Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 5-9, 2026)

Significant Economic Indicators & Reports

Monday

The Institute for Supply Management reported that its manufacturing index signaled contraction in December for the 10th month in a row and the 36th time in 38 months. Based on surveys of supply managers, the index showed that the industry slump accelerated for the third month in a row. The trade group said 85% of the sector’s gross domestic product shrank in December, compared to 58% in November, and 43% of manufacturing GDP was in strong contraction, vs. 39% the month before. The ISM said the index suggested the overall U.S. economy was growing at an annual rate of 1.6%.

Tuesday

No significant reports or announcements

Wednesday

A report from the Commerce Department showed manufacturing orders shrinking in October for the third time in five months. The value of orders fell 1.3% from September and was 3.3% ahead of October 2024. Excluding volatile orders for transportation equipment – most notably commercial aircraft, orders sank 0.2% for the month and gained 0.8% from the year before. A proxy for business investments was up 0.5% from October and 3.1% from the year before.

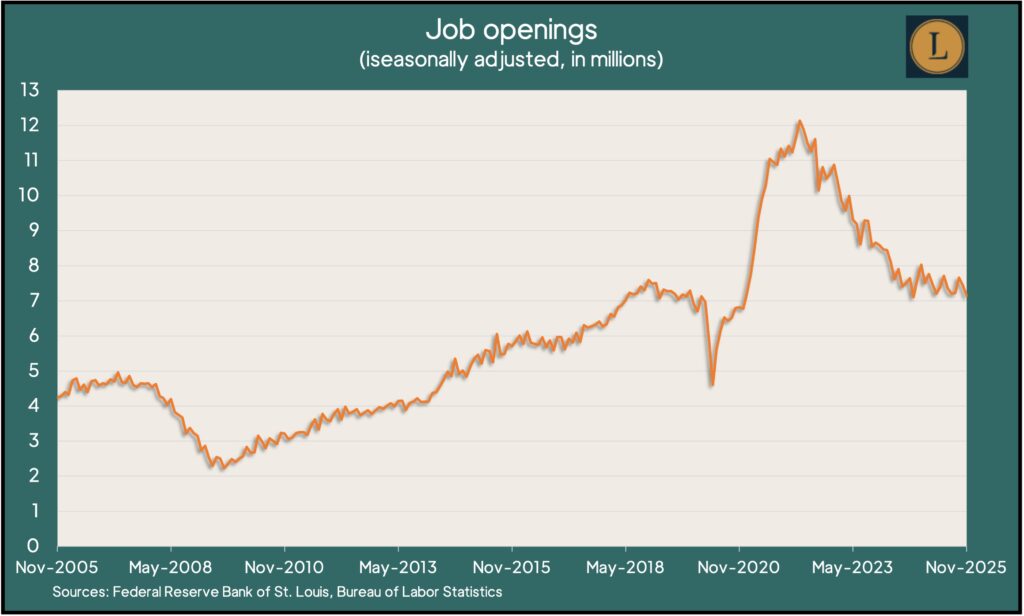

U.S. employers posted 7.1 million job openings in November, as both hiring and separations remained stagnant. Openings were down from a record high of 12.2 million in March 2022 and remained above the pre-pandemic level of about 7 million. The Bureau of Labor Statistics reported that both the number and proportion of workers quitting their jobs – an indicator of worker confidence – stayed below the pre-pandemic level for the 23rd month in a row.

The U.S. services sector grew at a faster pace for the third month in a row in December, according to the Institute for Supply Management. The trade group’s services index showed most components improved from November. Employment expanded for the first time in seven months. The 12-month average for the index has been dropping for nearly four years. Supply managers told the ISM they’re concerned about prices, tariffs and seasonal factors.

Thursday

The U.S. trade deficit narrowed 39% in October to $29.4 billion, the slimmest margin since mid-2009, amid continued adjustments to shifting tariffs. According to the Bureau of Economic Analysis, exports rose by 2.6% from September, with non-monetary gold and other precious metals offsetting a decline in other goods sold abroad. Imports fell 3.2%, led by pharmaceuticals. Through the first 10 months of 2025, the deficit – which detracts from gross domestic product – widened 7.7%; exports gained 6.3%, while imports rose 6.6%.

The Bureau of Labor Statistics said worker productivity rose at an annual rate of 4.9% in the third quarter, the fastest pace in two years. Measured year over year, productivity advanced 1.9% from the third quarter of 2024. That compares to an average 1.5% annual gain since the end of 2019, which is below the 2.1% average since 1947. The productivity report showed unit labor costs falling at a 1.9% annual pace during the latest quarter, as output rose faster than compensation. Adjusted for inflation, compensation rose 0.3% from the third quarter of 2024.

The four-week moving average for initial unemployment claims fell for the second time in three weeks to its lowest level since April 2024. The measure of employer willingness to part with workers was 41% below the all-time average and 2% above where it stood just before the COVID-19 pandemic. Data from the Labor Department showed 1.9 million Americans claiming unemployment benefits in the latest week. That was down 5.7% from the week before and up 1% from the same time last year.

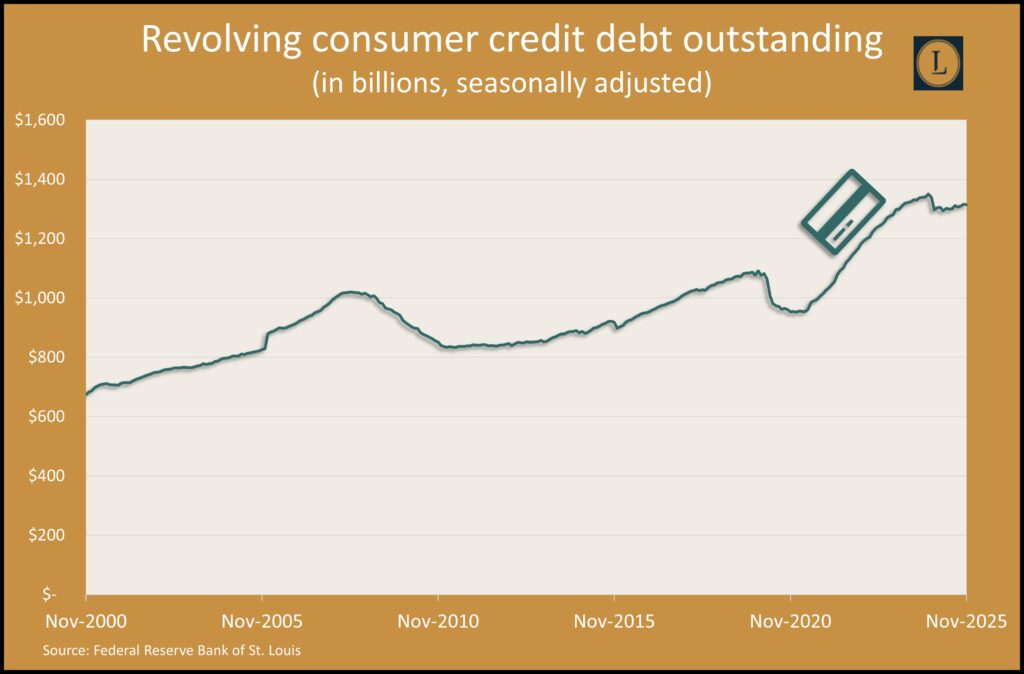

In a sign of ongoing consumer caution, credit card debt sank in November at a 1.9% annual pace. The Federal Reserve Board reported that revolving consumer debt outstanding declined for the sixth time in 13 months. The decrease amounted to $2.1 billion. Consumer spending accounts for about two-thirds of U.S. economic output, as measured by the gross domestic product. Credit card debt partly reflects the confidence of consumers to keep spending.

Friday

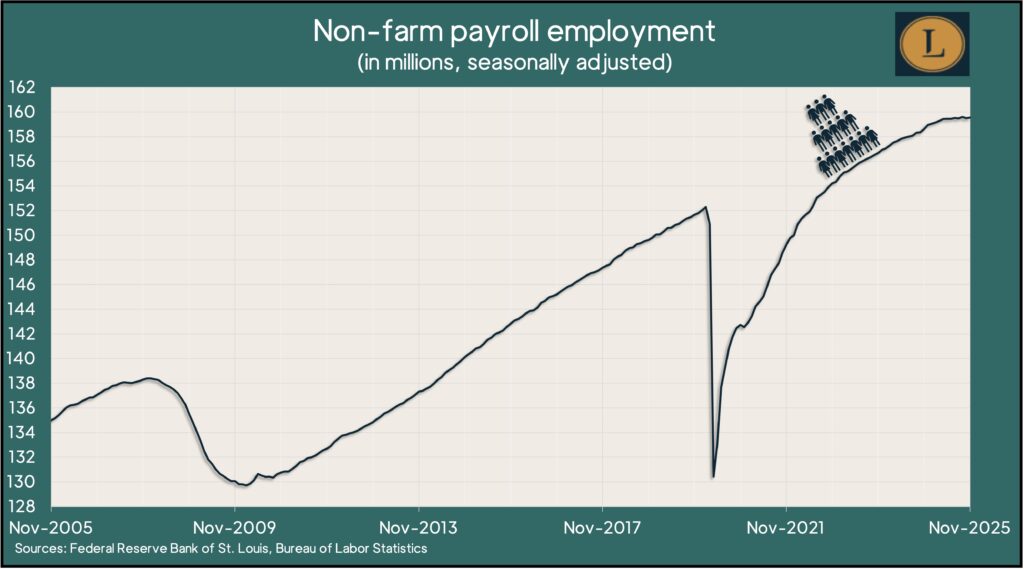

U.S. employers added 50,000 jobs in December, barely higher than the average for 2025 and well below the monthly addition of 168,000 jobs in 2024. Other data from the Bureau of Labor Statistics report suggests a resilient though cooling job market. Temporary help jobs — considered a bellwether of overall hiring trends — dropped to the lowest number in 14 years. The average hourly wage rose 3.8% from December 2024, exceeding overall inflation for the 31st month in a row. The same report showed the unemployment rate at 4.4%, staying above the pre-pandemic rate since mid-2023.

The pace of U.S. housing starts and building permits continued to slow in October. The Commerce Department reported the annual rate of new construction declined nearly 5% from September and almost 8% from the year before. The annual pace of permits inched down 0.2% for the month and was more than 1% lower than in October 2024. The pace of houses under construction was down 23% from the peak three years earlier but still stayed 8% above the pre-pandemic level.

The University of Michigan reported a second consecutive month of slightly improving consumer sentiment. A preliminary January reading of the survey-based index showed overall sentiment down nearly 25% from the beginning of 2025, though up from mid-year pessimism surrounding unclear tariff policies. The university said consumers remained mostly concerned about higher prices and a weaker job market.

Market Closings for the Week

- Nasdaq – 23671, up 436 points or 1.9%

- Standard & Poor’s 500 – 6966, up 108 points or 1.6%

- Dow Jones Industrial – 49504, up 1122 points or 2.3%

- 10-year U.S. Treasury Note – 4.17%, down 0.02 point