Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Blake Miller)

Week in Review (June 9-13, 2025)

Significant Economic Indicators & Reports

Monday

No major reports

Tuesday

No major reports

Wednesday

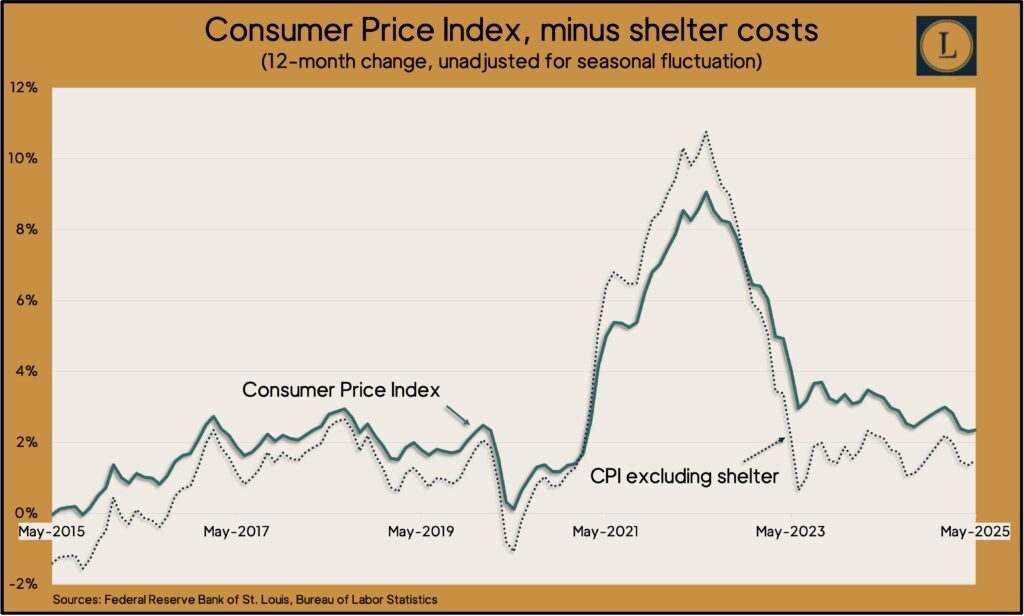

The broadest measure of inflation rose slightly to 2.4% in May, still within striking distance of the long-range Federal Reserve target. The Consumer Price Index was up from 2.3% in May, which was the lowest rate in more than five years, and down from a decades-high 9.1% in June 2022. According to the Bureau of Labor Statistics, shelter costs continued to boost overall inflation. If not for housing, inflation was up 1.5% from May 2024, the third month in a row below its pre-pandemic level. In other key measures, gas prices declined for the fourth month in a row, and the cost of eggs dropped for the second straight month.

Thursday

Inflation on the wholesale level also showed mild growth in May. The Bureau of Labor Statistics said the Producer Price Index rose 0.1% from April, the first gain in three months. Compared to 12 months earlier, wholesale inflation rose 2.6% in May, compared to 2.5% in April and more than 11% in mid-2022. Excluding volatile prices for food, energy and trade services, the core PPI was up 0.1% from April. Core PPI was up 2.7% from May 2024.

The four-week moving average for initial unemployment claims rose for the sixth time in seven weeks to its highest level since September 2023. Still, the indicator of employers’ willingness to let workers go remained 34% below its 58-year average. According to the Labor Department, total claims for jobless benefits fell 1% from the week before to slightly less than 1.8 million, which was 5% above where it stood at the same time last year.

Friday

Accompanying short-term easing in U.S. trade policies, consumer sentiment rose in early June for the first time in six months. Overall confidence in the economy and personal finances was still 20% lower than in December, according to the University of Michigan. A preliminary June reading of the university’s longstanding consumer surveys showed sentiment still broadly guarded with expectations that no matter where tariff rates land, they’ll increase inflation.

Market Closings for the Week

- Nasdaq – 19407, down 123 points or 0.6%

- Standard & Poor’s 500 – 5977, down 23 points or 0.4%

- Dow Jones Industrial – 42198, down 565 points or 1.3%

- 10-year U.S. Treasury Note – 4.42%, down 0.09 point