Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Dave Sandstrom

Mike Hoelzl

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (May 6-10, 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

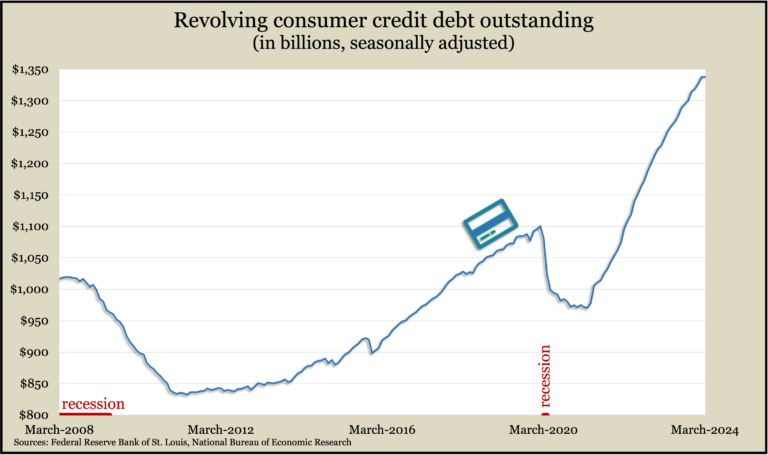

The Federal Reserve said consumer credit card debt rose by an annual rate of 0.1% in March. The pace of so-called revolving credit debt slowed from 9.7% in February. Through the first quarter of 2024, revolving credit slowed to a 5.7% annual rate from 7.5% in the fourth quarter of 2023 and 8.9% in the third quarter. Consumer spending accounts for about two-thirds of U.S. economic activity, so economists keep an eye on credit card debt for signs of demand and confidence.

Wednesday

No major releases

Thursday

The four-week moving average for initial unemployment claims rose for the first time in five weeks, according to new data from the Labor Department. The measure of employer reluctance to let workers go was 41% below the 57-year average, suggesting continued tightness in the labor market. Total claims for benefits declined 3% in the latest week to just under 1.8 million, which was nearly 4% above the level the year before.

Friday

The University of Michigan said consumer sentiment declined sharply from the end of April as both expectations and current assessments fell following three months of little movement. Though still 14% higher than the year before, the preliminary May reading of the sentiment index dropped 13% from April to its lowest point in six months. The university reported broad declines in consumer attitudes with worries of worsening inflation, unemployment and interest rates in the next year.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16341, up 185 points or 1.1%

- Standard & Poor’s 500 – 5223, up 95 points or 1.9%

- Dow Jones Industrial – 39513, up 837 points or 2.2%

- 10-year U.S. Treasury Note – 4.50%, no change