Podcast: Play in new window | Download

Landaas & Company newsletter March edition now available.

Advisors on This Week’s Show

Bob Landaas

Kyle Tetting

Dave Sandstrom

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 28-March 4, 2022)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The manufacturing sector expanded at a faster pace in February following a 12-month low in January, according to the Institute for Supply Management. The trade group’s manufacturing index showed rising demand based on new orders and customer backlogs. And though purchasing managers cited continued challenges around staffing and supply deliveries, they were “strongly optimistic” about business prospects in March and April. According to the ISM, the manufacturing sector has been expanding for 21 months in a row.

Housing led a 1.3% increase in the pace of construction spending in January, reaching a record annual rate of nearly $1.7 trillion. The Commerce Department reported residential spending rose 1.3% from the December pace and was up 13.2% from January 2021. Construction spending for manufacturing was up 8.4% for the month and 31.4% from January 2021.

Wednesday

No major announcements

Thursday

The service sector of the U.S. economy expanded in February for the 21st month in a row but the pace of growth slowed for the third time in as many months. The Institute for Supply Management said its services index registered the slowest pace in at least 12 months. Purchasing managers surveyed for the index reported continued challenges from supply chains, labor supply and inflation. The index showed supplier deliveries taking longer and employment contracting.

The Commerce Department said factory orders rose 1.4% in January, the 20th increase in the last 26 months and 15% ahead of the same time last year. Demand for commercial aircraft and motor vehicles boosted activity. Excluding transportation, orders rose 1% for the month and 12.7% from the year before. Core capital goods orders, a proxy for business investments, rose 1% from December and 10.4% from January 2021.

The four-week moving average for initial unemployment claims declined for the fourth week in a row, reaching 38% below the 55-year average. A Labor Department report showed total claims down 3% in the latest week, dropping below 2 million. The year before, claims exceeded 18.5 million.

The Bureau of Labor Statistics said worker productivity rose at an annual pace of 6.6% in the fourth quarter. That resulted from the number of hours worked rising at a 2.4% pace while output grew at 9.1%. The full-year productivity growth for 2021 was 1.9%, down from 2.4% in 2020 and just below the average rate of 2.1% since 1948. Since the pandemic started in the first quarter of 2020, output has grown 4.1% while the number of hours worked declined 0.4%.

Friday

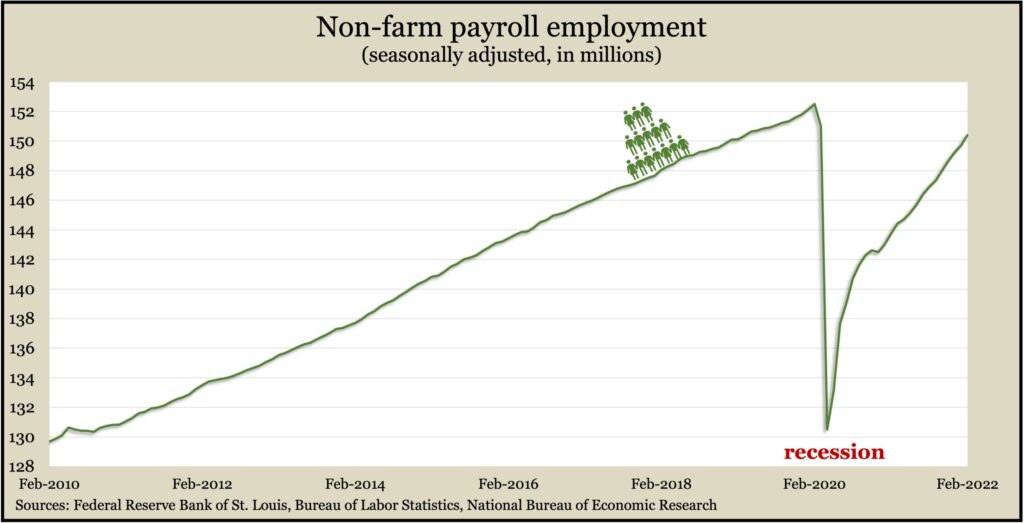

U.S. employers added 678,000 jobs in February, still down 2.1 million or 1.4% from the level two years ago, just before the pandemic. According to payroll data from the Bureau of Labor Statistics, the leisure and hospitality field accounted for 26% of the employment gains in February. Leisure and hospitality employers remain 9% below their pre-pandemic payroll levels and account for 71% of the missing jobs. The bureau’s household survey showed the unemployment rate declining to 3.8%, the lowest since hitting a 50-year low of 3.5% in February 2020. The rate reached a record high of 14.7% in April 2020.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13313, down 381 points or 2.8%

- Standard & Poor’s 500 – 4329, down 56 points or 1.3%

- Dow Jones Industrial – 33615, down 444 points or 1.3%

- 10-year U.S. Treasury Note – 1.74%, down 0.25 point

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.