Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Aug. 18-22, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

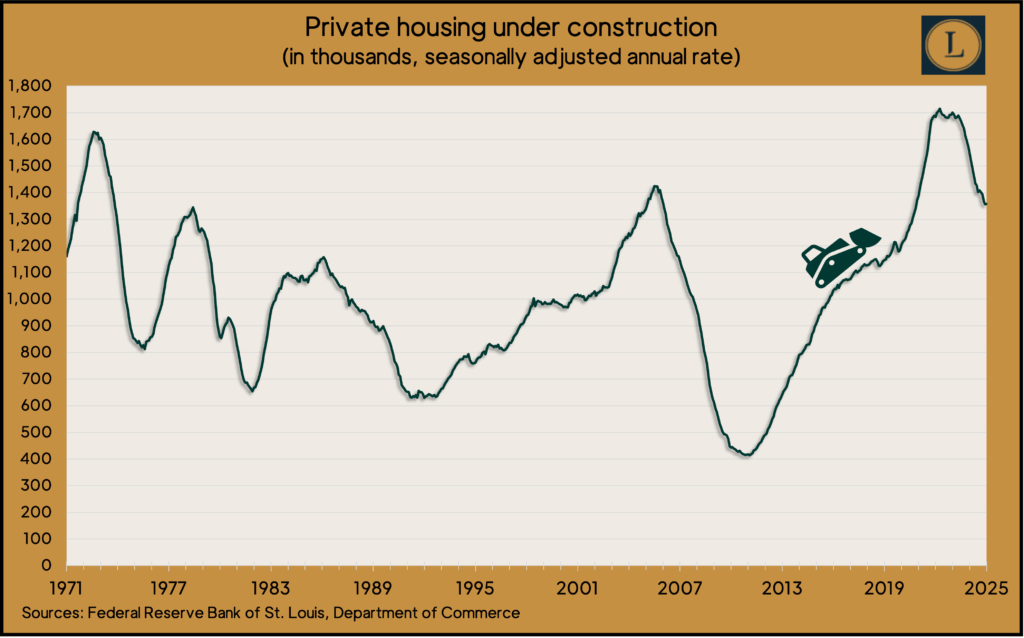

The Commerce Department reported mixed news on the annual rate of building permits and housing starts for July. New construction increased 5.2% from the June pace and was nearly 13% ahead of the year before, despite conventional mortgage rates hovering above 6.5% and widespread uncertainty over the shake-up of U.S. tariffs. Permits, an indication of prospects for future construction, fell to the slowest pace in more than five years. Meantime, the number of housing units under construction continued to decline, down 21% from the all-time peak in late 2022.

Wednesday

No major announcements

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row. An indication of employers’ willingness to let go of workers, the rolling average was 38% below the long-term average dating back to 1967. Total jobless claims dropped 1.3% from the week before to 2 million, which was up 5.1% from the same time in 2024.

The Conference Board said its index of leading economic indicators fell 0.1% in July, after a decline of 0.3% in June. The business research group said consumer pessimism and weak factory orders were the biggest drags on the index, offset somewhat by rising stock prices and falling unemployment claims. The six-month decline of the index accelerated to 2.7% from a 1% setback in the previous six months. The Conference Board forecast that the U.S. economy would avoid recession in the near term but that effects from higher tariffs would slow overall growth. The group expects gross domestic product to rise 1.6% in 2025 and 1.3% in 2026. GDP grew by 2.8% in 2024.

Existing home sales rose 2% in July and were up 0.8% from the same time last year, according to the National Association of Realtors. Sales reached an annual pace of 4.01 million houses, historically slow, but the trade group found encouraging signs from slightly rising inventories and narrowing price increases. The median sales price was $422,400, up just 0. 2% from the year before and the 25th consecutive gain. The Realtors said wages are outpacing home prices and estimated that about half of the houses sold cost less than a year ago. The group estimated that the average U.S. house appreciated in value by 49% since the pandemic.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 21497, down 126 points or 0.6%

- Standard & Poor’s 500 – 6467, up 17 points or 0.3%

- Dow Jones Industrial – 45632, up 686 points or 1.5%

- 10-year U.S. Treasury Note – 4.26%, down 0.07 point