Photo by Reuben Neese

Here are the answers to the 2013 Investment Outlook Seminar Quiz. (Thank you for not peeking ahead. Delayed gratification is its own reward.)

View our recording of the seminar by clicking here.

1. Name the two fundamental determinants of whether stock prices go up or down over the long run.

Corporate earnings and interest rates

2. Economists have estimated that sequestration – raising federal taxes and cutting federal spending – had what effect on the U.S. economy in the first half of 2013?

c. Held back economic growth by 1.8 percentage points.

3. True or False? Corporate profits have never been higher.

True (See below. Click graphics to enlarge.)

4. Recent trends toward developing-nation markets have been reversing. Which of these is NOT a factor in that global economic shift?

c. The further slowdown of Japan’s economy. (Japan’s economy actually has been on a tear after government stimulus programs by Prime Minister Shinzo Abe.)

5. True or False? U.S. inflation is nearing the historic average.

False. (See below.)

6. Which statement about the U.S. budget deficit is correct?

d. It is not at a record high, neither in dollar amount nor as a percent of GDP. (See below.)

7. True or False? The U.S. economic output has never been higher.

True (See below.)

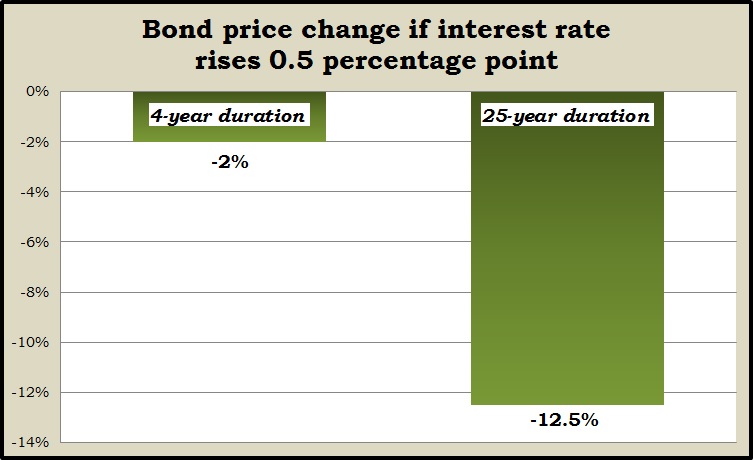

8. Bond prices move in the opposite direction of interest rates in proportion to the bond’s duration. Which of these formulas best illustrates that?

c. (Change in Interest Rate) X (Duration) = Change in Price. (That means that investors with shorter-duration bonds are less exposed to price falls as interest rates drop. See below.)

9. What lesson should investors take from the Federal Reserve’s eventual tapering of its $85 billion-a-month bond-buying program?

b. The Fed considers the U.S. economy strong enough to keep growing without needing the bond buying as stimulus. (In a statement Sept. 18, the Federal Open Market Committee explained that it hopes to have a stronger economy before it begins tapering.)

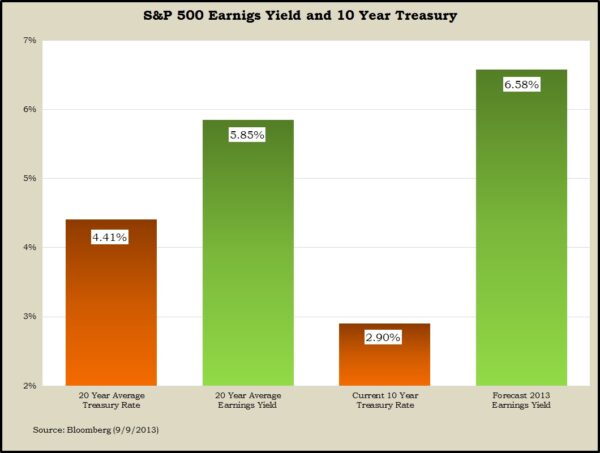

10. Which is the bigger number?

a. 6.58%. (It wasn’t a trick question. Comparing the earnings yield forecast for the S&P 500 index vs. the recent yield of the 10-year U.S. Treasury note suggests greater returns expected from stock investments. See below.)

(initially posted Oct. 1, 2013)

Want to quiz our advisors? They love to respond to listeners on our weekly Money Talk Podcast. Click here to send us a question.

More information and insight from Money Talk

Follow us on Twitter @_Money_Talk