Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 1-5, 2025)

Significant Economic Indicators & Reports

Monday

The manufacturing industry shrank in November for the ninth month in a row and the 35th time in 37 months, according to the Institute for Supply Management. The trade group said manufacturers continued to complain about tariffs, prices and uncertainty as supplier deliveries and new orders grew. Employment sank. A rare bright spot was a slight increase in production. Based on past history, the index suggests the U.S. economy is growing at an annual rate of 1.7%.

Because of the federal government shutdown in October and the first couple of weeks in November, the Commerce Department did not releasee its scheduled report on construction spending.

Tuesday

No major releases

Wednesday

Industrial production in the U.S. grew by 0.1% in September, rising for the third time in four months, the Federal Reserve reported. Production of consumer goods fell, led by automotive. The output of consumer goods declined for the second quarter in a row, at an annual pace of 0.6%, according to the Fed. Industries were using 75.9% of their production capacity, which was below the 50-year average of 79.5%, suggesting a lack of inflationary pressure.

The service sector showed signs of an emerging recovery in November, according to the Institute for Supply Management. The trade group’s ISM services index signaled expansion for the second month in a row, reaching a reading of 52.6, compared to its 12-month average of 51.7. The ISM noted that the average is the lowest since August 2024 and the second lowest since mid-2010. Supply managers surveyed for the index said higher tariffs and the federal government shutdown are upsetting both demand and costs.

Thursday

The Bureau of Economic Analysis failed to report on the U.S. trade gap for October, as scheduled, because of the 43-day federal government shutdown.

The four-week moving average of initial unemployment claims fell for the third week in a row, the fifth time in six weeks, to its lowest level since January. The numbers continued to suggest an overall reluctance to let workers go. Data from the Labor Department put the moving average at 41% below its 58-year average. Just over 1.8 million Americans claimed unemployment benefits in the latest week, up 3.2% from the week before, and 4% above the same time last year.

Demand for manufactured goods improved in October, with factory orders rising the second month in a row. Led by military equipment, orders gained 0.2% from September and were up 3.5% from October 2024. Excluding volatile transportation equipment, orders rose 0.2% for the month and were 0.8% higher than the year before, the Commerce Department reported. Orders for core capital goods, a measure of business investment, advanced 0.9% from September and were up 2.7% from October 2024.

Friday

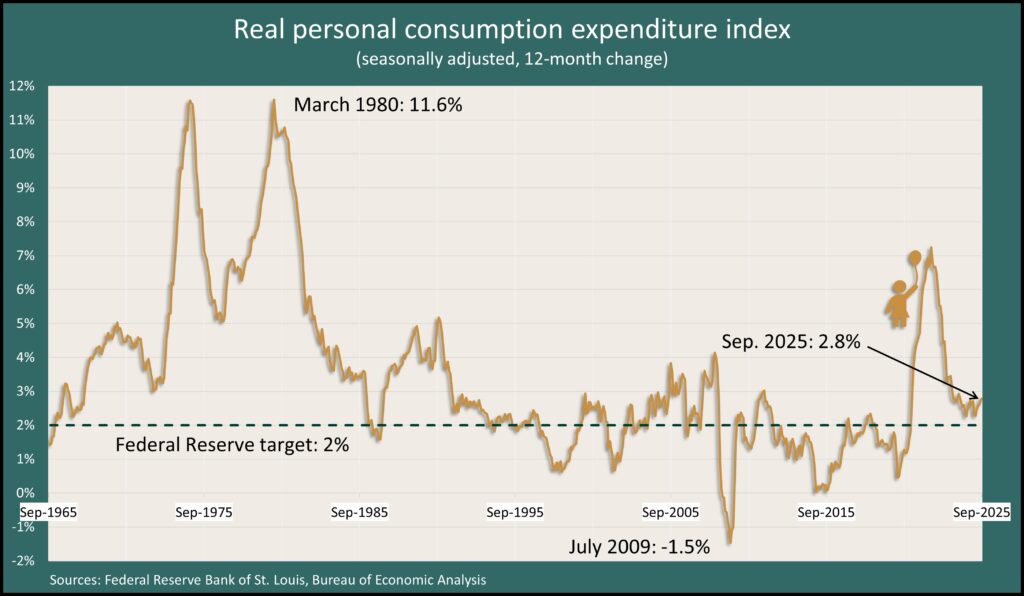

A delayed report on inflation showed a slight increase in September. The Bureau of Economic Analysis said the Personal Consumption Expenditure index, the Federal Reserve’s preferred inflation gauge, rose 2.8% from the year before, up from 2.7% In August and the highest rate in 17 months. The core PCE, which strips out volatile food and energy prices, rose slightly less than it did in August, and its year-to-year pace slowed slightly. Consumer spending, which drives more than two-thirds of economic output, increased 0.3% from August, following three months of 0.5% gains.

Consumer sentiment rose minimally in early December, based on a preliminary report from the University of Michigan. Survey data showed the university’s sentiment index up 4.5% from November, within the margin of error, though it remained 28% below where it stood in December 2024. Expectations for personal finances increased, the university said, but they remained 12% below where they began the year. High expectations of inflation also moderated. Ongoing concerns over high prices made consumers “broadly somber,” the university said.

Market Closings for the Week

- Nasdaq – 23578, up 212 points or 0.9%

- Standard & Poor’s 500 – 6870, up 21 points or 0.3%

- Dow Jones Industrial – 47955, up 239 points or 0.5%

- 10-year U.S. Treasury Note – 4.14%, up 0.12 point