Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 1-5, 2024)

Significant Economic Indicators & Reports

Monday

Markets and government offices closed

Tuesday

U.S. construction spending rose in November for the 10th month in a row. The Commerce Department said the seasonally adjusted annual rate of construction expenditures advanced 0.4% from October to more than $2 trillion. Residential construction accounted for 44% of the spending and rose 1% from the October rate, led by an increase in single-family housing projects. Total construction spending was up 11% from November 2022, led by a 59% rise among manufacturers.

Wednesday

The Institute for Supply Management reported that its manufacturing index signaled contraction in December for the 14th month in a row. Based on surveys of purchasing managers, the index showed the industry slumping slightly less than in November with demand weakening more. On the brighter side, production expanded for the first time in a couple of months, and supplier deliveries improved for the 15th month in a row. The trade group said its index suggests the overall economy is contracting at a 0.5% annual rate.

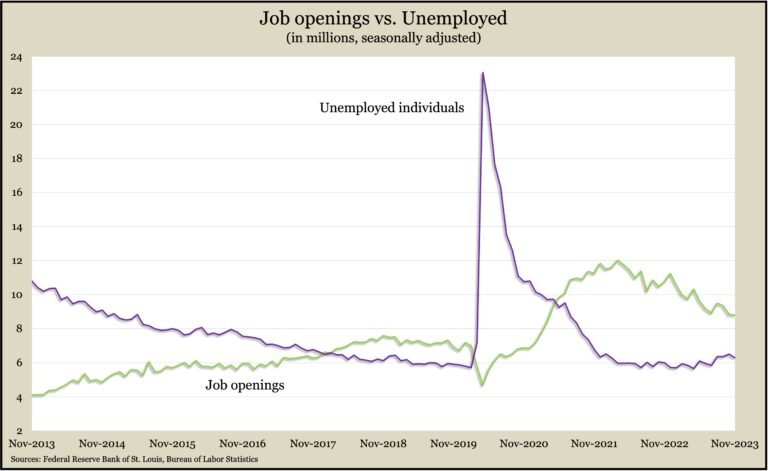

U.S. employers posted 8.8 million job openings in November, down marginally from October and the lowest level since early 2021. Openings reached a record high of 12 million in March 2022 and remained above the pre-pandemic level of about 7 million. The Bureau of Labor Statistics said the number of hires and separations both declined in November, with the number of workers quitting their jobs reaching below the level just before the pandemic. Job openings stayed well above the number of unemployed job seekers, showing a continued gap between the demand and supply of workers.

Thursday

The four-week moving average for initial unemployment claims fell for the third time in four weeks, its lowest level since late October, 43% below the all-time average and about where it was just before the COVID-19 pandemic. Data from the Labor Department showed more than 1.8 million Americans were claiming unemployment benefits in the latest week. That was little changed from the week before but up 16% from the same time last year.

Friday

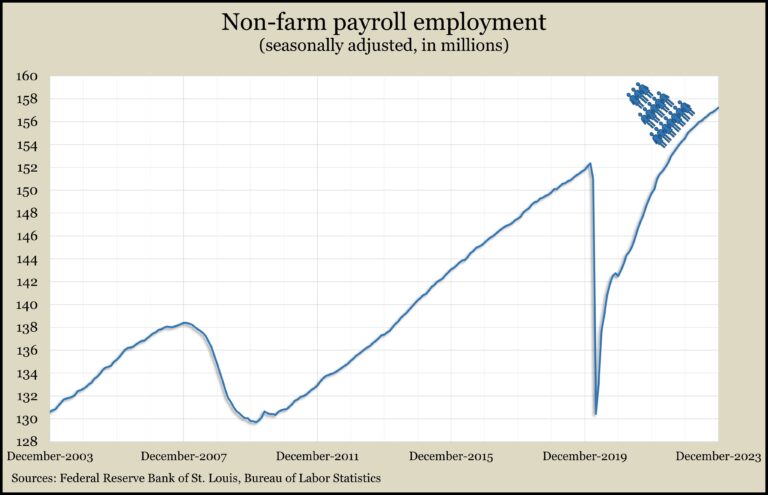

U.S. employers added 216,000 jobs in December, lower than the monthly average for 2023 (225,000) and 2022 (399,000). Other data in the report from the Bureau of Labor Statistics suggests a strong but cooling labor market. Temporary help jobs – often a harbinger of overall hiring trends – fell for the 15th month in a row. The average hourly wage rose 4.1% from December 2022, the first acceleration in gains since June. The same report showed the unemployment rate unchanged at 3.7%, but a number of other household measures showed conditions weakening slightly from the year before.

The U.S. services sector barely grew in December, gaining for the 12th month in a row, though at the slowest pace since May, according to the Institute for Supply Management. The trade group’s services index showed new orders slowing and employment receding since November. Purchasing managers told the ISM they’re concerned about economic uncertainty, geopolitical conflicts and labor constraints.

A report from the Commerce Department showed manufacturing orders rising in November for the third time in four months. The value of orders rose 2.6% from October and was 0.7% ahead of November 2022. Excluding volatile orders for transportation equipment – most notably commercial airline parts, orders increased 0.1% for the month and declined 1.4% from November 2022. A proxy for business investments was up 0.8% from October and 1.7% from the year before.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14524, down 487 points or 3.2%

- Standard & Poor’s 500 – 4697, down 73 points or 1.5%

- Dow Jones Industrial – 37466, down 224 points or 0.6%

- 10-year U.S. Treasury Note – 4.04%, up 0.18 point