Podcast: Play in new window | Download

Landaas & Company newsletter September edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Sept. 11-15, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

The broadest measure of inflation delivered mixed signals from August. For the month, the Consumer Price Index rose 0.6%, the most in 14 months, according to the Bureau of Labor Statistics. A 10.6% jump in the price of gasoline accounted for more than half the increase. Also contributing: Shelter costs, which rose for the 40th month in a row. The core CPI, which excludes volatile prices for food and energy items, rose 0.3% from July. Year to year, the CPI was up 3.7%, after reaching 3% in June. The core index fell to 4.3% from the year before, the lowest in nearly two years.

Thursday

Higher gas prices also boosted inflation on the wholesale level in August. The Bureau of Labor Statistics said its Producer Price Index rose 0.7%, the biggest gain in 14 months. Food prices fell for the fourth time in five months. Excluding food, energy and trade services, the core PPI rose 0.3% for the second month in a row. Since August 2022, the PPI rose 1.6%, which was the most since April. The core PPI was up 3% from the year before, compared to 2.9% in July.

The four-week moving average for initial unemployment claims fell for the second week in a row and the seventh time in 11 weeks, reaching the lowest level since February. According to Labor Department data, the average moved to 224,500 new applications, 39% below the average since 1967. Just under 18 million Americans claimed jobless benefits in the latest week, down more than 2% from the week before and up about 28% from the year before.

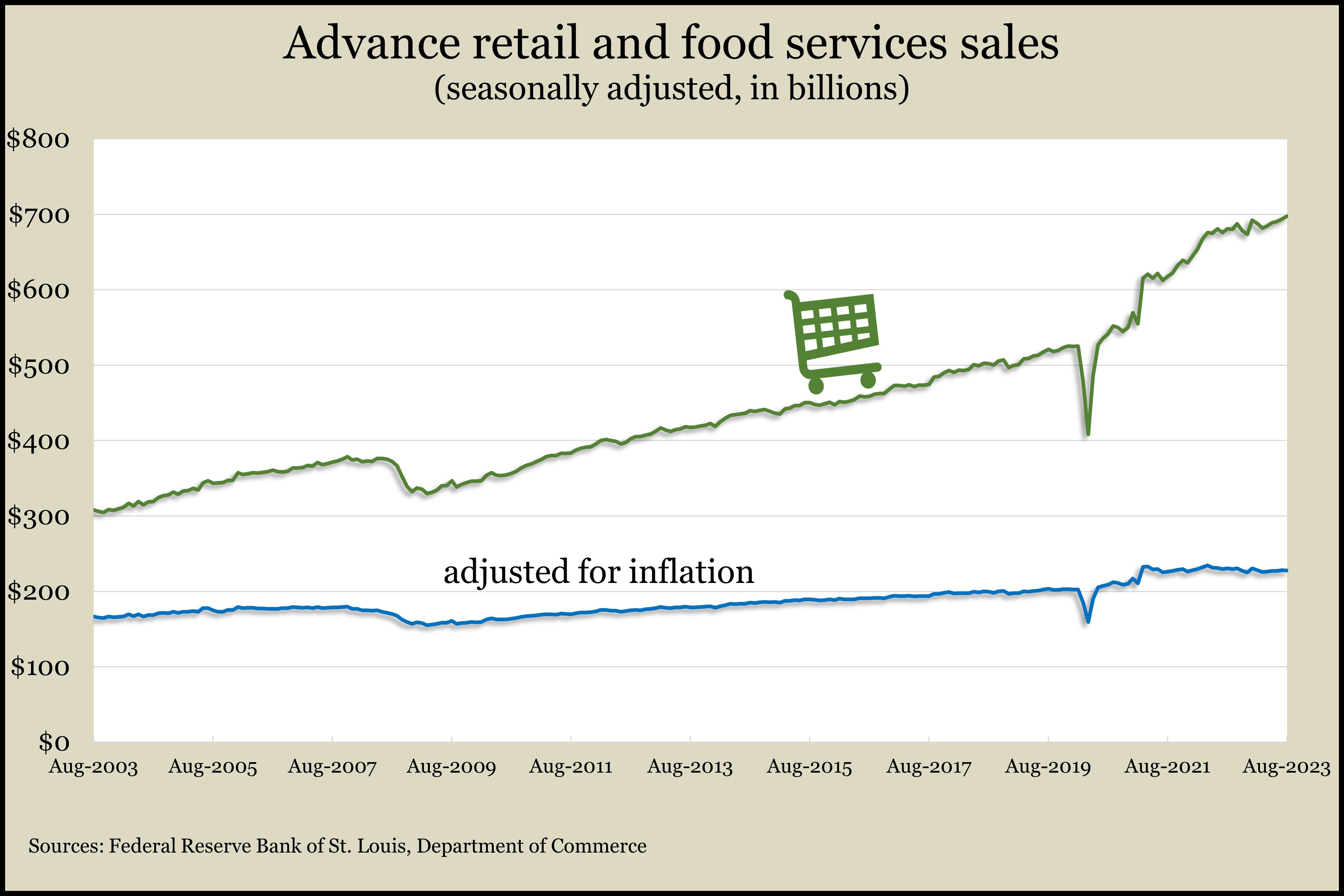

The Commerce Department reported a 0.7% rise in retail sales in August, fueled by higher gas prices. Excluding gas stations, sales rose 0.2% for the month, compared with 0.5% in July. Sales rose in 10 of 13 categories. Sellers of furniture, sporting goods and miscellaneous merchandise experienced declines. Adjusted for inflation, retail sales fell 0.1% in August, the first decline since March.

Friday

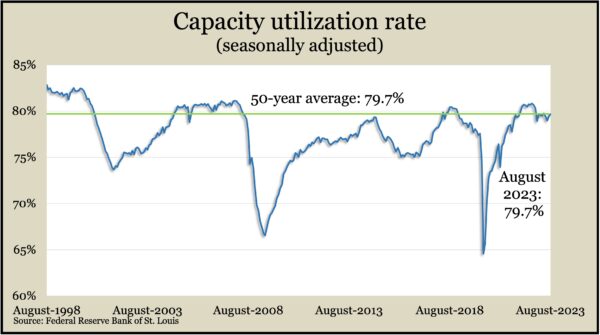

U.S. industrial output rose 0.4% in August, the second gain in a row, though down from a 0.7% increase in July. A 5% drop in production from the auto industry held back the measure, the Federal Reserve reported. Output from factories rose 0.1%, but excluding motor vehicles and parts, manufacturing increased 0.6%. Since August 2022, overall industrial production rose 0.2%, with manufacturing output declining 0.6%. Meanwhile, capacity utilization rose marginally, reaching the 50-year average operating rate.

Consumer sentiment stayed relatively steady in early September, according to the University of Michigan. A preliminary index reading of 67.7 was down from 69.5 at the end of August but about 35% above its record low in June 2022. Sentiment remained well below the historical average of 86. The university said consumer outlooks on economic conditions have improved modestly, but threats to shut down the government has the potential to send sentiment sliding.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13708, down 53 points or 0.4%

- Standard & Poor’s 500 – 4450, down 7 points or 0.2%

- Dow Jones Industrial – 34619, up 42 points or 0.1%

- 10-year U.S. Treasury Note – 4.32%, up 0.06 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.