Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 22-26)

Significant Economic Indicators & Reports

Monday

The Conference Board said its index of leading economic indicators declined slightly in December, continuing to suggest a pending recession. The business research group said its gauge fell 0.1% from November, following a 0.5% drop from October. Over the last half of 2023, the index fell 2.9%, improving from a 4.3% decline in the first six months of the year. Of 10 leading indicators, six were positive, the organization said, but they were offset by weaker manufacturing, high interest rates and low consumer confidence. The Conference Board forecast a recession for the second and third quarters of 2024, with a revival toward the end of the year.

Tuesday

No major releases

Wednesday

No major releases

Thursday

The Commerce Department said durable goods orders were unchanged in December, following a 5.5% gain in November. Compared to the year before, long-lasting factory orders were up 4.4%, with aircraft accounting for the bulk of the increase. Excluding transportation equipment, orders rose just 0.8% from the end of 2022. A proxy for business investment gained 0.3% from November and was up 1.7% from December 2022.

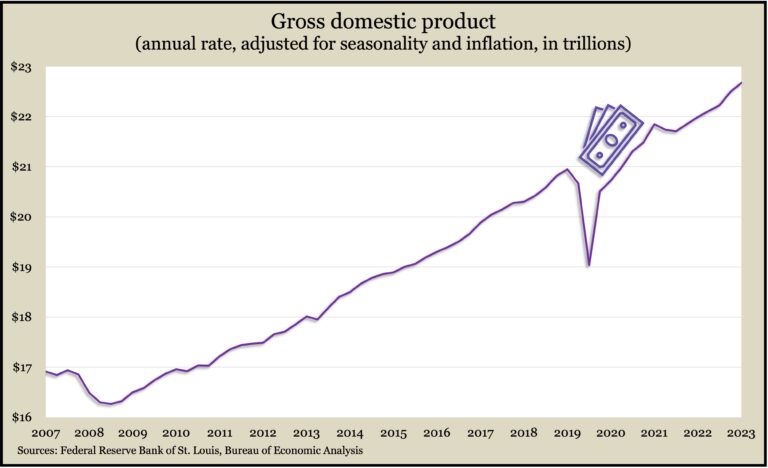

The U.S. economy rose at an annual pace of 3.3% in the fourth quarter, down from 4.9% in the previous three months. The Bureau of Economic Analysis said the deceleration in gross domestic product was led by consumer spending, which slowed to a 2.8% annual rate from 3.1% in the third quarter. Also slowing: Inventories, federal spending and residential spending. Compared to the fourth quarter of 2022, GDP rose 3.1%, the strongest showing in seven quarters.

The four-week moving average for initial unemployment claims fell to its lowest level since January. The average was 45% below the all-time average dating back to 1967. The Labor Department said 1.8 million Americans claimed jobless benefits in the latest week, up 0.8% from the week before and 11% higher than the same time in 2022.

The Commerce Department reported an 8% gain in the annual rate of new home sales in December. Sales were up 4% from the year before and just below where they were heading into the COVID-19 pandemic. The median sales price dropped 14% from the year before to $413,200. In 2023, 53% of new homes were sold at $400,000 or more, compared to 63% in 2022.

Friday

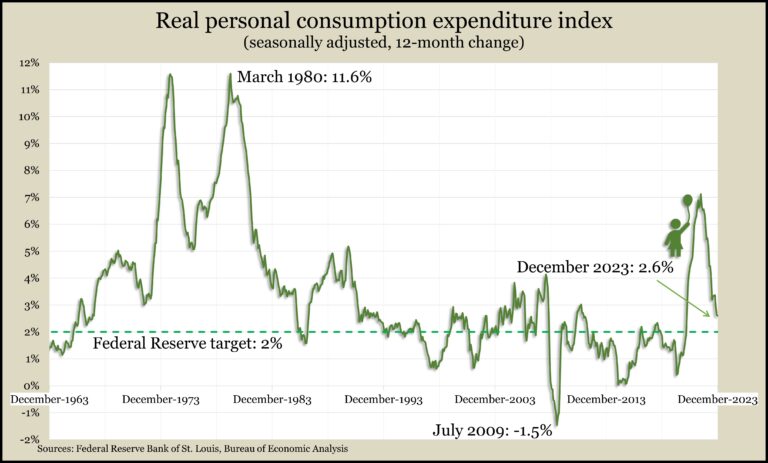

The Bureau of Economic Analysis said consumer spending jumped 0.7% in December, more than double the 0.3% increase in personal income. Adjusted for inflation, spending rose 0.5% from November. Consumer spending accounts for about two-thirds of gross domestic product, so the gain was another sign of resilience amid the highest interest rates in a couple of decades. The personal consumption expenditures index, which the Federal Reserve Board follows for inflation, rose 2.6% from December 2022, the slightest incline since February 2021, which was the last time the rate was below the Fed’s 2% long-term target. The rate reached a 40-year high exceeding 7% in June 2022.

An early indicator of home sales increased in December. The National Association of Realtors’ index of pending home sales rose 8.3% from November and was up 1.3% from December 2022. The trade group said more home buyers have begun turning to the relatively larger stock of new homes for sale amid chronic shortages of existing houses. The group said an easing in mortgage rates since peaking in November also has encouraged potential home buyers. The Realtors forecast a 13% gain in annual home sales in 2024.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15455, up 144 points or 0.9%

- Standard & Poor’s 500 – 4891, up 51 points or 1.1%

- Dow Jones Industrial – 38109, up 246 points or 0.6%

- 10-year U.S. Treasury Note – 4.16%, up 0.01 point