Podcast: Play in new window | Download

Landaas & Company newsletter January edition now available.

Advisors on This Week’s Show

Kyle Tetting

Dave Sandstrom

Tom Pappenfus

(with Jason Scuglik and Joel Dresang)

Week in Review (Jan. 23-27, 2023)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

The Conference Board said its index of leading economic indicators declined again in December, further signaling a near-term recession. The business research group said its gauge fell 1% from November, following a 1.1% drop from October. Over the last half of 2022, the index fell 4.2%, steepening from a 1.9% decline in the first six months of the year. Although measures of employment and personal income appeared “robust,” the group said, weakness in manufacturing, housing construction and financial markets suggest recession. The Conference Board forecast a revival in the economy toward the end of the year.

Tuesday

No major releases

Wednesday

No major releases

Thursday

The Commerce Department reported durable goods orders rose 5.6% in December for the fourth gain in five months. A surge in aircraft orders – both commercial and military – boosted the manufacturing indicator after it declined 1.1% in November. Excluding volatile transportation equipment, orders declined slightly in December for the second time in four months. Compared to December 2021, orders for long-lasting factory goods rose more than 10%. Excluding transportation equipment, demand rose 6% from the year before. A proxy for business investment gained 8% from December 2021.

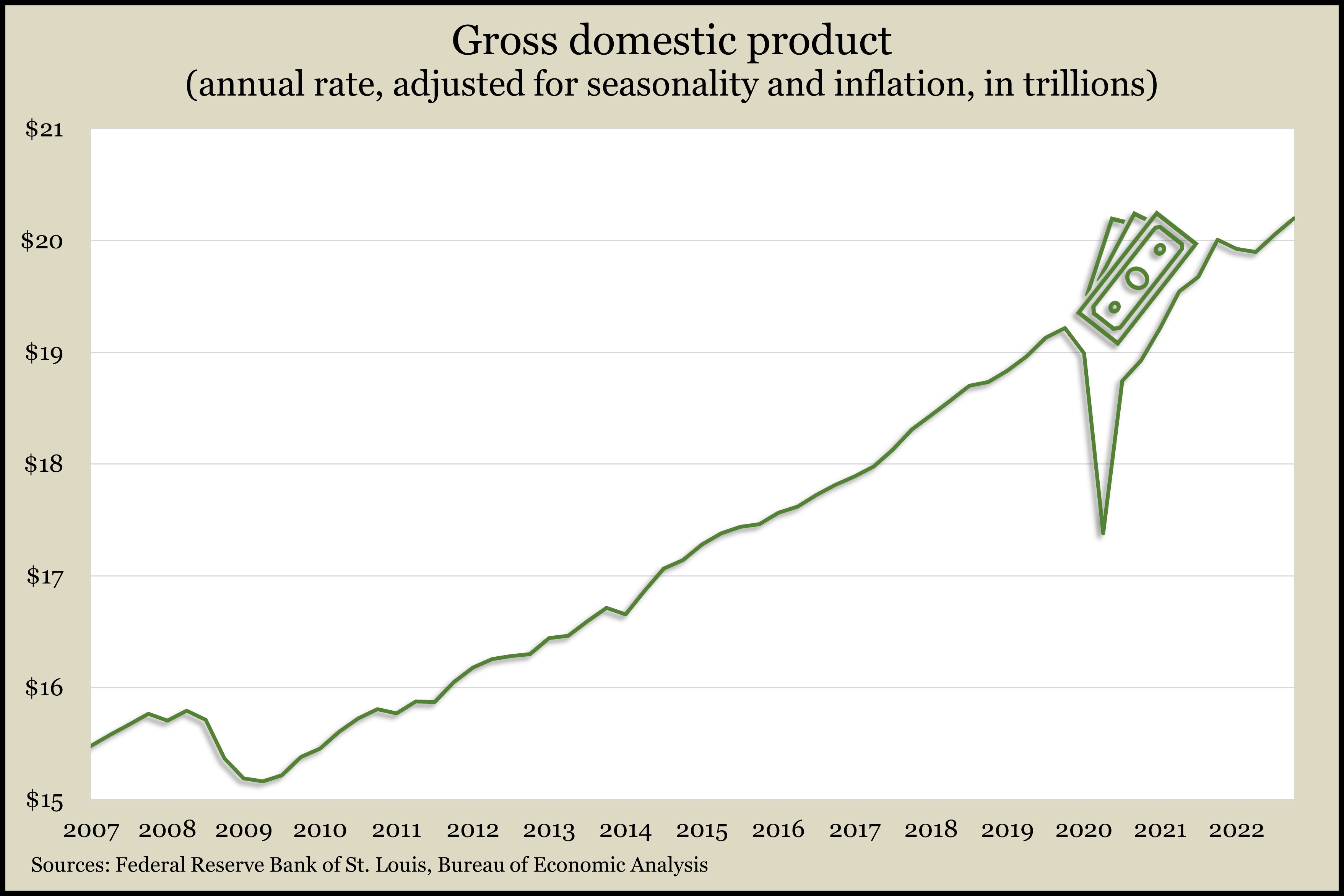

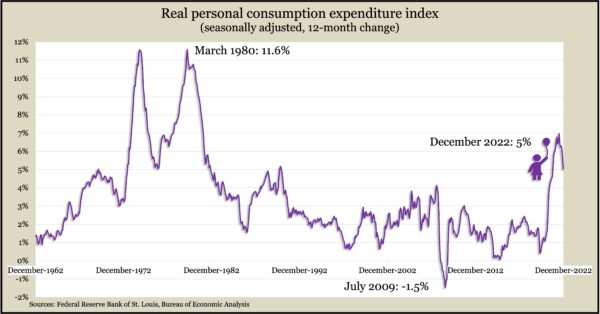

The U.S. economy rose at an annual pace of 2.9% in the fourth quarter, down from a 3.2% rate in the previous three months. The Bureau of Economic Analysis cited consumer spending, business inventories and commercial investments in intellectual property among the contributors to the boost in gross domestic product. After setbacks in the first two quarters of 2022, GDP rose 1% from the year before, adjusted for inflation. The Federal Reserve Board’s favorite measure of inflation, the personal consumption expenditures index, rose 5.5% from the year before, the lowest in five quarters. The core PCE, excluding food and energy prices, was up 4.7% from the end of 2021, its slowest rate in a year.

The four-week moving average for initial unemployment claims fell for the seventh week in a row to its lowest level since early May. The average was 46% below the all-time average dating back to 1967. The Labor Department 1.9 million Americans claimed jobless benefits in the latest week, down from 2.3 million the year before and 19 million and the same time in 2021.

The Commerce Department reported a 2.3% gain in the annual rate of new home sales in December. Despite the increase, sales were down 27% from the year before and 11% below where they were just before the pandemic. The median sales price rose 8% from the year before to $442,100. In 2022, 41% of new homes were sold at $500,000 or more, compared to 30% in 2021.

Friday

The Bureau of Economic Analysis said consumer spending fell 0.2% in December, the second consecutive slowdown for a chief measure of economic growth. The decline was 0.3% when adjusted for inflation and suggest individuals have been giving pause to spending amid high inflation and rising interest rates. Consumer spending accounts for about two-thirds of GDP. The personal saving rate rose for the third month in a row. The personal consumption expenditures index, which the Fed follows for inflation, rose 5% from December 2021, the slightest incline in 15 months. The rate remained far above the long-range Fed target of 2% inflation, but it was down from 7% in June, a 40-year high.

Though it stayed near a record low, consumer sentiment improved in January for the second month in a row. The longstanding survey-based index from the University of Michigan showed attitudes toward current conditions getting a big boost from perceptions of strong incomes and easing inflation. Expectations for inflation fell for the fourth month in a row. A university economist warned that consumer sentiment – considered a precursor for consumer spending – suffered measurably during debt ceiling dust-ups in Congress in 2013 and 2011.

The National Association of Realtors said its index of pending home sales rose in December for the first time in seven months. The trade group said a recent decline in mortgage rates helped stabilize the market and the low point in sales activity has likely passed. The index rose 2.5% from its November reading but was down 34% from the year before. The Realtors said steady job gains should drive housing sales with conventional mortgage rates hovering between 5.5% and 6.5%.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11622, up 481 points or 4.3%

- Standard & Poor’s 500 – 4071, up 98 points or 2.5%

- Dow Jones Industrial – 33978, up 603 points or 1.8%

- 10-year U.S. Treasury Note – 3.52%, up 0.04 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.