Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl,Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 12-16, 2026)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The broadest measure of inflation rose slightly in December, staying above the Federal Reserve Board target though below the four-decade peak in 2022. The Bureau of Labor Statistics reported the Consumer Price Index, rose 0.3% from November, led by shelter costs and food prices, offset by lower gas prices. The CPI advanced 2.7% from December 2027, unchanged from the November pace. That’s down from 9.1% in June 2022 but above the Fed’s long-range target of 2%. Excluding volatile prices for food and energy items, the core CPI rose 0.2% from November and was 2.6% ahead of December 2024, the slowest pace for core inflation since March 2021.

The Commerce Department reported a slight decline in the annual rate of new home sales in October. All the growth occurred in southern states and was nearly 19% ahead of the year-ago pace. Despite declining 0.1% from September, the annual sales rate of new houses stayed above the pre-pandemic level for the third month in a row. An increase in sales of houses for less than $400,000 brought the median sales price down to $392,300, 8% below the mark in October 2024.

Wednesday

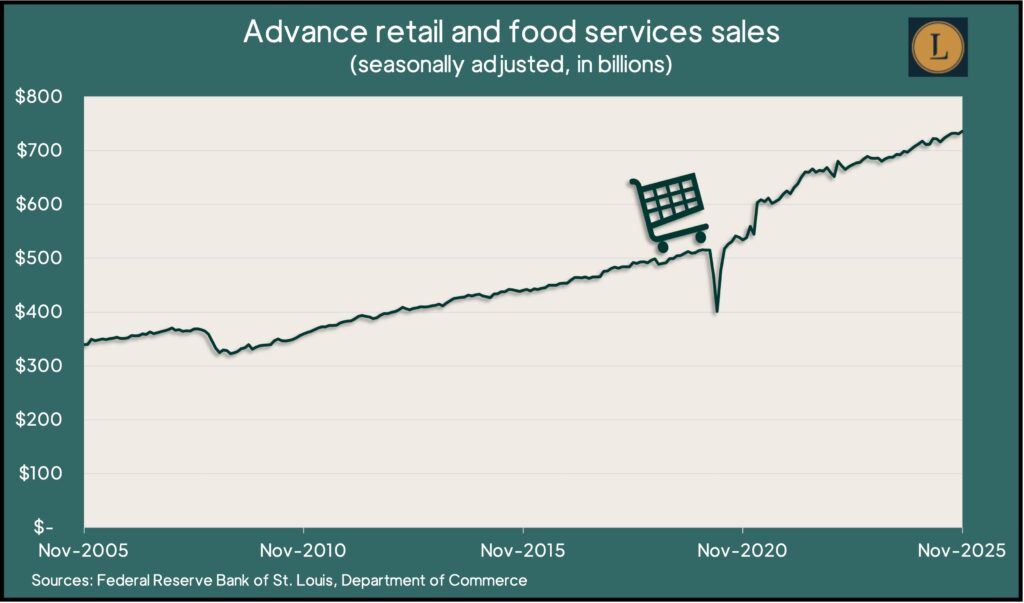

The Commerce Department said retail sales rose 0.6% in November after slipping 0.1% in October. The latest gain suggested continued resilience in the economy, with 10 of 13 retail categories expanding, led by car dealers, gas stations, home-and-garden centers and sporting goods/hobby stores. Sales at bars and restaurants also rose in November, rising for the fifth time in six months. Retail sales represent about two-thirds of consumer spending, which drives more than two-thirds of economic growth.

The Bureau of Labor Statistics reported that wholesale inflation rose 0.2% in November, as prices on goods increased while services were unchanged. A 4.6% jump in energy prices accounted for 90% of the rise in the cost of goods. The Producer Price Index advanced 3% from the year before, down from the record 11.7% reached in March 2022. Excluding volatile prices for food, energy and trade services, the so-called core PPI also rose 0.2% from October and was up 3.5% from the year before, the most since March.

Housing sales continued to tank in 2025. The National Association of Realtors reported 4.06 million houses and condominium sold, the same as 2024, and the lowest since 1995. Existing home sales account for 90% of the residential market. The trade group cited record-high prices and scant supply. The median sales price for December reached $405,400, up 0.4% from the year before, the 30th straight increase. The number of unsold houses on the market fell below 1.2 million, or 3.3 months’ worth at the current sales pace.

Thursday

The four-week moving average for initial unemployment claims fell to its lowest level since January 2024, dropping 43% below the all-time average. An indicator of employers’ willingness to let workers go, the moving average was 1% above where it stood just before the COVID-19 pandemic, according to Labor Department data. Total claims for jobless benefits rose 16% from the week before to 2.2 million, affected in part by year-end layoffs. That was up 0.2% from the year before.

Friday

Industrial production rose in December for the second month in a row and gained 2% from the year before. The Federal Reserve Board said production from factories increased 0.2% from November and also was up 2% from December 2024. Industries’ capacity utilization rate — covering manufacturing, mining and utilities — also rose for the second consecutive month, though it stayed below its 53-year average, suggesting higher prices weren’t imminent.

Market Closings for the Week

- Nasdaq – 23515, down 156 points or 0.7%

- Standard & Poor’s 500 – 6940, down 26 points or 0.4%

- Dow Jones Industrial – 49359, down 145 points or 0.3%

- 10-year U.S. Treasury Note – 4.23%, up 0.04 point