Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 28-May 2, 2025)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

Housing prices remained resilient to softening demand and affordability challenges, according to the latest S&P CoreLogic Case-Shiller home price index. The national index rose 3.9% in February from the year before, down from 4.1% in January. An analyst for the index said, “Buyer demand has certainly cooled compared to the frenzied pace of prior years, but limited housing supply continues to underpin prices in most markets.”

The Conference Board said its April report on consumer confidence reflected “pervasive pessimism about the future.” Expectations especially plunged, dipping to an index reading of 54.4, the lowest since 2011. The business research group said consumer expectations of job losses were the highest since the Great Recession; forecasts for stock declines were the most in 14 years. Economists monitor consumer confidence because consumer spending accounts for about two-thirds of U.S. economic activity.

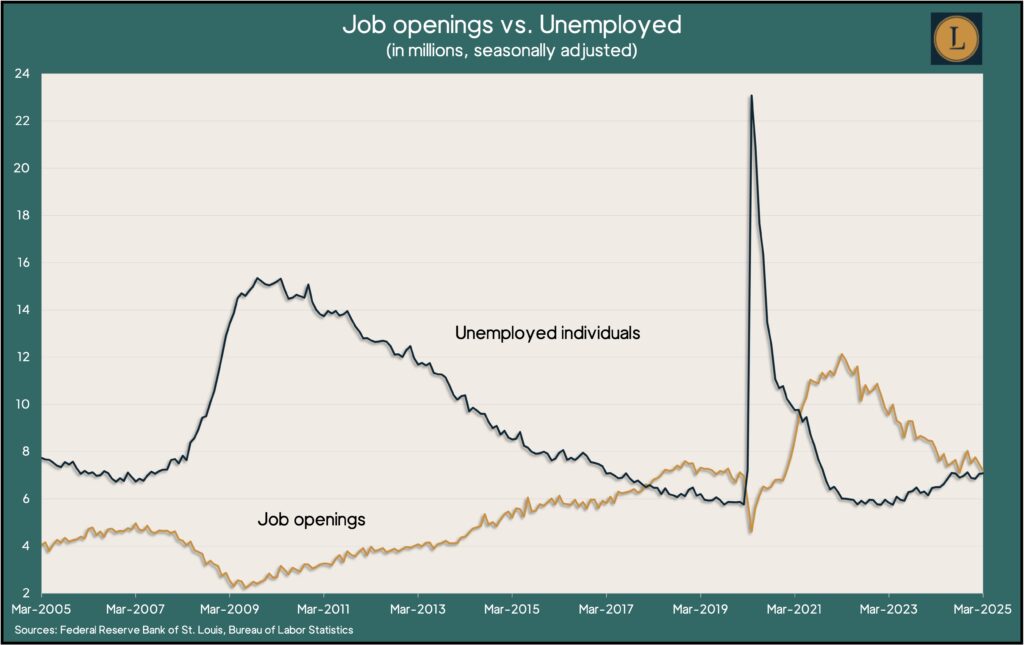

Employers posted 7.2 million job openings in March, down 3.8% from February, according to the Bureau of Labor Statistics. That’s slightly above the level just before the COVID-19 pandemic but off from the peak of 12.1 million three years ago. Compared to the number of unemployed individuals looking for work, the gap between labor demand and supply reached its narrowest point in four years. The number and rate of workers quitting their jobs – a sign of employment confidence – rose for the third time in four months but stayed below the pre-pandemic level for the 15th month in a row.

Wednesday

The U.S. economy contracted at an annual pace of 0.3% in the first quarter, the first setback for the gross domestic product in three years. A 41% increase in imports, spurred by anticipation of new tariffs, led the decline, according to the Bureau of Economic Analysis. Federal government spending dropped 5% in the quarter, and consumer spending slowed to an annual rate of 1.8%, the lowest since mid-2023. The surge in imports contributed to a decrease of nearly 5 percentage points from the GDP, a record for measures going back to 1947.

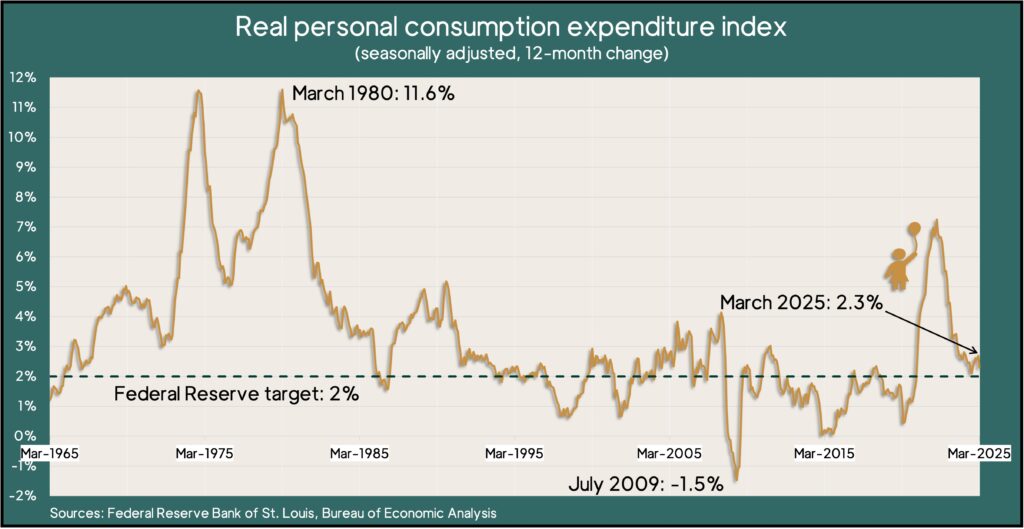

Separately, the Bureau of Economic Analysis said consumer spending rose 0.7% in March, outpacing a 0.5% gain in personal income. Spending on motor vehicles shot up 57%, which analysts attributed to consumers trying to beat expected price increases from shifting trade policies. Meantime, the Federal Reserve’s favorite inflation gauge showed prices rising 2.3% since March 2024, the fourth straight slowdown and the lowest rate in 13 months. The Fed’s long-term target for inflation is 2%.

The National Association of Realtors said its index of pending home sales rose 6.1% in March. The trade group’s index was down 0.6% from the year before and remained about 25% below its baseline set in 2001. An economist for the Realtors said continued job growth bolstered demand for housing but buyers remained sensitive to mortgage interest rates.

Thursday

The four-week moving average for initial unemployment claims rose for the first time in three weeks. The measure suggested the labor market stayed historically tight: 38% below the all-time average, which dates to 1967. The Labor Department said 1.9 million Americans claimed jobless benefits in the latest week, down 33% from the week before but up 3% from the year before.

The manufacturing sector continued contracting in April for the second month in a row and the 28th time in 30 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of purchasing managers, showed further lapses in demand, output and hiring tied to uncertainty over U.S. trade policies.

The Commerce Department said construction spending declined 0.5% in March while rising nearly 3% from March 2023. Residential expenditures, accounting for about 43% of all construction spending, slowed 0.5% from the seasonally adjusted annual rate in February and were about 3% ahead of the year-ago pace. Government outlays for construction – about 23% of the total rose – slipped 0.2% for the month and were up nearly 5% from March 2024.

Friday

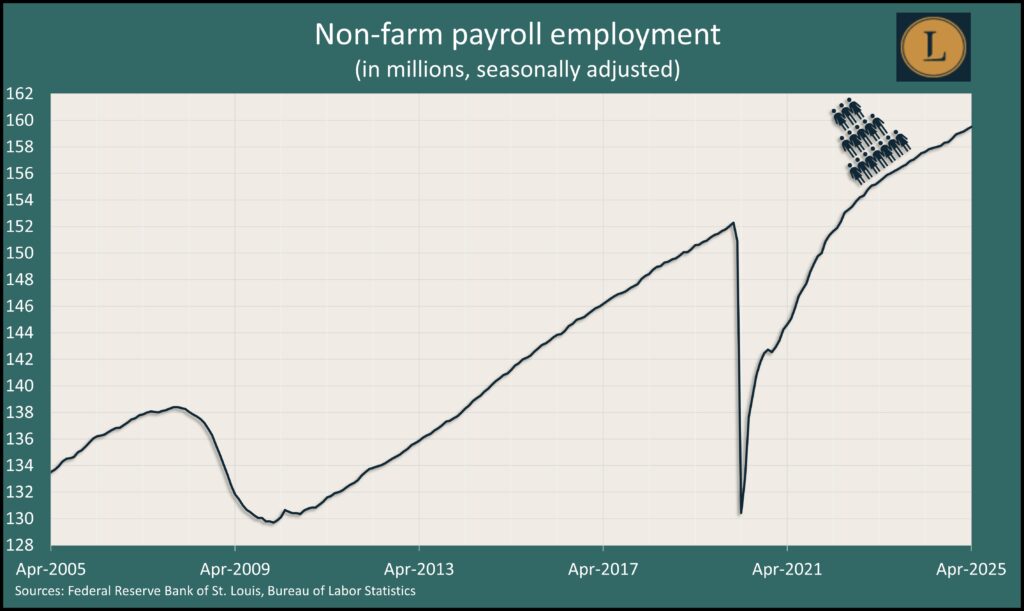

U.S. employers added 177,000 jobs in April, the 52nd consecutive gain. According to payroll data from the Bureau of Labor Statistics, the additional jobs exceeded the 152,000 12-month average. Transportation and warehousing more than doubled its annual pace of hiring. Federal government employment edged down 9,000 for April and was down 24,000 through the first four months of 2025. Temporary help positions – considered a harbinger of overall hiring trends – moved up slightly but stayed below their pre-pandemic level for the 16th month in a row. The average hourly wage rose 3.8% from the year before, continuing to outpace inflation. A separate survey of households showed the unemployment rate steady at 4.2%. Unemployment has ranged narrowly between 4% and 4.2% since last May.

The Commerce Department said factory orders rose 1.4% in March, led by demand for commercial aircraft and automotive products. Excluding orders for transportation equipment, demand for manufactured goods rose 0.5%. Compared to March 2023, the dollar amount for total orders rose 0.3%, vs. a 0.7% gain excluding transportation. A proxy for business investments rose 0.6% from its year-earlier level.

Market Closings for the Week

- Nasdaq – 17978, up 595 points or 3.4%

- Standard & Poor’s 500 – 5687, up 161 points or 2.9%

- Dow Jones Industrial – 41317, up 1204 points or 3.0%

- 10-year U.S. Treasury Note – 4.32%, up 0.05 point