Podcast: Play in new window | Download

Landaas & Company newsletter October edition now available.

Advisors on This Week’s Show

Kyle Tetting

Adam Baley

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 30-Nov. 3, 2023)

Significant Economic Indicators & Reports

Monday

no significant reports

Tuesday

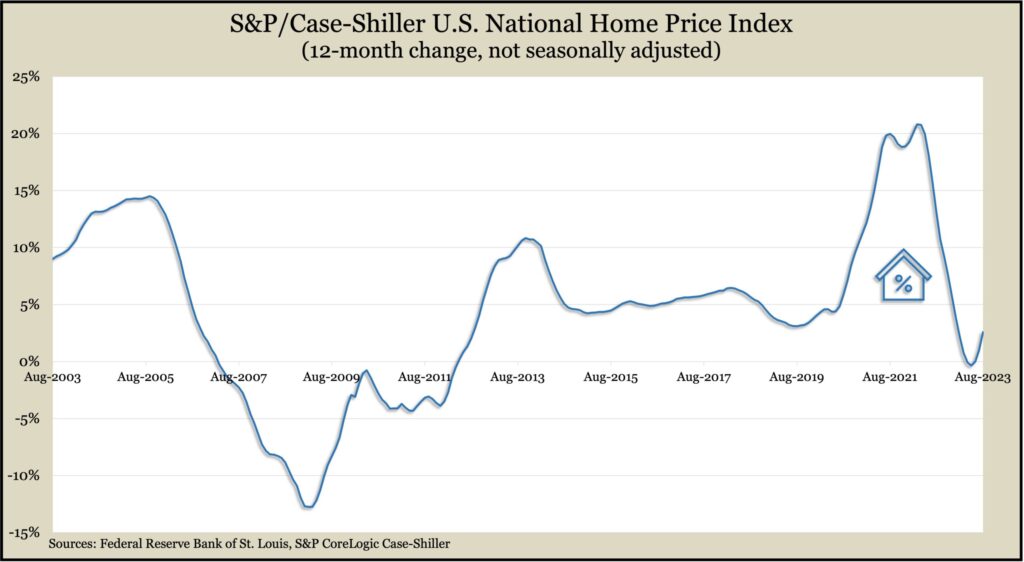

Housing prices continued gaining in August, according to the S&P CoreLogic Case-Shiller national home price index. The measure showed broad gains in prices across the country with year-to-year price increases accelerating in 19 of 20 cities studied. The national index was up 2.6% from the year before, vs. a 1% year-to-year gain in July. The index was 6.4% ahead of its recent bottom in January. A spokesman for the index explained the rising prices by saying that higher mortgage rates have been suppressing the supply of houses for sale more than the demand.

The Conference Board said its consumer confidence index dipped in October for the third month in a row, suggesting expectations for an economic recession. The business research group said consumers are preoccupied with rising prices and expressed concerns about political volatility and global uncertainty, including war in the Middle East. The Conference Board repeated its prediction of a short, shallow downturn in the first half of 2024.

Wednesday

The manufacturing sector contracted in October for the 12th month in a row, according to the Institute for Supply Management. The trade group’s index, based on surveys of industry purchasing managers, showed new orders declining at a faster rate while production grew, though slower than it had in September. Employment fell after having expanded the month before, and some companies reported considering layoffs. The group said based on past index readings, the U.S. gross domestic product is receding at an annual rate of 0.7%.

The Commerce Department said construction spending rose slightly in September, aided by single-family housing. At a seasonally adjusted annual rate of nearly $2 trillion, expenditures were up 0.4% from the August pace and up almost 9% from the year before. Spending on residential construction, which accounted for 44% of the total, rose 0.6% for the month but was 2.1% lower than the year-ago pace. Expenditures on factory construction fell 0.4% from August but was up 62% from the year before.

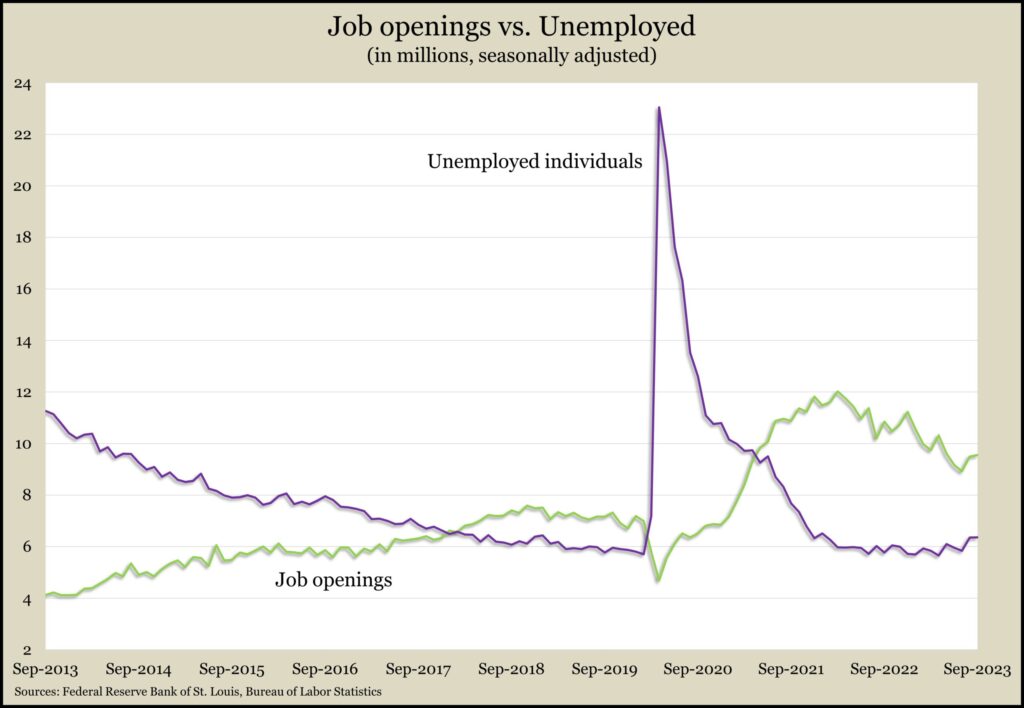

Job openings rose slightly in September, another sign of the labor market’s resilience so far amid Federal Reserve Board efforts to slow the economy. Openings rose 0.6% from August to 9.6 million positions, the Bureau of Labor Statistics reported. That was 12% below the September 2022 level but still higher than the 7 million mark just before the COVID pandemic. The report showed little change in the numbers and rates of hires, separations and quits. Compared to the number of unemployed people actively seeking jobs, demand for workers outnumbered supply by about 3 million, little changed from August.

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row, though the level continued to reflect tight labor conditions. The measure was 43% below the all-time average, according to Labor Department data. The report said 1.6 million Americans claimed jobless benefits in the latest week, up 2% from the week before and up 28% from the year before.

The Bureau of Labor Statistics said the annual rate of worker productivity rose in the third quarter by 4.7%, the most in three years. Measuring year to year, third-quarter productivity rose 2.2% for the third consecutive acceleration. Over the last four quarters, productivity rose because output, which was up 3.1%, exceeded the 0.8% increase in hours worked. Hourly compensation rose at a 3.9% annual rate in the third quarter, so labor costs fell 0.8%. Measured from the third quarter of 2022, labor costs gained 1.9%.

The Commerce Department said the value of factory orders rose 4.7% in September for the sixth increase in seven months. Growth was led by sizable sales of commercial aircraft. Excluding the volatile transportation category, orders rose 0.8% for the month. Year to year, total orders were 0.7% higher than they were in September 2022. Excluding transportation, orders were down 1.4% in the same period. Demand for core capital goods, a proxy for business investments, rose 0.5% from August and were up 1.9% from the year before.

Friday

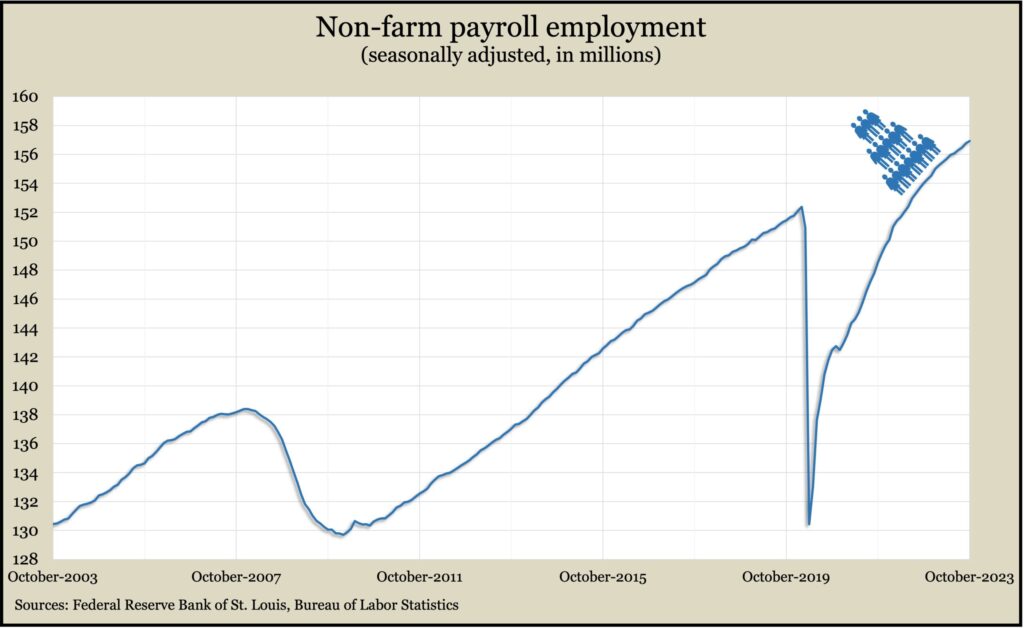

U.S. employers added 150,000 jobs in October, below the 12-month average of 258,00 and another sign that economic growth may be slowing. According to jobs data from the Bureau of Labor Statistics, August and September gained 101,000 fewer jobs than previously estimated. The average wage was up 4.1% from the year before, the slowest increase since June 2021, though still outpacing general inflation. The unemployment rate ticked up to 3.9% in October, the highest in nearly two years, but continued the longest streak below 4% since the 1960s.

The service sector of the U.S. economy grew in October for the 10th month in a row, though at the slowest rate since May. The Institute for Supply Management said its services index showed new orders growing faster than in September while inventories and export orders declined. The trade group said its survey of purchasing managers suggests the overall economy was growing at an annual rate of 0.7%.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13478, up 835 points or 6.6%

- Standard & Poor’s 500 – 4358, up 241 points or 5.9%

- Dow Jones Industrial – 34061, up 1643 points or 5.1%

- 10-year U.S. Treasury Note – 4.56%, down 0.29 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.