Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 3-7, 2024)

Significant Economic Indicators & Reports

Monday

The manufacturing sector shrank again in May. The Institute for Supply Management said its manufacturing index landed under 50 for the 18th time in 19 months, suggesting the industry was contracting. Reductions accelerated in new orders and production, although the employment component of the index rose after declining in April. The trade group said purchasing managers surveyed for the index were showing reluctance to invest in their business because of Federal Reserve interest rate policies as well as other conditions, such as suppliers’ commitments.

The pace of construction spending fell 0.1% in April, the second consecutive setback. The annual spending rate of nearly $2.1 trillion was up 10% from April 2023, the Commerce Department reported. Residential spending, which accounted for about 43% of the total, rose 0.1% from the March pace and was up 8% from the year before, including a 20% increase from April 2022 in spending on single-family housing. Construction expenses in the manufacturing sector rose 31% from the year before; public-sector spending was up 17% from April 2023.

Tuesday

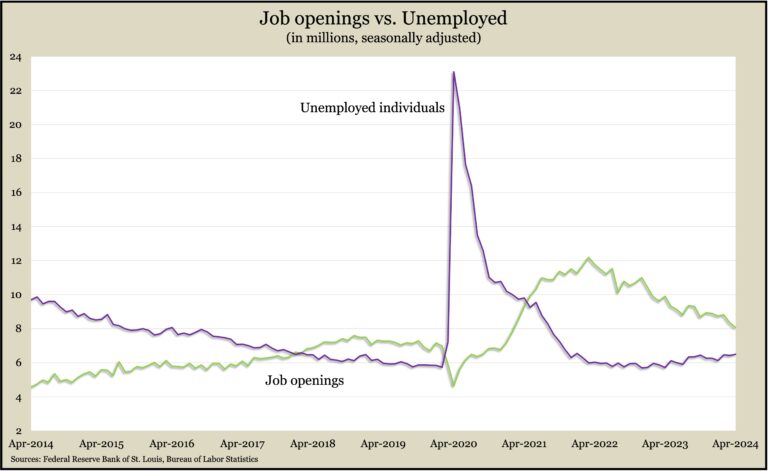

U.S. employers posted fewer than 8.1 million job openings in April, the lowest demand for workers since February 2021. Want ads still outnumbered unemployed job seekers, but it was the narrowest gap in almost three years. Job postings were down from a record 12.2 million in mid-2022, when the Fed was raising interest rates to slow inflation. The Bureau of Labor Statistics reported that overall levels of hiring and separations stayed about the same since March. The degree to which workers were quitting their jobs voluntarily – a sign of worker confidence in the hiring market – remained below the pre-pandemic level for the fifth month in a row.

Demand for manufactured goods picked up in April for the third month in a row. The Commerce Department said factory orders grew 0.7% from March and were up 1.1% from April 2023. Monthly gains were broadly distributed, although commercial air transportation orders declined 8%. Orders for core capital goods, a proxy for business investments, increased by 0.4% in April and were up 2% from the same time last year.

Wednesday

The U.S. services industry grew in May after shrinking in April, according to the Institute for Supply Management. The ISM services index, based on surveys of purchasing managers, suggested the largest sector of the economy expanded in May at the fastest pace since August. The trade group said orders and business activity improved while employment contracted for the fourth month in a row, though not as fast. The group said based on past relationships between the index and U.S. gross domestic product, the overall economy grew in May for the 17th consecutive month and at an annual rate of 1.6%.

Thursday

The U.S. trade deficit widened 8.7% to $74.6 billion in April. The Bureau of Economic Analysis reported that U.S. exports rose 0.8% from March, led by goods, especially pharmaceuticals. Imports grew 2.4%, led by cars. Through the first four months of 2024, the trade gap grew 2% from the year before. In that time, exports gained 3.2%, and imports rose 2.9%. Trade deficits count against gross domestic product, the main measure of the U.S. economy.

The Bureau of Labor Statistics said worker productivity rose at an annual rate of 0.2% in the first quarter. The rate was lowered from a preliminary estimate of 0.3%. Non-farm output rose at an annual pace of 0.9% in the first three months of the year while hours worked rose at a 0.6% rate. Since the first quarter of 2023, productivity climbed 2.9% – the most in three years. Since just before the pandemic, productivity has increased by an annual rate of 1.5%, equal to the pace in the previous business cycle, which began in 2007. Since 1947, productivity has grown at an average annual rate of 2.1%.

The four-week moving average of initial unemployment claims fell for the first time in five weeks and continued to suggest a tight hiring market. The measure of employers’ reluctance to let workers go was 39% below its average since 1967, according to Labor Department data. Just under 1.7 million Americans claimed jobless benefits in the latest week, down 1% from the week before but up 3% from the same time last year.

Friday

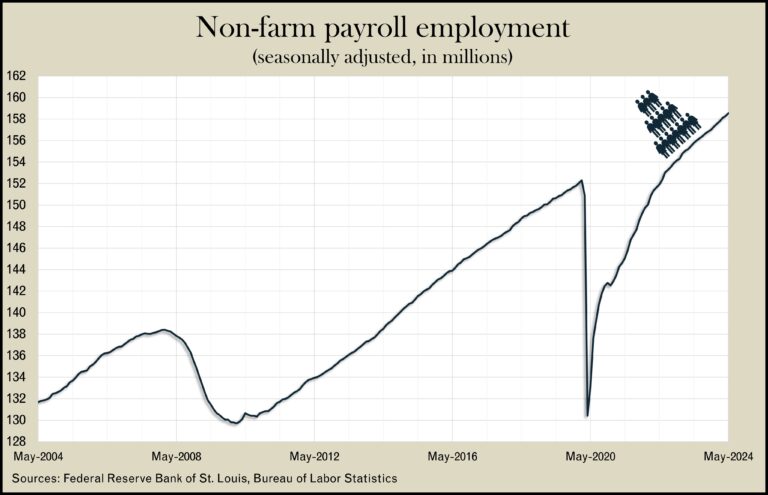

U.S. employers added 272,000 jobs in May, far stronger than analysts expected and above the 12-month average. The unemployment rate also rose, reaching 4% for the first time in three years, according to the May jobs report from the Bureau of Labor Statistics. The annual pace in wage inflation increased for the first time in four months, reaching 4.1% from May 2023. That’s down from 5.9% in March 2022, when the Federal Reserve started raising short-term interest rates to keep inflation from accelerating.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 17133, up 398 points or 2.4%

- Standard & Poor’s 500 – 5347, up 70 points or 1.3%

- Dow Jones Industrial – 38799, up 113 points or 0.3%

- 10-year U.S. Treasury Note – 4.43%, down 0.08 point