Podcast: Play in new window | Download

Landaas & Company newsletter March edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 27-March 3, 2023)

Significant Economic Indicators & Reports

Monday

The Commerce Department said durable goods orders fell 4.5% in January. A drop in commercial aircraft orders accounted for the bulk of the decline, which was the biggest setback since April 2020. Excluding the volatile transportation industry, demand for long-lasting manufactured items rose 0.7% from December and was up 2.6% from the year before. Core capital goods orders, a proxy for business investments, rose 0.8% from December and 5.3% from January 2022.

Commitments to home ownership rose again in January, according to the pending home sales index of the National Association of Realtors. The trade group said demand increased 8% from December, up for the second straight month following six consecutive declines. The index was 24% below its level in January 2022. The Realtors cited lower mortgage rates and strong employment for the two-month revival but forecast that full-year sales would fall 11% in 2023 to about 4.5 million existing houses. The association said the median sales price should decline 1.6% this year to $380,100.

Tuesday

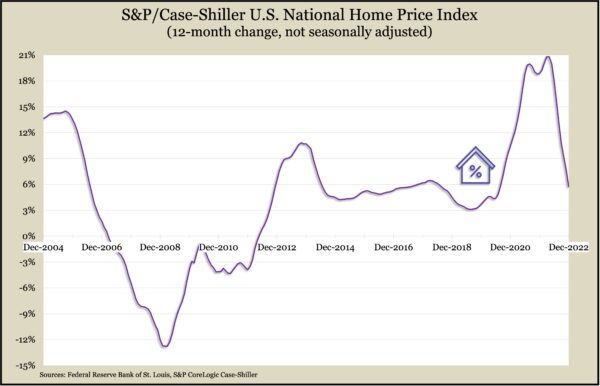

Housing prices continued to weaken in December amid higher mortgage rates and concerns of recession, according to the S&P CoreLogic Case-Shiller home price index. Compared to the year before, the index rose 5.8%, the lowest gain since July 2020. The price increase has been dropping every month since last March, when it peaked at 20.8%. An analyst for S&P said macroeconomic conditions should continue to hamper demand for home buying and price gains should continue to decelerate.

The Conference Board reported another decline in its consumer confidence index in February, the second drop in a row. Consumers had a slightly higher opinion of current economic conditions because of a robust job market, the business research group said, but expectations remained below a level associated with recessions for the 11th time in 12 months. The group said survey results showed diminished expectations for inflation at the same time that fewer consumers were planning on big-ticket purchases or vacations.

Wednesday

The manufacturing sector contracted for the fourth month in a row in February, according to the Institute for Supply Management. The trade group’s index showed manufacturers continuing to ease up on production and hiring to try to keep pace with weaker demand. The group also said the purchasing managers it surveyed anticipated a revival in business activity in the second half of the year.

The annual pace of construction spending fell in January, the second month in a row, the Commerce Department reported. Spending on residential construction, which makes up nearly half of all spending, declined for the eighth consecutive month. Total construction spending was up 5.7% from the year before, but residential outlays were down 3.8%. Public construction spending dipped nearly 1% for the month but was up 11.1% from January 2022.

Thursday

The four-week moving average for initial unemployment claims declined for the third week in a row but remained historically low — 48% below the 56-year average, signifying the strong job market. The Labor Department also reported that total jobless claims declined 1% in the latest week to just below 2 million, slightly lower than the year before and down from more than 18.5 million at the same time in 2021.

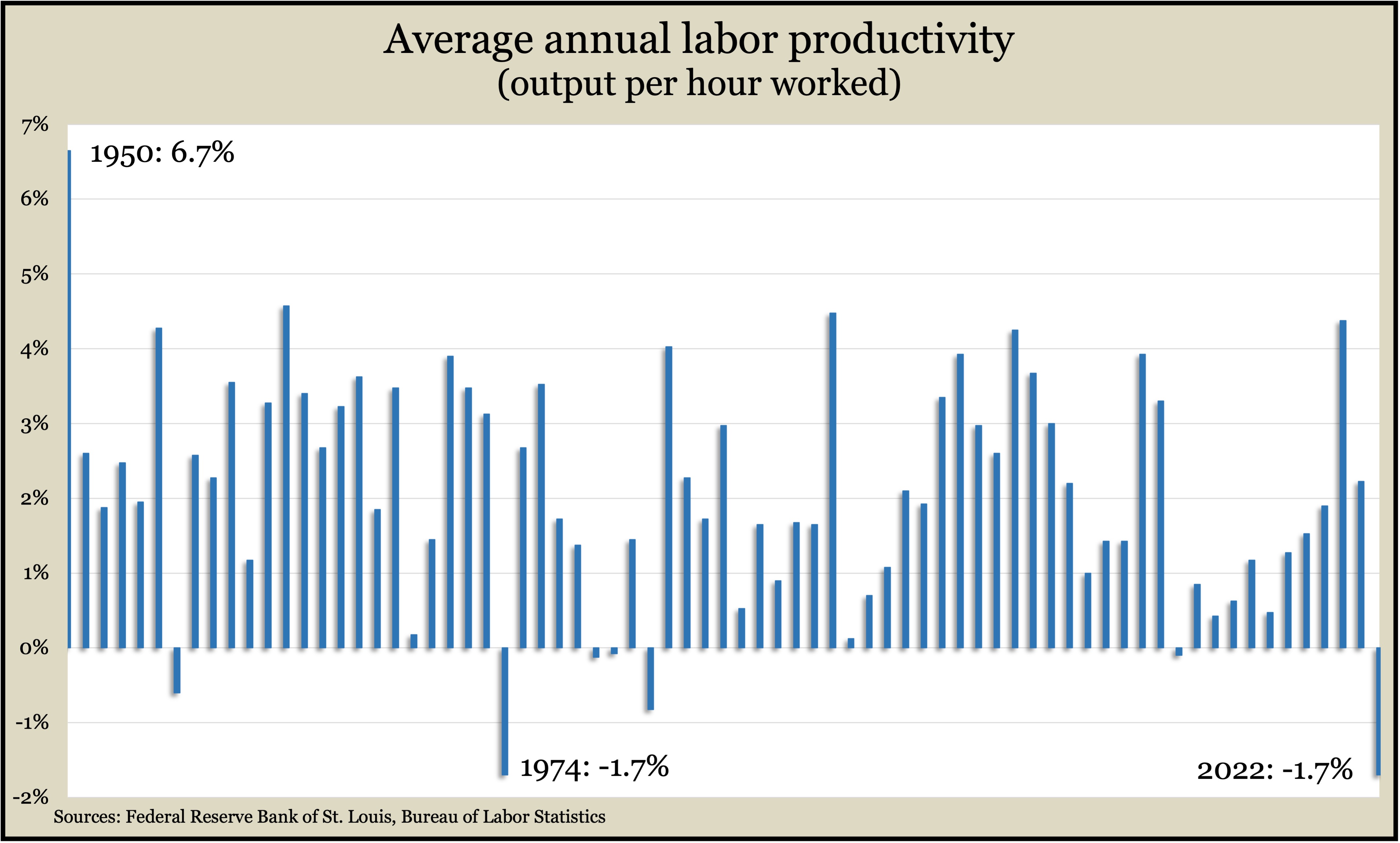

The Bureau of Labor Statistics said worker productivity rose at an annual pace of 1.7% in the fourth quarter, down from an earlier estimate of 3%. The rate resulted from the annual pace of output rising 3.1% in the last four months of the year while hours worked rose 1.4%. Productivity declined 1.8% in the last four quarters, and the annual average productivity dropped 1.7% for 2022, the biggest setback since 1974. The average productivity rate since 1948 has been 2.1%.

Friday

The service sector of the U.S. economy expanded in February for the 2nd month in a row at about the same pace as January. The Institute for Supply Management said its survey of purchasing managers found supply deliveries to be at the swiftest pace since 2009 because of improvements in capacity and logistics. Companies interviewed cited high but easing prices, tighter profit margins and some job cuts.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11689, up 294 points or 2.6%

- Standard & Poor’s 500 – 4045, up 75 points or 1.9%

- Dow Jones Industrial – 33390, up 573 points or 1.7%

- 10-year U.S. Treasury Note – 3.96%, up 0.02 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.