Podcast: Play in new window | Download

Landaas & Company newsletter October edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

Kendall Bauer

(with Max Hoelzl, and Joel Dresang, engineered by Jason Scuglik)

Week in Review (October 9-13, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

Prices on the wholesale level rose more than analysts expected in September, fueled by increases in energy costs. The Bureau of Labor Statistics said its Producer Price Index rose 0.5% from August. Demand for goods climbed 0.9%. Since September 2022, the PPI rose 2.2%, the fastest rate since April, but down from an 11.7% one-year pace in March 2022. Excluding volatile prices for food, energy and trade services, the core PPI advanced 0.2% for the month and was up 2.8% from the year before, which was on par with recent months and down from 7.1% in March 2022.

Thursday

Shelter costs accounted for more than half of the 0.4% increase in inflation in September. The Bureau of Labor Statistics said gasoline prices also added to its Consumer Price Index. The gain was down from 0.6% in August. In the latest 12 months, the broadest measure of inflation rose at a 3.7% pace, tied with August for the slowest in 30 months and down from 9.1% in June 2022. The core CPI, which strips out volatile costs for food and energy, rose 0.3% from August and 4.1% from September 2022. The year-to-year rate was the lowest in two years and down from 6.6% a year ago.

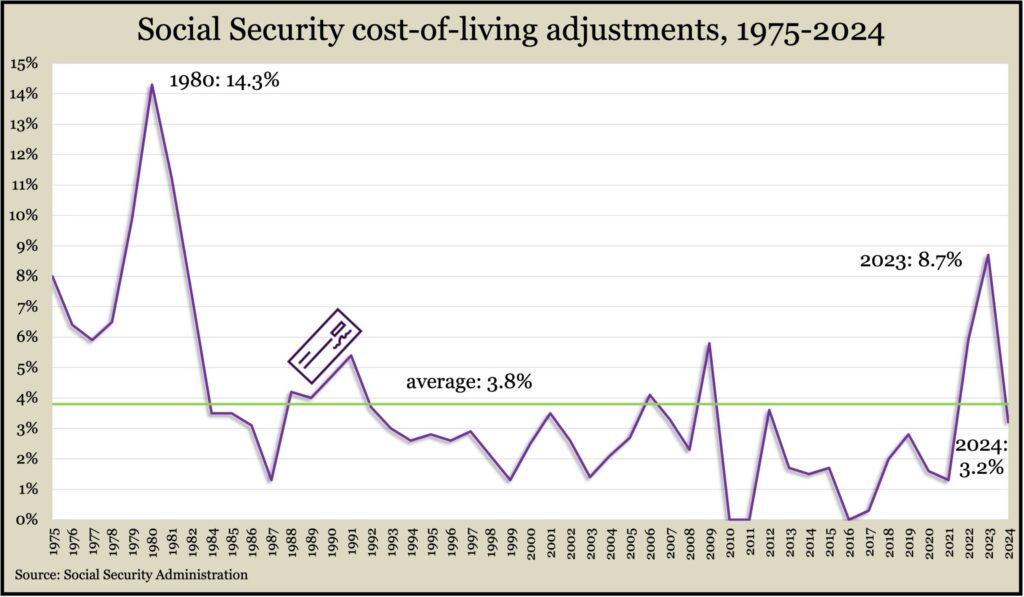

Based on CPI data, the Social Security Administration announced a 3.2% adjustment to benefits in 2024. That was a drop from 8.7% in 2023, the biggest raise for Social Security recipients since 1981. The average cost-of-living adjustment since Social Security began adjusting benefits to inflation in 1975: 3.8%. Social Security said the average recipient can expect an added $50 in their benefit checks, beginning in January.

The four-week moving average for initial unemployment claims sank for the sixth week in a row, reaching 44% below the all-time average and the lowest level since January. The Labor Department said fewer than 1.6 million Americans claimed jobless benefits in the most recent week, down 0.2% from the week before but up 28% from the same time last year. The historically low claims numbers illustrate the reluctance of employers to let workers go in a tight labor market.

Friday

A preliminary reading of consumer sentiment in October showed lower confidence because of higher expectations for inflation. The survey-based index from the University of Michigan dropped 7.5% from where it stood at the end of September. It was 5.2% ahead of where it was in October 2022. One-year expectations for inflation rose to their highest level since May, staying well above the range before the pandemic. Long-term expectations also edged up. According to the university, expectations for rising prices tend to stifle consumer spending, which drives nearly 70% of U.S. economic activity.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13407, down 24 points or 0.2%

- Standard & Poor’s 500 – 4328, up 19 points or 0.4%

- Dow Jones Industrial – 33671, up 263 points or 0.8%

- 10-year U.S. Treasury Note – 4.63%, down 0.16 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.