Podcast: Play in new window | Download

Landaas & Company newsletter June edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Kevin Lofy)

Week in Review (May 29-June 2, 2023)

Significant Economic Indicators & Reports

Monday

Markets and government closed for Memorial Day

Tuesday

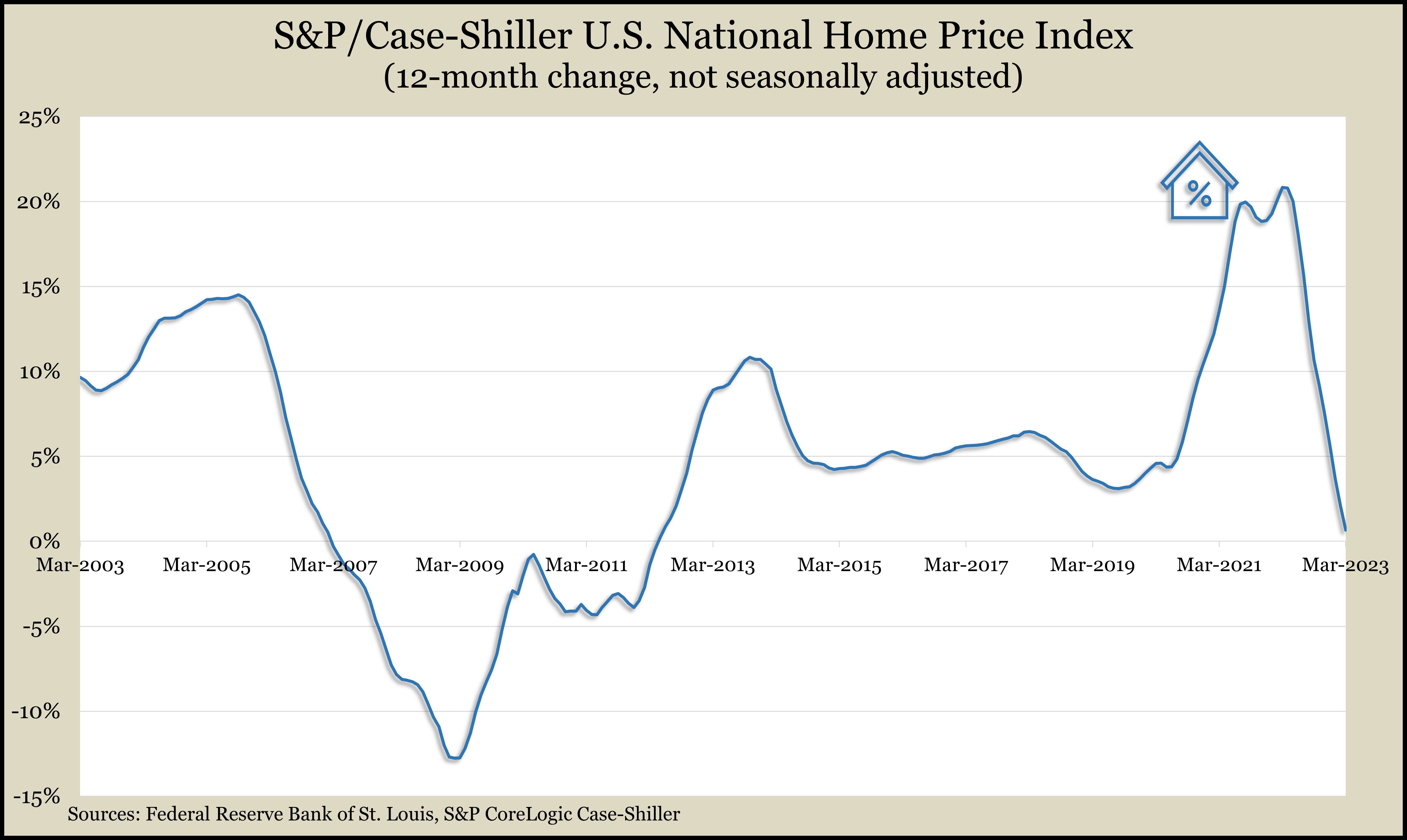

Housing prices continued to decelerate in March, although some data suggested the trend might be reversing. The S&P CoreLogic Case Shiller home price index grew at a 12-month rate of 0.7%, down from nearly 21% the year before, which was the highest in more than 35 years of data. An analyst for S&P noted regional differences with home prices rising faster in the Southeast (up 5.4%) and actually declining in the Northwest (down 6.2%). Also, month-to-month measures suggested price gains may be increasing again, despite higher mortgage rates in the last year and a weaker economy.

The Conference Board said its consumer confidence index declined in May, though not as much as analysts expected. The business and research group said perceived weakness in the labor market lowered views of current conditions. Expectations for the economy faded slightly and remained below the level associated with recession for the 14th time in 15 months. Consumers older than 55 especially soured on the outlook.

Wednesday

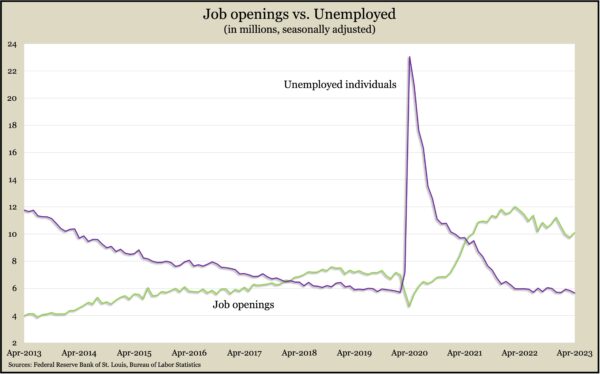

U.S. employers posted 10.1 million job openings in April, up 3.7% from March, making it the first increase in four months. Retailers and health care employers led the gain in want ads, as the gap grew between jobs posted and unemployed job seekers. The Bureau of Labor Statistics also reported a 4.7% decline in the number of layoffs, led by the construction industry. The degree to which workers were quitting their jobs voluntarily – a sign of worker confidence in the hiring market – remained steady, down from the historic peak of the year before but still well above the long-time average.

Thursday

The four-week moving average for initial unemployment claims declined for the third time in four weeks to its lowest level since March and 38% below the all-time average, dating back to 1967. New Labor Department data showed more than 1.6 million Americans claimed unemployment compensation in the latest week, down marginally from the week before, up from 1.3 million the year before but down from more than 15 million at the same time in 2021.

The Bureau of Labor Statistics said worker productivity fell at an annual rate of 2.1% in the first quarter. Non-farm output rose at an annual pace of 0.5% in the first three months of the year while hours worked rose at a 2.6% rate. Since the first quarter of 2022, productivity dipped 0.8% for the fifth consecutive quarter of decline, which had never happened before in data going back to 1947. Since just before the pandemic, productivity has increased by an annual rate of 1.1%, a historic low for business cycles, according to the BLS. Labor costs rose at a 4.2% rate in the first quarter, which factors in the 2.1% productivity growth and a 2.1% rise in hourly compensation. Since the first quarter of 2022, labor costs increased 3.8%.

The manufacturing sector shrank again in May. The Institute for Supply Management said its manufacturing index landed under 50 for the seventh month in a row, suggesting the industry was contracting. Rises in production and employment components of the index were offset by declines in new orders, supplier deliveries and inventories. The trade group said its index, based on surveys of purchasing managers, suggested the U.S. economy was receding at an annual pace of 0.6%.

The pace of construction spending rose 1.2% in April, the third increase in a row and the sixth in eight months. The record annual rate of more than $1.9 trillion was up 7.2% from April 2022, the Commerce Department reported. Residential spending, which accounts for about 45% of total spending, rose 0.4% from the March pace. Residential spending was down 9% from the year before, including a 25% decline in single-family housing.

Friday

U.S. employers added 339,000 jobs in May, the third straight acceleration in hiring despite Federal Reserve Board attempts to slow the economy. According to payroll data from the Bureau of Labor Statistics, the pace of employment neared the 12-month average and was led by gains in professional and business services, government, and health care. Hiring in the leisure and hospitality field slowed from its 12-month pace and remained below its level just before the pandemic. The bureau’s household survey showed the unemployment rate rising to 3.7% from a decades-low 3.4% in April.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13241, up 265 points or 2%

- Standard & Poor’s 500 – 4282, up 77 points or 1.8%

- Dow Jones Industrial – 33763, up 669 points or 2%

- 10-year U.S. Treasury Note – 3.69%, down 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.