Podcast: Play in new window | Download

Landaas & Company newsletter October edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Reuben Neese)

Week in Review (Sept. 25-29, 2023)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

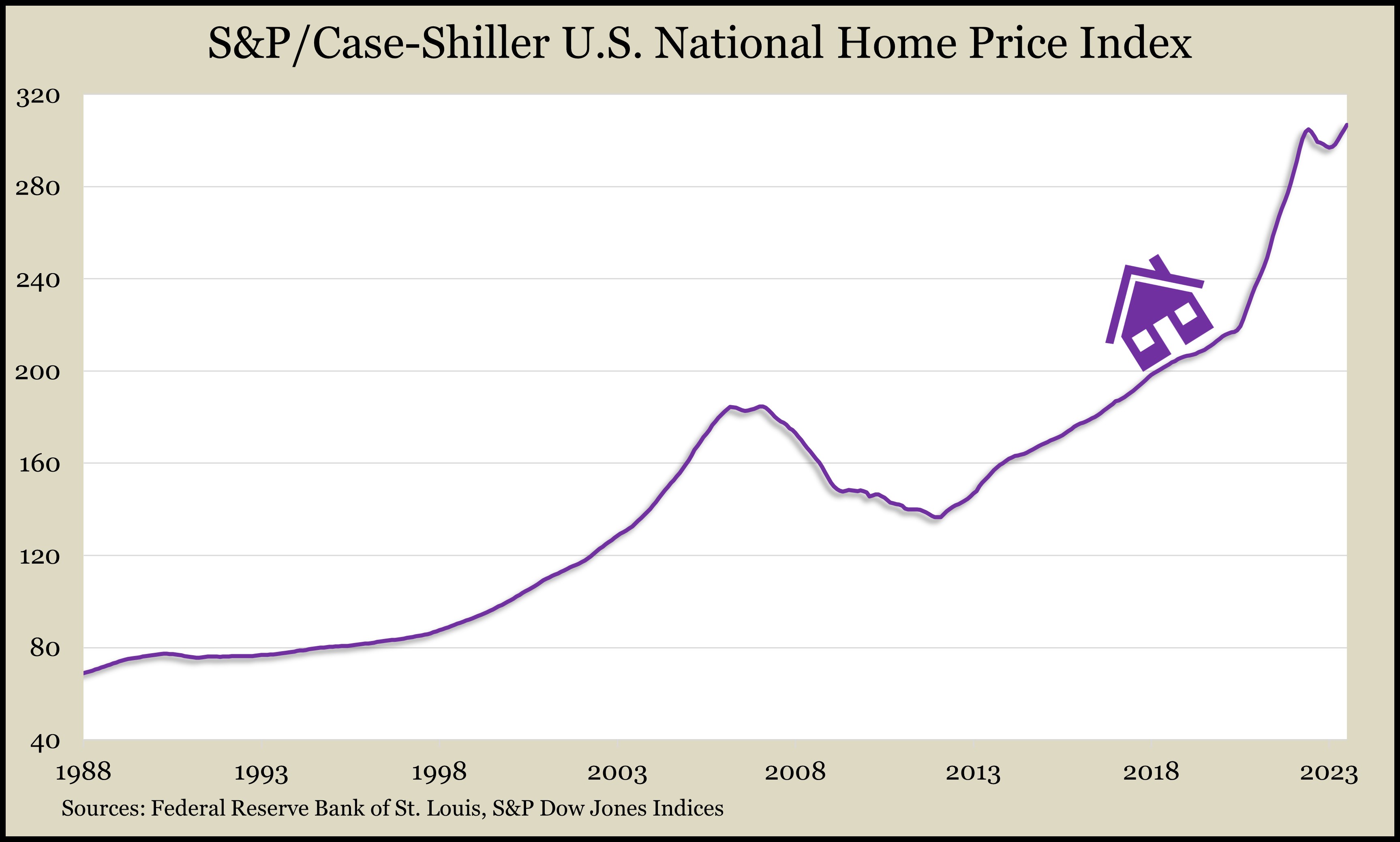

Housing prices reached an all-time high July, according to the S&P CoreLogic Case-Shiller home price index. The previous peak was in June 2022, after which price increases decelerated for six months. The index shows home prices up 1% from the year before. An S&P analyst said higher mortgage rates and economic weakness could offset momentum, but the breadth and strength of the July data were encouraging.

The Conference Board said its consumer confidence index fell in September for the second month in a row as short-term expectations dipped below the level that historically indicates a recession in the next year. The business research group said more consumers are registering fears of a downturn as well as rising prices and political disruption. The group said it expects a shallow recession in the first half of 2024.

The seasonally adjusted annual rate of new home sales fell nearly 9% in August, although it was up almost 6% from the year before. The Commerce Department reported that the median price for a new house fell 2% from the year before to $430,300. The supply of new houses rose to the highest level since March.

Wednesday

The Commerce Department said orders for durable goods rose in August for the fifth time in six months. The 0.2% increase was broadly distributed. A rise in defense orders offset a decline in commercial aircraft contracts. Excluding transportation equipment, orders rose 0.4%; they declined 0.7% when defense orders were excluded. Total durable goods orders were up 4.2% from August 2022. Core capital goods orders, a proxy for business investments, rose 0.9% from July and were up 10% from the year before.

Thursday

The U.S. economy grew at an annual pace of 2.1% in the second quarter of 2023, according to a final estimate of the gross domestic product. The rate was unchanged from a previous estimate by the Bureau of Economic Analysis and down from 2.2% in the first quarter. Measured year to year, the economy grew 2.4%. Consumer spending, which drives more than two-thirds of the economy, was slower than initially estimated. Slower spending drove the personal saving rate up to 5.2% from the previous estimate of 4.7% of disposable income.

The four-week moving average for initial unemployment claims dropped for the fourth week in a row, falling to the lowest level since early February. The average was down 42% from its 56-year average, highlighting employers’ continued reluctance to let workers go. The Labor Department said nearly 1.7 million Americans were claiming unemployment compensation in the latest week, down 0.5% from the week before.

The National Association of Realtors said its index on pending home sales sank more than 7% in August as higher mortgage rates and low inventory diminished demand. Plans to buy houses were down nearly 19% from the year before, the trade group reported.

Friday

Consumer spending increased 0.4% in August, in line with gains in income for the month. Higher prices accounted for some of the spending growth. Corrected for inflation, spending was up 0.1%, according to the Bureau of Economic Analysis. The Federal Reserve’s favorite inflation gauge – the Personal Consumption Expenditure index – also edged up 0.4% in August but was just 0.1% when volatile prices for energy and food were excluded. Since August 2022, the PCE was up 3.5% while the core PCE rose 3.9%, the least since May 2021.

The University of Michigan’s consumer sentiment index rose slightly in September, though it was down marginally from its mid-month mark. The reading of 68.1 was 16% higher than the year before, when sentiment was near a record low. A university economist said uncertainties from union strikes and a looming government shutdown contributed to a holding pattern for consumer attitudes. Expectations for inflation dropped to their lowest point in more than two years.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13219, up 8 points or 0.1%

- Standard & Poor’s 500 – 4288, down 32 points or 0.7%

- Dow Jones Industrial – 33509, down 455 points or 1.3%

- 10-year U.S. Treasury Note – 4.57%, up 0.13 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.