Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 26-30)

Significant Economic Indicators & Reports

Monday

Orders for commercial aircraft boosted durable goods orders in November, the Commerce Department reported. Total orders rose 5.3% from October, the third increase in four months, and were 7.3% ahead of their level in November 2024. Excluding transportation equipment, orders rose 0.5% for the month and were up 2.4% from the year before. Core capital goods orders, a proxy for business investment, gained 0.7% from October and were up 3.1% from November 2024.

Tuesday

Housing prices increased again in November, though less than overall inflation, according to the S&P Cotality Case-Shiller national index. The 1.4% gain was unchanged from October and compared to a 2.7% year-to-year increase in the cost of living, as measured by the Consumer Price Index. An executive with the index said it indicated the U.S. housing market is in a period of tepid growth. Data showed a divergence of markets geographically with prices rising 5.7% in Chicago and declining 3.9% in Tampa. Month to month seasonally adjusted prices fell in 15 of 20 major cities.

The Conference Board said its consumer confidence index fell in January to its lowest point since May 2014. The business research group said expectations sank across demographics including age, income and party affiliation. Expectation levels continued to signal near-term economic recession. Economists follow consumer confidence as a precursor to consumer spending, which drives about 70% of U.S. economic activity.

Wednesday

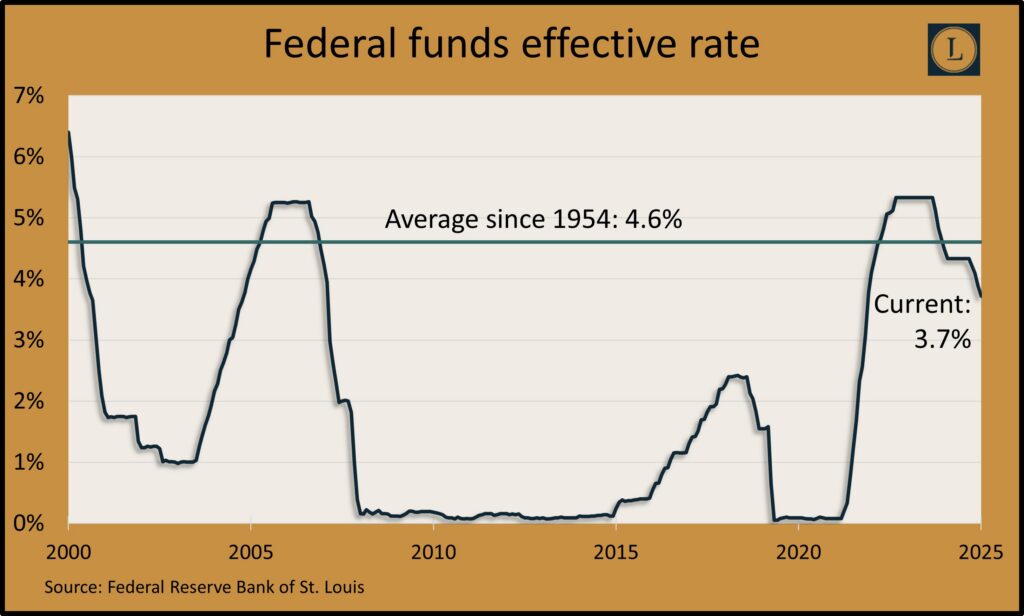

The policy-making body of the Federal Reserve Board announced no change to the overnight funds rate. Citing stabilizing unemployment and somewhat elevated inflation, the Federal Open Market Committee said it would hold the fed funds rate after dropping it three times in the last half of 2025. The rate is what banks charge one another. The Fed tends to raise it when it’s more concerned about inflation and to lower it when unemployment gets worrisome.

Thursday

The U.S. trade deficit nearly doubled in November, widening by 94.6% to $56.8 billion. Exports declined as imports rose as global trade continued to be volatile amid fluctuating U.S. tariffs. According to the Bureau of Economic Analysis, exports fell by 3.6% from October, led by sales of non-monetary gold and pharmaceutical products. Imports gained 5%, led by increased U.S. purchases of overseas pharmaceuticals and computers. Through the first 11 months of 2025, the deficit — which detracts from gross domestic product — widened 4%; exports gained 6.3%, and imports rose 5.8%.

The four-week moving average for initial unemployment claims rose for the first time in four weeks but continued to show overall tight hiring conditions. The average was 43% below the all-time average dating back to 1967. The Labor Department said just under 2.3 million Americans claimed jobless benefits in the latest week, down 3% from the week before and a smidge below the same time in 2024.

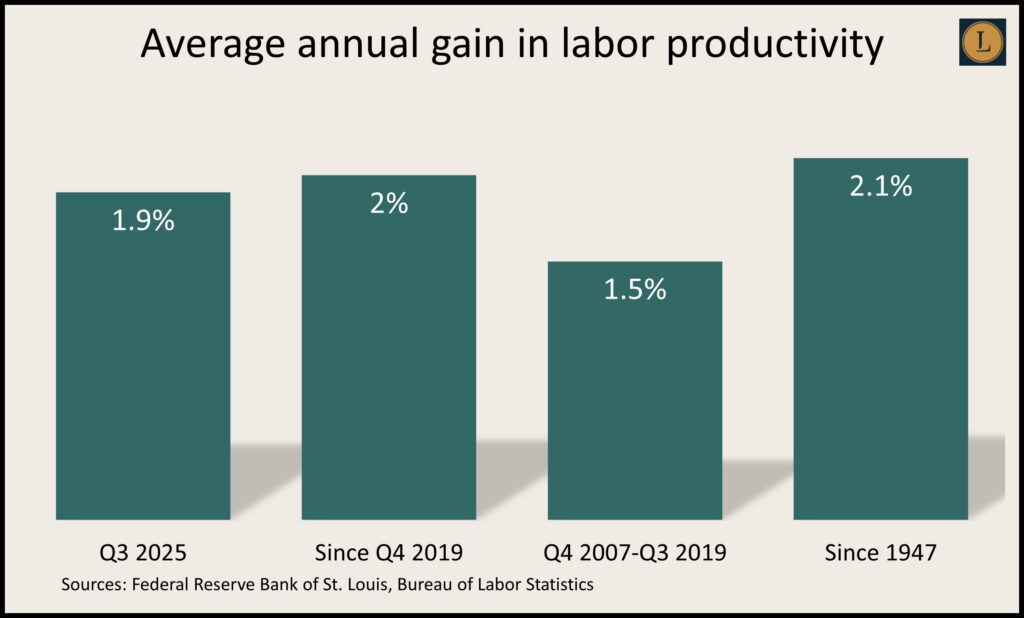

Worker productivity increased at a 4.9% annual rate in the third quarter, unchanged from a previous estimate. The Bureau of Labor Statistics reported worker output rose at a 5.4% pace while hours worked rose 0.5%. Hourly compensation advanced at a 2.9% pace in the quarter, resulting in a decline of 1.9% in labor costs. Year to year, productivity rose 1.9%, just below the 2% annual average in the business cycle that started at the end of 2019. In the previous cycle, beginning at the end of 2007, productivity averaged 1.5%, vs. a 2.1% average gain since 1947.

A rise in demand for commercial aircraft boosted factory orders in November. The Commerce Department reported that total orders rose 2.7% from October, the third increase in four months. Demand for manufactured goods was up 3.4% from the year before. Excluding volatile orders for transportation equipment, orders rose 0.2% for the month and were up 0.7% from November 2024. Core capital goods orders, a proxy for business investments, rose 0.4% from October and were up 3.1% from November 2024.

Friday

The Bureau of Labor Statistics reported that wholesale inflation rose 0.5% in December, as prices on goods were unchanged while services increased. The Producer Price Index advanced 3% from the year before, down from 3.5% in 2024 but up from as low as 2.4% in June. The Federal Reserve target for long-term inflation is 2%. Excluding volatile prices for food, energy and trade services, the so-called core PPI rose 0.4% from November and was up 3.5% from December 2024.

Market Closings for the Week

- Nasdaq – 23462, down 39 points or 0.2%

- Standard & Poor’s 500 – 6939, up 23 points or 0.3%

- Dow Jones Industrial – 48892, down 206 points or 0.4%

- 10-year U.S. Treasury Note – 4.24%, no change