Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 25-29, 2025)

Significant Economic Indicators & Reports

Monday

The annual rate of new home sales fell 0.6% in July and was more than 8% below its year-ago pace, the Commerce Department reported. The sales pace was below the pre-pandemic level for the seventh month in a row, and the supply of new houses on the market remained above the pre-pandemic mark as it has since January 2022. As a result of weaker demand and stronger supply, the median sales price in July was nearly 6% lower than the year before, at $403,800.

Tuesday

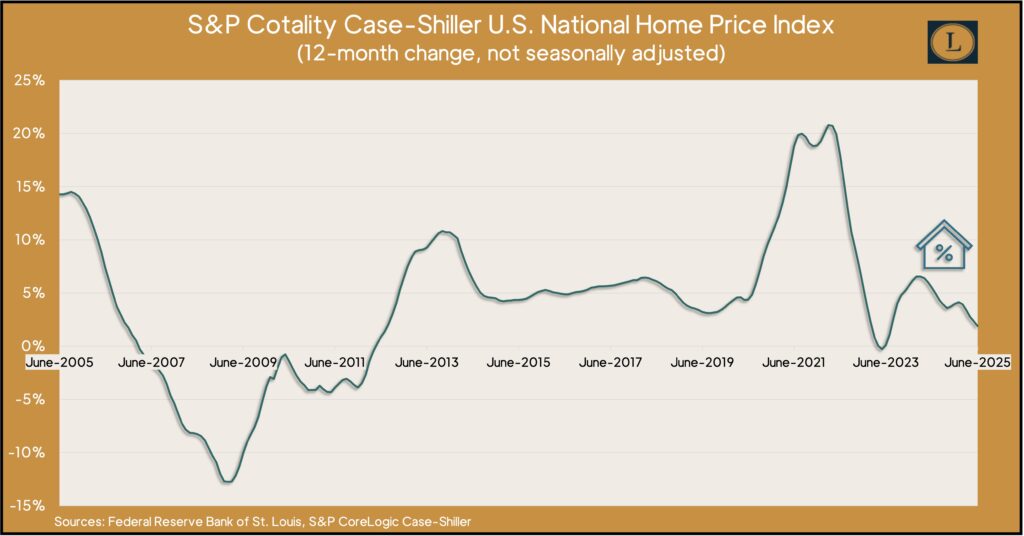

Overall housing inflation continued to decelerate in June, slipping under the general pace of inflation for the second month in a row, according to the S&P Cotality Case-Shiller national index. Month-to-month, prices actually decreased 0.3% from May, after adjusting for seasonal fluctuation. And compared to the year before, prices rose 1.9% in June vs. 2.7% inflation as measured by the Consumer Price Index. An analyst for the index cited a “continuation of a decisive shift in the housing market” in which price increases may be tracking closer to overall inflation. That would mean slower wealth accumulation for homeowners but a healthier housing market long-term.

Manufacturing demand dropped in July for the third time in four months, mostly on the wings of fallen orders for commercial aircraft. The Commerce Department said durable goods orders sank 2.8% from June, though they were up 7.3% from July 2024. Excluding transportation equipment, orders rose 1.1% in July, with a 1.9% increase from the same time last year. Orders for core capital goods orders, a measure of business investment, gained 1.1% from June and were up 2.3% from July 2024.

Amid growing concerns about tariffs and their contribution to inflation, consumer confidence declined slightly in August, though it stayed near the mood of the past three months. The Conference Board reported that overall expectations stayed at a level associated with recessions, and consumer views of the job market fell for the eighth month in a row. The business research group said consumers’ outlook for stocks fell slightly, with about half expecting stock prices to rise in the next year and about 30% expecting lower prices.

Wednesday

No major releases

Thursday

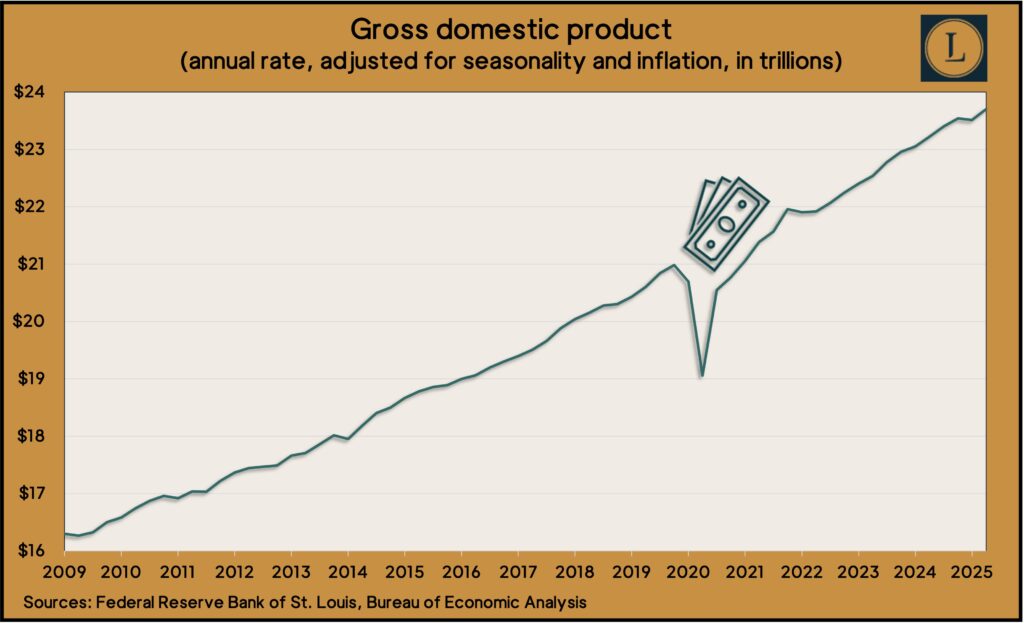

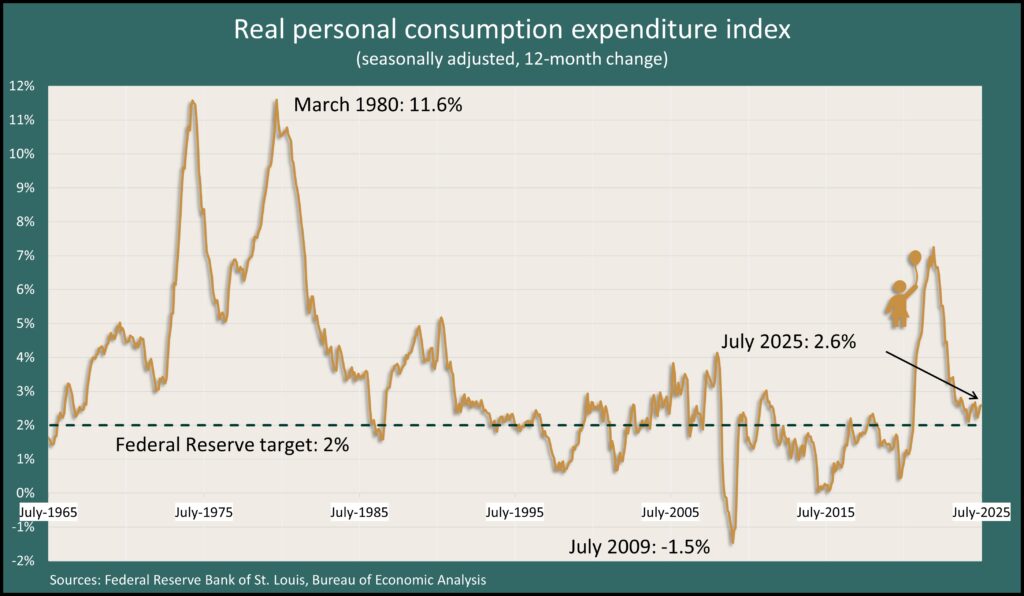

Because of slightly higher consumer spending and a lower decline in investments, the U.S. economy grew at a 3.3% annual pace in the second quarter. That was up from an initial estimate of 3% growth. The Bureau of Economic Analysis said it raised its estimate for the gross domestic product in part because personal consumption rose at a 1.6% annual rate. A prior estimate paced consumer spending at 1.4%. It was the second weakest quarter for consumer spending in two years. A drop in imports also spurred economic growth after surging in the first quarter when companies anticipated higher tariffs. Imports detract from GDP. The Federal Reserve Board’s favorite measure of inflation, the Personal Consumption Expenditures index, rose 2.4% from the year before. That was the smallest increase since the third quarter of 2024.

The four-week moving average for initial unemployment claims rose for the third week in a row, suggesting employers were more willing to let workers go. According to Labor Department data, new jobless claims reached their highest level in six weeks. They remained 37% below the 58-year average. Total claims fell 0.9% from the week before to just under 2 million. That was up 5.5% from the same time last year.

The National Association of Realtors said its pending home sales index sank in July. The trade group reported continued reluctance among would-be buyers. The association said commitments to sales dipped 0.4% from June. They were up 0.7% from July 2024, which at the time was a 23-year low. The index reading was nearly 30% below the baseline for sales activity, set in 2001. In a statement, the Realtors chief economist, Lawrence Yun, said: “Even with modest improvements in mortgage rates, housing affordability, and inventory, buyers still remain hesitant.”

Friday

Personal spending rose a steady 0.5% in July, the Bureau of Economic Analysis reported. The spending increase slightly outpaced the month’s 0.4% gain in personal income. The report showed heavier consumer spending on autos and insurance, with lower outlays for restaurants and hotels. The Fed’s favorite gauge of inflation rose 2.6% from July 2024. That was unchanged from June. Inflation had been as low as 2.2% in April, closer to the Fed’s long-range target of 2%. The PCE reached a four-decade high of 7.2% in mid-2022.

The University of Michigan said its consumer sentiment index sank again in August. Expectations for higher prices clouded views of the economy, buying conditions and personal finances. Though up about 11% from its lows in April and May, the index fell 6% from where it ended in July. It was down 14% from August 2024. The university said the survey-based index showed broad declines across demographic and political affiliations. Sentiment is considered a bellwether for consumer spending, the chief driver of U.S. gross domestic product.

Market Closings for the Week

- Nasdaq – 21456, down 41 points or 0.2%

- Standard & Poor’s 500 – 6460, down 7 points or 0.1%

- Dow Jones Industrial – 45545, down 87 points or 0.2%

- 10-year U.S. Treasury Note – 4.23%, down 0.03 point