Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Kendall Bauer

John Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (May 27-31, 2024)

Significant Economic Indicators & Reports

Monday

Markets and government closed for Memorial Day

Tuesday

Housing prices continued to accelerate in March, hitting more all-time highs, according to the S&P CoreLogic Case Shiller home price index. Prices overall grew by 6.5% from their March 2023 level, the same increase as in February. Adjusted for seasonal fluctuations, the national index reached a record high for the ninth time in the last year. An analyst for the index described “widespread and sustained growth” for the housing sector.

The Conference Board said its consumer confidence index rose in May for the first time in four months, exceeding analyst forecasts yet suggesting fears of recession. The business and research group said strong sentiment toward the labor market overall offset concerns about higher inflation and rising interest rates. Consumers younger than 35 and earning more than $100,000 a year were the most confident. A measure of expectations associated with recessions remained at a warning level for the fourth month in a row.

Wednesday

No major releases

Thursday

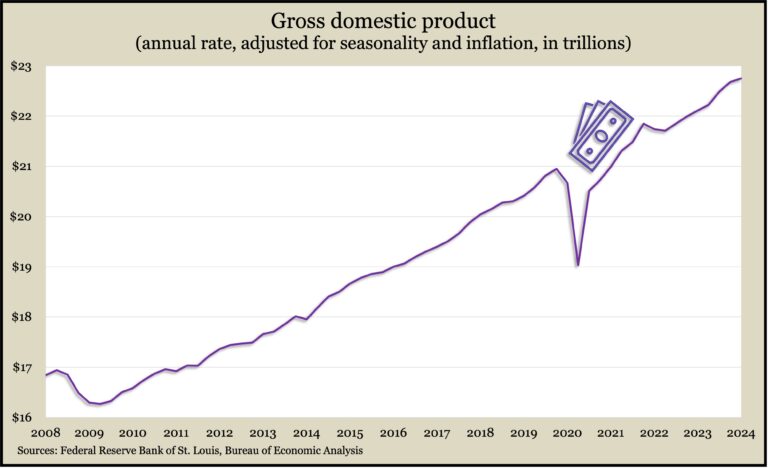

The U.S. economy grew at an annual pace of 1.3% in the first quarter. That was down from an initial estimate of 1.6% and the slowest rate for the gross domestic product since back-to-back declines to start 2022. In comparison, GDP grew at a 3.4% pace in the last quarter of 2023. The Bureau of Economic Analysis reported consumer spending rose at a 2% rate in the first three months of 2024, down from an initial estimate of 2.5%. Consumer spending accounts for about two-thirds of GDP. The Federal Reserve Board’s preferred measure of inflation rose 3.3% in the first quarter, down from an initial estimate of 3.4%.

The four-week moving average for initial unemployment claims rose for the fourth week in a row, reaching its highest level since September. Still, the measure of employer reluctance to lose workers suggested a tight hiring market, staying 39% below the all-time average, which dates back to 1967. New Labor Department data showed 1.7 million Americans claiming unemployment compensation in the latest week, unchanged from the week before and up 4.5% from the year before.

The National Association of Realtors said its index of pending home sales fell 7.7% in April. The trade group’s index was down 7.4% from the year before. An economist for the association said high mortgage rates and record-high home prices chilled demand from home buyers. Inventory continued to rise in April, though, which the Realtors said should decelerate price increases. The group said anticipated interest rate cuts by the Federal Reserve should further help affordability and spur sales.

Friday

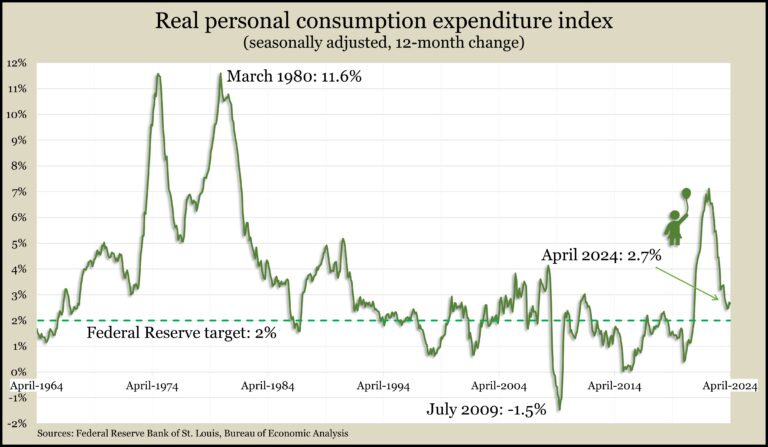

The Bureau of Economic Analysis said consumer spending rose 0.2% in April, the slightest increase since January. Increased expenditures on services such as housing and health care were offset by declining outlays for goods. The slower spending came as personal income rose 0.3% from March. The personal savings rate remained at 3.6% of disposable income, less than half the rate entering the COVID-19 pandemic. The personal consumption expenditures index, which the Fed follows for inflation, rose 2.7% from April 2023, the same as March. The Fed’s long-range target for inflation is 2%.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16735, down 186 points or 1.1%

- Standard & Poor’s 500 – 5278, down 27 points or 0.5%

- Dow Jones Industrial – 38686, down 383 points or 1.0%

- 10-year U.S. Treasury Note – 4.51%, up 0.04 point