Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Feb. 2-6, 2026)

Significant Economic Indicators & Reports

Monday

The manufacturing sector expanded in January for the first time in a year and only the second time in more than three years, according to the Institute for Supply Management. The trade group’s index, based on surveys of manufacturing supply managers, showed new orders growing for the first time since August and at the fastest pace in four years. Production also rose the most since early 2022, while employment contracted for the 28th month in a row. The ISM said 12% of manufacturing gross domestic product was in strong contraction in January, compared to 43% in December.

Tuesday

No major releases, in part because of the partial shutdown of the federal government.

Wednesday

Service industries, the largest segment of the U.S. economy, showed continued expansion in January. The Institute for Supply Management’s service index indicated growth for the 19th month in a row. The index level was unchanged from December and the highest since October 2024. Supply managers surveyed for the report continued to voice concerns over the impact and uncertainty of tariffs. The trade group said a trend in price increases deserved monitoring.

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row but continued to suggest a historically tight job market. According to data from the Labor Department, the latest four-week average was 41% below the all-time average, dating back to 1967. As an early measure of layoff trends, new jobless claims have signaled reluctance by employers to let workers go. Total claims fell 4.2% from the week before to just below 2.2 million, which was 1.2% lower than the year before.

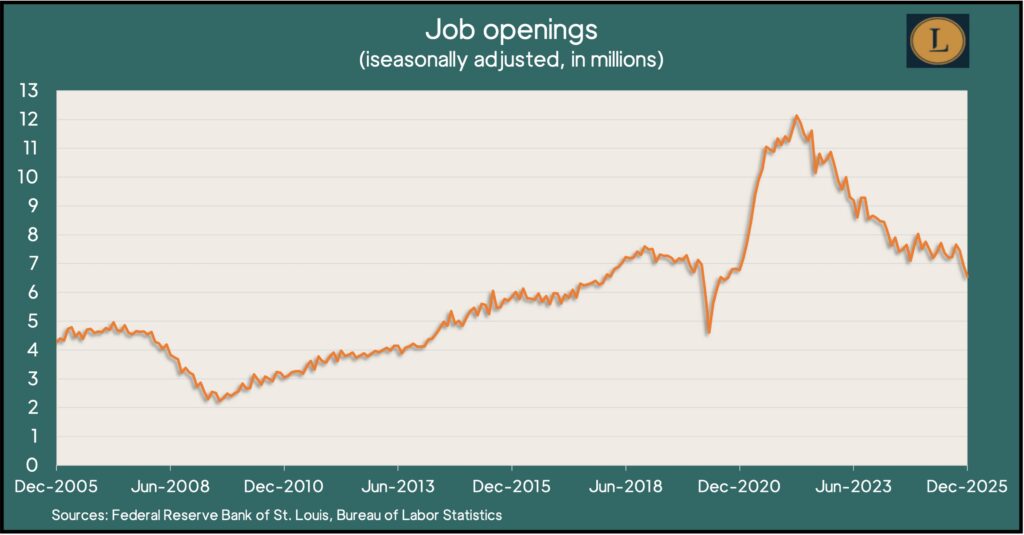

And while employers appear reluctant to dismiss workers, the number of job openings dropped in December to the lowest level since the pandemic. The Bureau of Labor Statistics counted 6.5 million openings in December, down from a record 12.1 million in March 2022 and below the pre-pandemic mark for the first time since September 2020. The number and rate of worker quitting their jobs — a measure of worker confidence — have stayed below pre-pandemic levels since the end of 2023.

Friday

A report on jobs and employment from the Bureau of Labor Statistics was delayed because of the partial shutdown of the federal government.

The University of Michigan said a preliminary measure of its consumer sentiment index showed essentially no change from January. Though it was the highest reading since August, it was down 11% from February 2025 and remained “relatively low from a historical perspective.” The survey-based report found consumers continuing to be concerned about their personal finances because of high prices and weakened job prospects. Stockholders tended to feel more confident. Expectations for inflation continued to outpace expectations before the pandemic.

Market Closings for the Week

- Nasdaq – 23031, down 431 points or 1.8%

- Standard & Poor’s 500 – 6932, down 7 points or 0.1%

- Dow Jones Industrial – 50116, up 1223 points or 2.5%

- 10-year U.S. Treasury Note – 4.21%, down 0.04%