Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Jason Scuglilk, Joel Dresang)

Week in Review (March 25-29)

Significant Economic Indicators & Reports

Monday

The annual rate of new home sales declined slightly in February but stayed ahead of the year-ago pace, the Commerce Department reported. The sales rate of 662,000 new houses was below the pre-COVID pace for the seventh month in a row. Inventories rose marginally, and the median sales price – $400,500 – dropped almost 8% from February 2023.

Tuesday

Demand for long-lasting manufactured goods rose in February for the first time in three months, according to the Commerce Department. Orders for durable goods were up 1.4% from January and 1.8% ahead of orders in February 2023. Excluding volatile transportation orders, demand increased 0.5% from January and was up 3.2% from the year before. Orders for core capital goods, a proxy for business investments, also advanced.

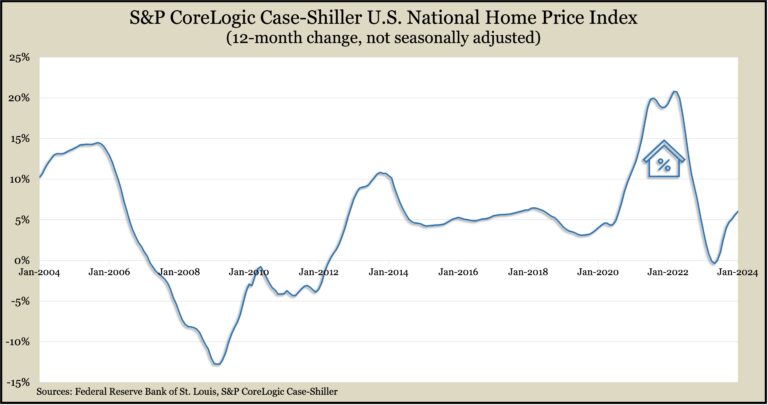

The annual gain in housing prices accelerated to 6% in January, the seventh consecutive increase. According to the S&P CoreLogic Case-Shiller home price index, broad-based price gains continued despite the head winds of higher borrowing costs. The year-to-year increase in January was the highest since November 2022.

The Conference Board said its consumer confidence index was essentially unchanged in March, with survey respondents improving their views of current conditions while taking a dimmer view of the future. The business research group offered some mixed signals, reporting that people continued to fret over higher prices while their expectations for inflation remained near four-year lows. Consumers’ expectations for recession continued to weaken at the same time an index reading associated with recession worsened.

Wednesday

No significant releases

Thursday

The U.S. economy rose at an annual pace of 3.4% in the fourth quarter of 2023, according to a final estimate of the gross domestic product. The growth rate was up from 3.2% in the previous estimate by the Bureau of Economic Analysis, mostly because the annual rate of consumer spending grew by 3.3%, instead of the earlier estimate of 3%. Economic growth also rose faster from more commercial investments than initially estimated.

The four-week moving average for initial unemployment claims fell for the first time in three weeks to reach 42% below the 57-year average. The indicator from the Labor Department suggested employers remained reluctant to let workers go. The same report showed 2 million Americans were claiming unemployment compensation in the latest week, down nearly 3% from the week before and up 7% from its level the year before.

The National Association of Realtors said its pending home sales index rose nearly 2% in February, though it was down 7% from the year earlier. The trade group said sales contracts in the Northeast and West fell for the month because housing prices were rising faster than incomes. Nationwide, the group predicted increasing inventory because of more newly built structures on the market and because of pent-up desires by many homeowners to move.

The University of Michigan’s longstanding measure of consumer sentiment rose marginally in March, staying about midway between its pre-pandemic level and its record low in 2022. The survey-based index suggested consumers were feeling better about their personal finances because of increased confidence that inflation was easing. The university said it expected sentiment to be on hold until later in the election season.

Friday

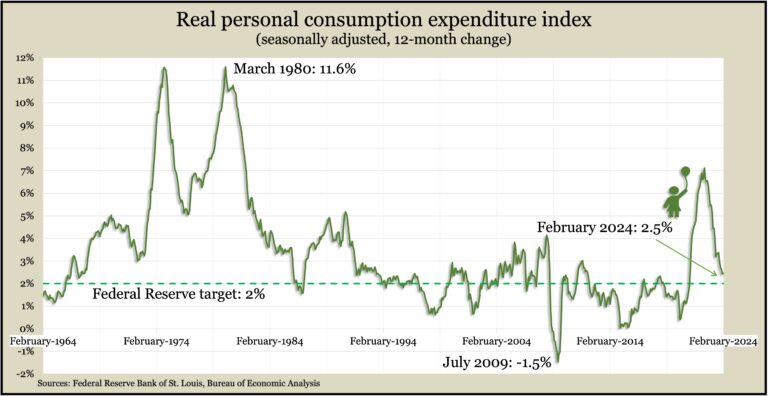

By far the biggest driver of the U.S. economy, consumer spending, rose 0.8% in February, the biggest jump in 13 months. Spending outpaced the 0.3% gain in personal income for February, resulting in a drop in the personal saving rate to 3.6% of disposable income from 4.1% in January. The Bureau of Economic Analysis also reported that the Federal Reserve’s favorite inflation gauge ticked up to a one-year rate of 2. 5%, slightly above the 2.4% mark reached in January, which was the lowest in nearly three years. Inflation continued to track faster than the Fed’s long-term target of 2%, but it was down from a four-decade high of 7.1% in mid-2022.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16379, down 49 points or 0.3%

- Standard & Poor’s 500 – 5254, up 20 points or 0.4%

- Dow Jones Industrial – 39807, up 331 points or 0.8%

- 10-year U.S. Treasury Note – 4.21%, down 0.01 point