Podcast: Play in new window | Download

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Tom Pappenfus

Kendall Bauer

(with Max Hoelzl, Joel Dresang, engineered by Reuben Neese)

Week in Review (March 27-31, 2023)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

The annual gain in housing prices slipped to 3.8% in January, the 10th consecutive deceleration since cresting at a record 20.8% last March, according to the S&P CoreLogic Case-Shiller home price index. An analyst with the longstanding report said higher mortgage rates and a weaker economy continued to soften housing market conditions and should remain as head winds to further lower prices.

The Conference Board said its consumer confidence index rose in March on slightly improved expectations. But the business research group said expectations remained below a level that often signals economic recession within the next year. Expectations have been below that level 12 of the last 13 months. The survey-based index found less confidence in current economic conditions. Consumer expectations for near-term inflation suggested a dampening effect on spending.

Wednesday

Three months of data suggests the housing market is turning a corner, according to the National Association of Realtors. The trade group’s index on pending home sales rose 0.8% in February for a third consecutive increase. The Realtors said because figures for home sales, pending sales and contracts for new construction have risen three months in a row, “the housing sector’s contraction is coming to an end.” The group cited recent improvements in mortgage rates, which it said especially helped affordable housing markets in the Midwest and South. Compared to the year before, pending sales were down 21%.

Thursday

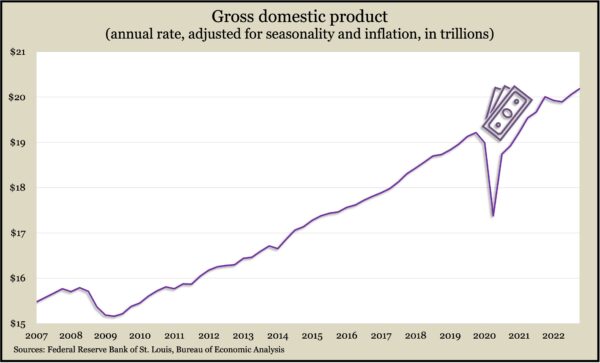

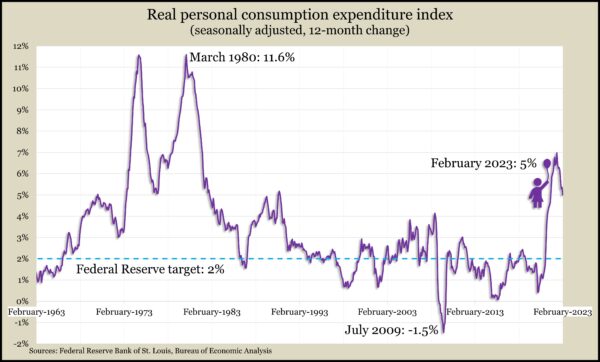

The U.S. economy rose at an annual pace of 2.6% in the fourth quarter of 2022, according to a final estimate of the gross domestic product. The growth rate was down from 2.7% in the previous estimate by the Bureau of Economic Analysis, mostly because the annual rate of consumer spending grew by 1%, instead of the earlier estimate of 1.4%. Adjusted for inflation, the economy advanced 5.1% from its pre-COVID peak at the end of 2019. The Federal Reserve’s favorite measure of inflation showed a 5.7% increase from the fourth quarter of 2021, down from 6.3% in the third quarter and 6.6% in the second quarter.

The four-week moving average for initial unemployment claims rose for the first time in three weeks but was still 46% below the all-time rolling average for new claims. The Labor Department said 1.9 million Americans were claiming unemployment compensation in the latest week, down nearly 2% from the week before but up more than 7% from its level the year before, when special pandemic relief programs had expired.

Friday

By far the biggest driver of the U.S. economy, consumer spending rose 0.2% in February, slightly below the 0.3% gain in personal income. Adjusted for inflation, though, personal expenditures declined 0.1% in March, the third drop in four months, suggesting a slowing in the economy. The Bureau of Economic Analysis also reported the fifth consecutive increase in personal savings – both in amount and as a percent of disposable income. The Fed’s favorite inflation gauge showed a 5% increase from February 2022 – the lowest rate since September 2021. Inflation had risen to 7% in June, the highest in four decades. The Fed’s long-range target is 2%.

Another sign of economic slowdown was the first setback in four months for consumer sentiment. The University of Michigan said its longstanding survey found consumers souring both on current conditions and future expectations. The sentiment index slipped to 62 from a reading of 67 in February. It stood at 59.4 the year before. A university economist said consumers are signaling they’re expecting a recession. Consumer projections of near-term inflation were the lowest in nearly two years, and long-run expectations remained at 2.9% for the fourth month in a row.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 12222, up 398 points or 3.4%

- Standard & Poor’s 500 – 4109, up 138 points or 3.5%

- Dow Jones Industrial – 33273, up 1036 points or 3.2%

- 10-year U.S. Treasury Note – 3.50%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.