Podcast: Play in new window | Download

Advisors on This Week’s Show

- Kyle Tetting

- Steve Giles

- Tom Pappenfus

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 16-20, 2026)

Significant Economic Indicators & Reports

Monday

Markets closed for Presidents Day

Tuesday

No major releases

Wednesday

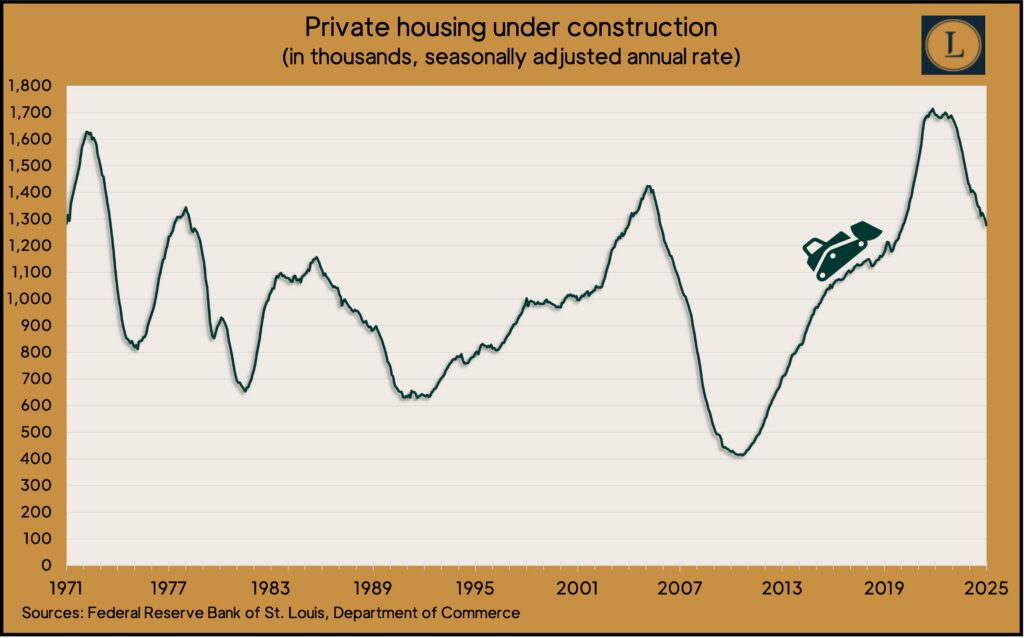

Home construction gained slightly in December but continued to provide little relief to ongoing inventory shortages. The Commerce Department said the annual rate of housing starts rose 6% from November, though it was down 7% from the year-ago pace and has remained below the pre-pandemic level since mid-2023. The pace of housing permits also rose for December but kept under the pre-pandemic rate. The number of houses under construction was down 26% from its peak in November 2022.

The Commerce Department said durable goods orders fell 1.4% in December, the second decline in three months. A dip in commercial aircraft orders led the drop-off. Excluding transportation equipment, demand for long-lasting manufactured items was up 0.9% from November and was up 2.8% from the year before. Core capital goods orders, a proxy for business investments, rose 0.6% for the month and were 3.5% ahead of December 2024.

The Federal Reserve reported that industrial production rose 0.7% in January, led by a broad lift in manufacturing output. The 0.6% increase in factory production was the most since February and included the first gain for auto makers since August. Industries’ capacity utilization rate rose slightly in January but stayed below the long-term average, suggesting low potential for inflation.

Thursday

The U.S. trade deficit narrowed slightly in 2025, as the value of exports outpaced imports. The Bureau of Economic Analysis reported that the 2025 trade gap was $901.5 billion, down 0.2% from the year before. Exports grew 6.2% in the year while imports rose 4.8%. Trade gaps detract from economic output, as measured by the gross domestic product. From November, the deficit widened 32.6% with exports declining 1.7% and imports rising 3.6%.

The four-week moving average for initial unemployment insurance claims declined for the first time in four weeks, remaining 39% below the 59-year average, according to new Labor Department data. Some 2.2 million Americans claimed jobless benefits in the latest week, down 0.4% from the week before and up 0.9% from the same time in 2025.

The Conference Board reported a 0.2% decline in its index of leading economic indicators in December. It was the fifth consecutive drop. In the last half of 2025, the index fell by 1.6%, an improvement from the 2.8% fall in the first half of 2026. The business research group said weak consumer expectations and meager factory orders led the decline. The Conference Board forecast 2.1% growth in U.S. gross domestic product in 2026, down slightly from estimates for 2025.

Commitments to home buying slipped in January as sales activity remained the lowest in three decades. The pending home sales index of the National Association of Realtors declined 0.8% from December and was down 0.4% from January 2025. The trade group said lower mortgage rates have improved affordability and could spur another 550,000 home buyers into the market in 2026. But with ongoing inventory shortages, additional buyers could boost prices.

Friday

The U.S. economy grew at a 1.4% annual pace in the fourth quarter, down from 4.4% in the third quarter, according to a preliminary estimate by the Bureau of Economic Analysis. Expansion of the gross domestic product slowed mostly because consumer spending decelerated but also as a result of a 17% decline in federal government spending, which shaved nearly 1.2 percentage points from the growth rate. For all of 2025, GDP rose 2.2%, down from a 2.4% increase in 2024 and the weakest in three years.

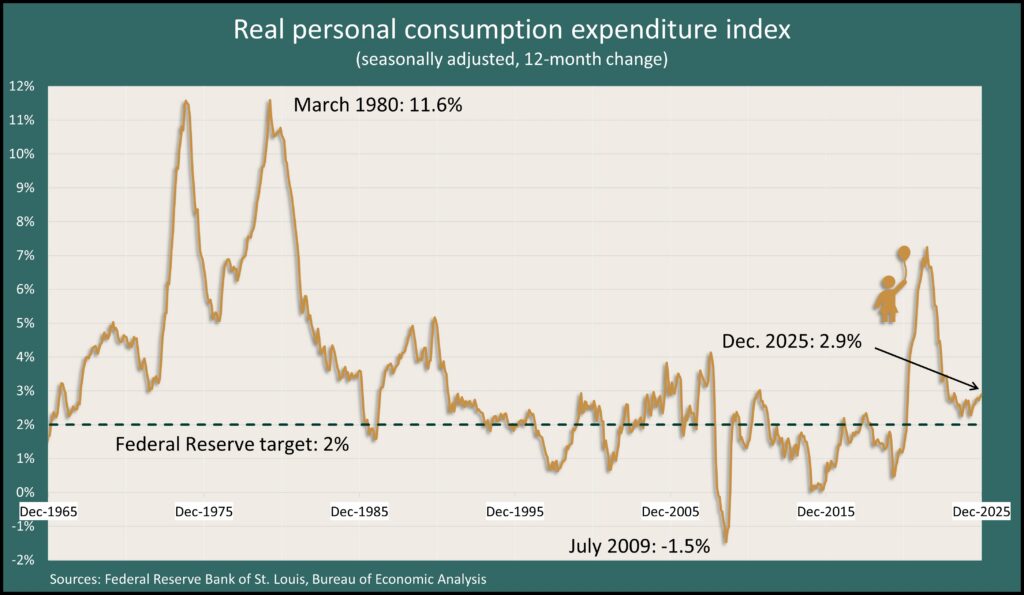

The Federal Reserve Board’s preferred measure of inflation rose to 2.9% in December, its highest rate since March 2024. The Bureau of Economic Analysis reported the Personal Consumption Expenditure index was down from a four-decade high of 7.2% in June 2022 but has stayed above the Fed’s long-range target of 2% since early 2021. The report also showed consumer spending rising 0.4% in December, outpacing the 0.3% gain in personal income. As a result, the personal saving rate fell to 3.6% of disposable income, its lowest point in more than three years.

Sales of newly constructed houses slipped in December, as the annual pace dropped 1.7% from November to 745,000 houses. New home sales were up nearly 4% from the year before, as the rate rose above the pre-pandemic level for the second month in a row. The median sales price fell 2% from December 2024 to $414,400. The inventory of unsold new houses fell to 7.6 months’ worth of inventory at current sales rates, compared to less than six months’ just before the pandemic.

The University of Michigan reported that its consumer sentiment index rose slightly from January. The reading was nearly 21% below where it stood in January 2025 as nearly half of all respondents said prices were eroding their personal finances. Sentiment was higher among consumers who were wealthier and had more education. Uncertainty and inflation expectations remained elevated historically but settled down from mid-2025 highs. Economists see consumer sentiment as a precursor to consumer spending, which accounts for about two-thirds of the U.S. gross domestic product.

Market Closings for the Week

- Nasdaq – 22886, up 339 points or 1.5%

- S&P 500 – 6910, up 73 points or 1.1%

- Dow Jones Industrial – 49626, up 125 points or 0.3%

- 10-year U.S. Treasury Note – 4.09%, up 0.03%

.