursday

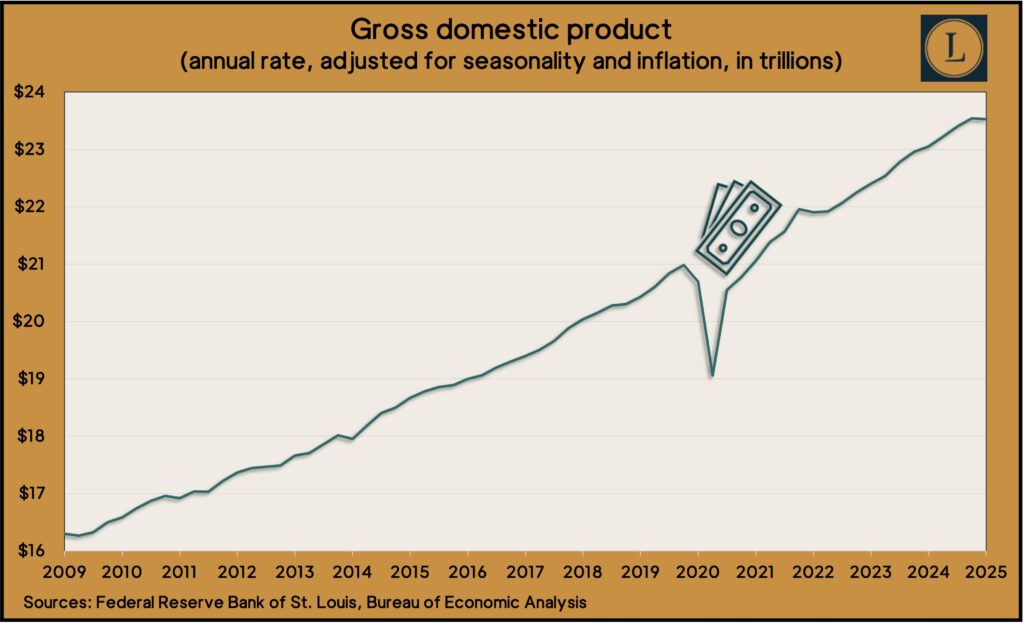

The U.S. economy contracted at an annual pace of 0.2% in the first quarter. The dip was slighter than an initial estimate of negative 0.3% but still the first setback in three years. The Bureau of Economic Analysis reported the gross domestic product declined mostly because of a 43% increase in imports, which detract from economic growth. A 4.6% reduction in federal government spending also contributed to the contraction. Consumer spending, which accounts for about 70% of the GDP, grew at an annual pace of 1.2%, the lowest in two years.

The four-week moving average for initial unemployment claims eased for the first time in five weeks. The measure of employer demand for workers suggested a tight hiring market, staying 36% below the all-time average, which dates back to 1967. Labor Department data showed 1.8 million Americans claiming unemployment compensation in the latest week, unchanged from the week before and up 5.7% from the year before.

The National Association of Realtors said its index of pending home sales fell 6.3% in April. The trade group’s index was down 5.5% from the year before and stood nearly 30% below what the association considers normal for the U.S. housing market. An economist for the association blamed mortgage rates: “Despite an increase in housing inventory, we are not seeing higher home sales.”

Friday

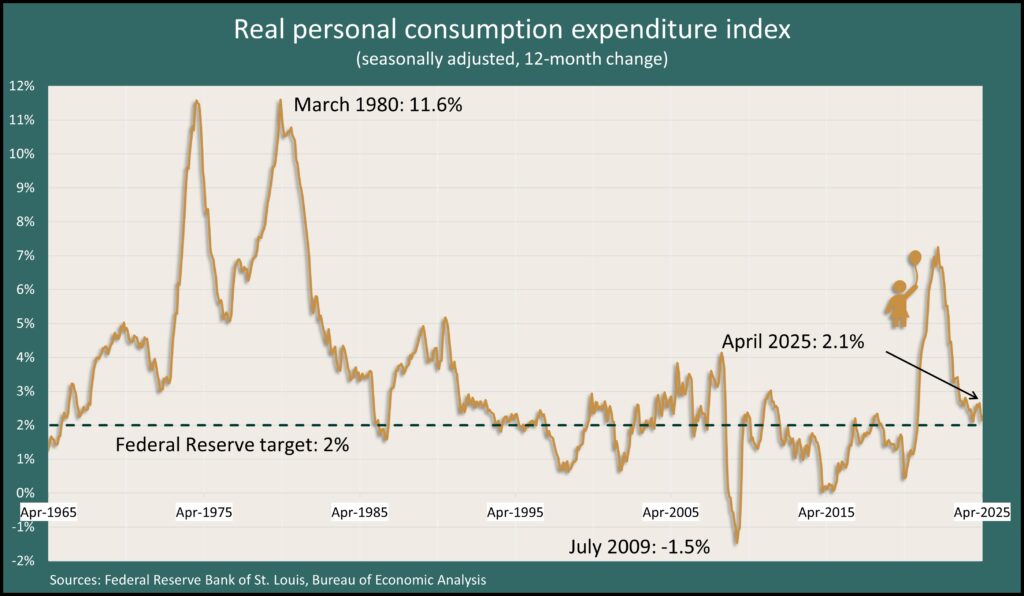

The Bureau of Economic Analysis said consumer spending rose 0.2% in April, down from 0.7% in March. Increased expenditures on services such as housing, utilities and health care offset an overall decline for goods. The slower spending came as personal income rose 0.8% from March, which resulted in a higher personal saving rate – 4.9%, the highest in 11 months. The personal consumption expenditures index, the Federal Reserve’s favorite inflation gauge, rose 2.1% from April 2024, tying with September as the lowest since early 2021. The Fed’s long-range target for inflation is 2%.

The University of Michigan said its consumer sentiment index steadied in May after four months of steep declines. The index moved up slightly from a preliminary mid-month reading after the U.S. and China temporarily paused on tariff conflicts. The survey-based index showed consumers pausing an unprecedented escalation in their expectations that tariffs would raise prices. Consumers expected the inflation rate to reach 6.6% a year from now and 4.2% in the longer run. The university said consumers are “quite worried” about tariffs and relatively disinterested in the multi-year tax-and-spending bill before Congress.

Market Closings for the Week

- Nasdaq – 19100, up 474 points or 1.9%

- Standard & Poor’s 500 – 5912, up 109 points or 1.9%

- Dow Jones Industrial – 42270, up 667 points or 1.6%

- 10-year U.S. Treasury Note – 4.42%, down 0.09 point