Podcast: Play in new window | Download

Landaas & Company newsletter March edition now available.

Advisors on This Week’s Show

(with Jason Scuglik, Joel Dresang)

Week in Review (March 18-22, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

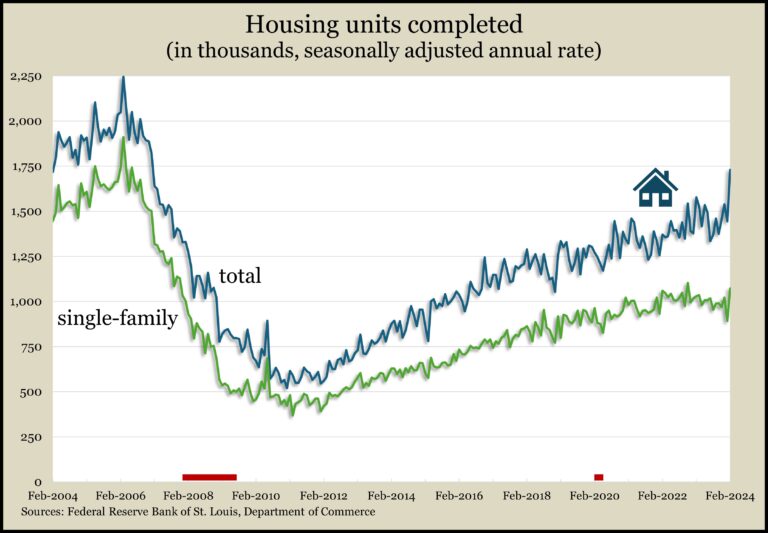

The pace of housing starts rose 11% in February, and it was up 6% from the year before, the Commerce Department and Department of Housing and Urban Development reported. Permits for new housing also increased at a seasonally adjusted annual rate, especially for single-family residences. Amid longstanding low inventories of housing units, the rate at which new houses are being completed is finally reaching levels not seen since before the Great Recession. Also, housing under construction has been hovering at record paces, according to data going back to 1970.

Wednesday

No major announcements

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row but stayed 42% below the 57-year average, according to new data from the Labor Department. The moving average, an indicator of employers’ reluctance to let workers go, continued to suggest strength in the labor market. Total claims rose 0.2% from the week before to 1.8 million, which was up 8% from the same time in 2023.

The annual rate of existing home sales rose 9.5% to nearly 4.4 million in February, which was still 3% slower than the year before. The National Association of Realtors said demand for housing continued to be strong while inventory improved nearly 6% from January. Still, supply remained historically record low, with 2.9 months’ worth of houses available at February’s sales rate. The median sales price was $384,500, up almost 6% from the year before, the eight increase in a row.

The Conference Board’s index of leading economic indicators rose 0.1% in February, its first gain in two years, led by increases in factory hours, stock prices and residential construction. The business research group said its index declined 2.6% since August, an improvement from a 3.8% decline in the previous six months. The group also warned that higher interest rates and rising consumer debt posed threats to continued personal spending, which drives about two-thirds of U.S. economic growth.

Friday

No major announcements

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16429, up 456 points or 2.9%

- Standard & Poor’s 500 – 5234, up 117 points or 2.3%

- Dow Jones Industrial – 39475, up 761 points or 2.0%

- 10-year U.S. Treasury Note – 4.22%, down 0.09 point