Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 28-Aug. 1, 2025)

Significant Economic Indicators & Reports

Monday

No major reports or releases

Tuesday

The year-to-year change in residential prices continued to slow in May, dipping below the overall inflation rate. The S&P CoreLogic Case-Shiller national home price index rose 2.3% from the year before, compared to a 2.7% gain in April. That compared to a Consumer Price Index inflation rate of 2.4% in May. Month to month, seasonally adjusted home prices fell 0.3% in May, the third consecutive decline. In a release, an analyst with the index said in part: “With affordability still stretched and inventory constrained, national home prices are holding steady, but barely.”

The Conference Board said its consumer confidence index rose slightly in July, though expectations were low enough to signal recession for the sixth straight month. The business research group said generally consumers’ moods have stabilized after rebounding from their drop in April. Tariffs and anticipation that they would result in higher inflation continued to top consumer concerns. Consumer assessments of job availability weakened for the seventh month in a row.

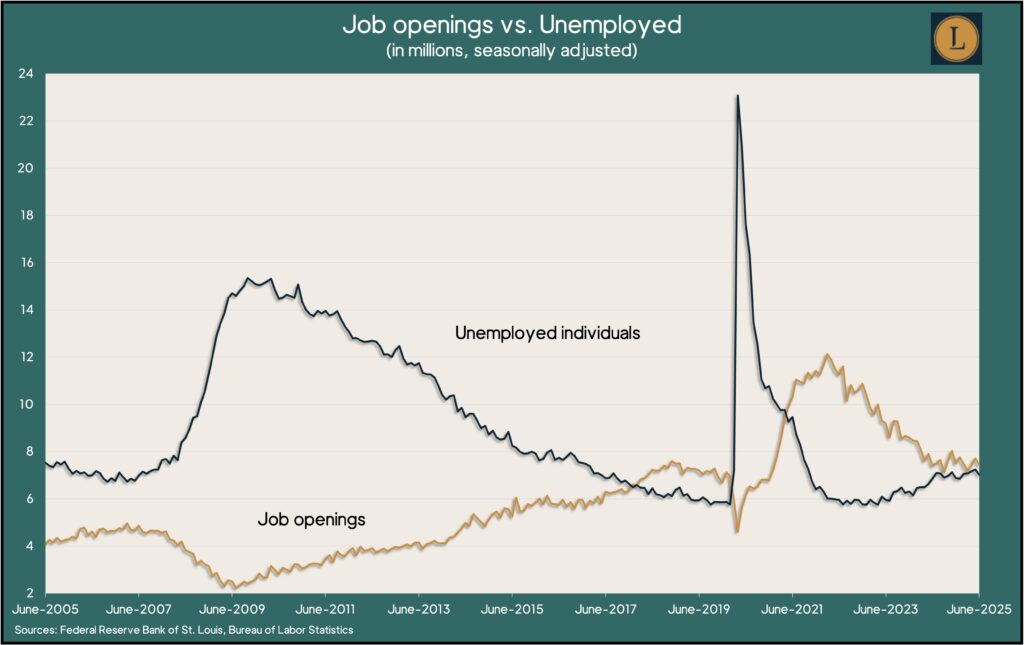

Employers’ demand for workers eased slightly in June, with job openings falling to 7.4 million, down 3.6% from May. The level remained above its peak prior to the COVID-19 pandemic but was down from a record 12.1 million in 2022. Openings continued to outpace the number of unemployed individuals seeking work. Meantime, the number and rate of workers quitting their jobs stayed below the pre-pandemic level, suggesting workers had less confidence in finding new jobs. Quits have been lower than the pre-pandemic mark since late 2023.

Wednesday

U.S. economic growth accelerated in the second quarter of 2025, overcoming a first-quarter decline. According to an advance report on gross domestic product from the Bureau of Economic Analysis, the economy expanded at an annual rate of 3% from the first three months of the year, compared to a 0.5% setback in the first quarter. Faster growth was attributed to increased consumer spending, which nearly tripled its pace, and a plunge in imports, which ballooned in the first quarter in anticipation of increased tariffs. Imports detract from GDP growth.

Despite recent growth in inventories, the National Association of Realtors reported its pending home sales index declined by 0.8% in June. Contract signings lagged 2.8% behind the June 2024 index. The trade group’s index was 28% below its 2001 baseline, which represents what the group considers a normal sales range to keep up with population growth. Final sales in 2024 were the lowest since 1995.

Thursday

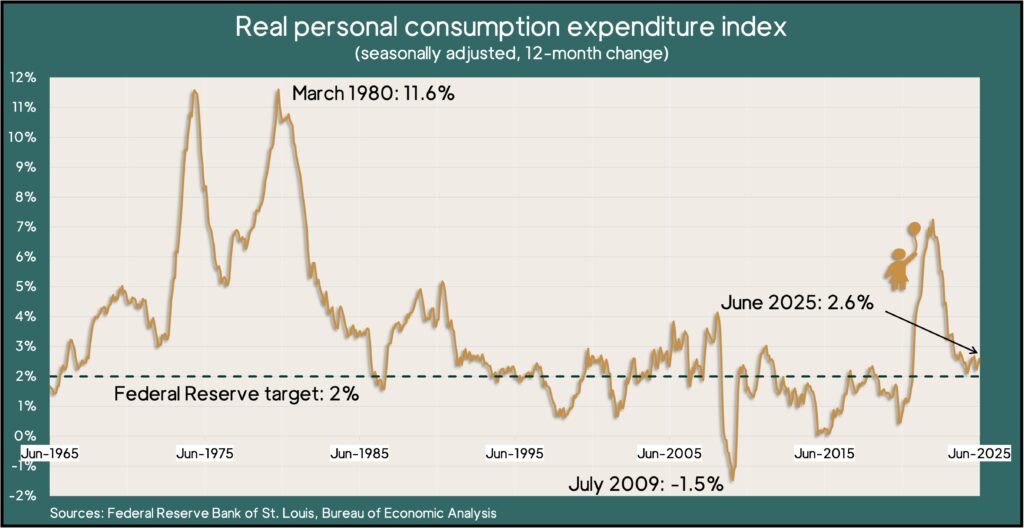

The Bureau of Economic Analysis said consumer spending – which accounts for about two-thirds of GDP – rose 0.3% in June, following no change in May. Personal income also gained 0.3% for the month. As a result, the personal saving rate stayed at 4.5% of disposable income. The personal consumption expenditures index, the Fed’s favorite inflation indicator, rose 2.6% from June 2024. That was up from a 2.4% inflation rate in May and 2.2% in April. Three years ago, the PCE index reached a four-decade high of 7.1%.

The four-week moving average for initial unemployment claims fell for the sixth week in a row, meeting its lowest level since April. Labor Department data shows that the measure of employers’ willingness to let go of workers was 39% below the all-time average. It was 10% higher than it was just before the COVID-19 pandemic. More than 1.9 million Americans claimed jobless benefits in the latest week, down marginally from the week before but up 10.2% from the same time last year.

Friday

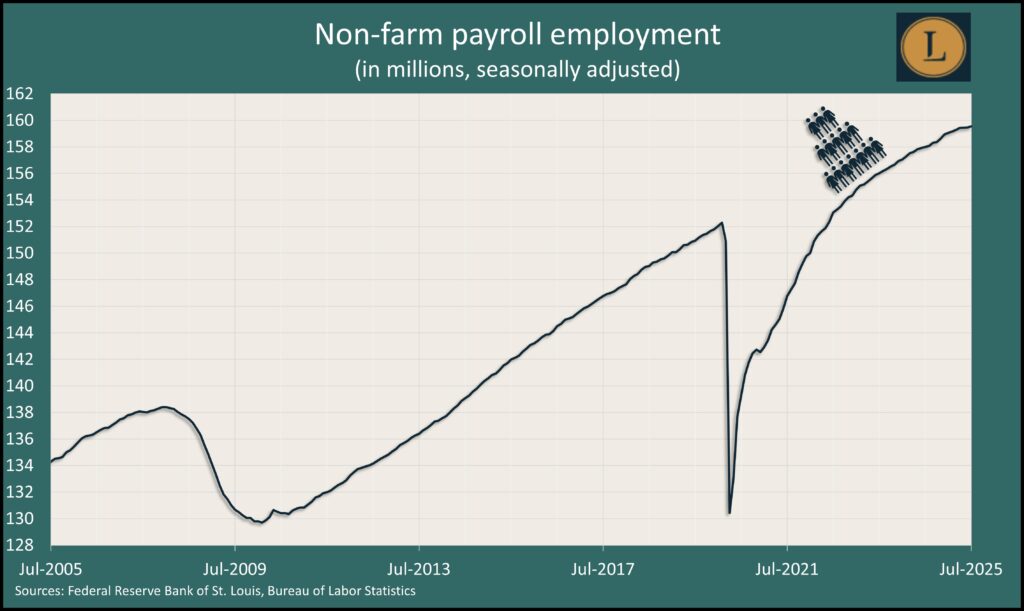

U.S. employers added 73,000 jobs in July, according to the employment situation report from the Bureau of Labor Statistics. The gains fell below the 12-month average of 129,000 new jobs, and additions in April and May were revised down to a combined 33,000 from a previous estimate of 291,000. The unemployment rate rose marginally to 4.2%, staying within a narrow range set in May 2024. The U-6 underemployment rate reached 7.9% in July, staying above its pre-pandemic level for the 23rd month in a row. Employment in temporary help services – often a harbinger of job conditions – hit its lowest point since September 2020.

The manufacturing sector contracted in July for the fifth month in a row and the 31st time in 33 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of purchasing managers, showed further weakening from June. The ISM said 79% of the sector’s GDP declined in July, vs. 46% in June. The ISM said the index suggested the U.S. economy overall was growing at a 1.6% annual rate.

The Commerce Department said construction spending declined in June for the second month in a row, dipping 0.4% from the seasonally adjusted annual pace in May. Housing, which accounted for 42% of all construction spending, pulled back 0.7%. Year to year, total construction spending was 2.9% behind the June 2024 pace. Spending on residential building sank 6% from the year before.

Often a pre-cursor to spending, consumer sentiment improved marginally in July. The University of Michigan said its survey-based index rose for the second month in a row, though it’s still “broadly negative.” The index was 7.1% lower than it was in July 2024. Overall opinions were broadly shared across demographic and political affiliations, the university said, although “a rise in sentiment among stock holders was partially offset by a decline among consumers who do not own stocks.”

Market Closings for the Week

- Nasdaq – 20650, down 458 points or 2.2%

- Standard & Poor’s 500 – 6238, down 151 points or 2.4%

- Dow Jones Industrial – 43589, down 1313 points or 2.9%

- 10-year U.S. Treasury Note – 4.22%, down 0.17 point