Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 15-19, 2024)

Significant Economic Indicators & Reports

Monday

Markets closed in observance of Martin Luther King Jr. Day

Tuesday

No major announcements

Wednesday

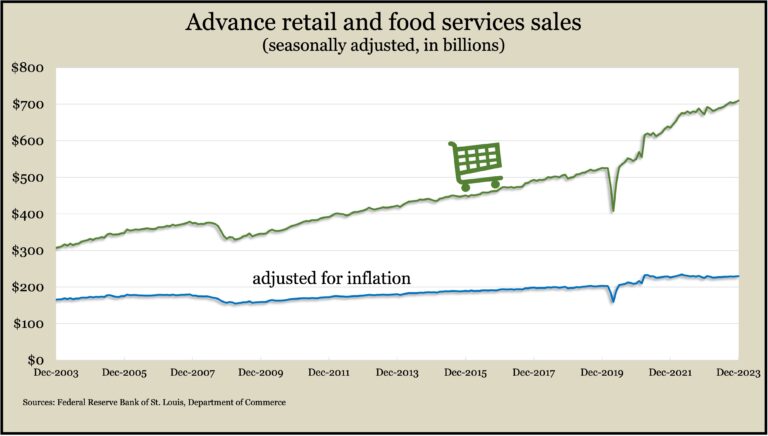

The Commerce Department said retail sales rose 0.6% in December for the eighth increase in nine months, another indication of consumers’ persistent spending. The gain was widespread, with nine of 13 retail categories advancing, led by car dealers and online retailers. Gas station sales fell because of lower prices. Compared to the end of 2022, total retail sales rose nearly 6%, with 10 of 13 categories gaining, led by bars and restaurants. Adjusting for inflation, retail sales were up 2.2% since December 2022.

Industrial production increased in December for the first time in three months as automakers boosted manufacturing output. The Federal Reserve Board said production from factories, mines and utilities rose 0.1% from November, advancing 1% from December 2022. Manufacturing production gained for the second month in a row and was up 1.2% from the year before. For the fourth quarter, total output fell at an annual rate of 3.1%. Factory output dropped at a 0.3% pace for the quarter, but it would have been a 2.2% decline if not for automakers. Industries’ capacity utilization rate – an inflation indicator – sank for the third month in a row, staying below its 50-year average for the eighth consecutive month.

Thursday

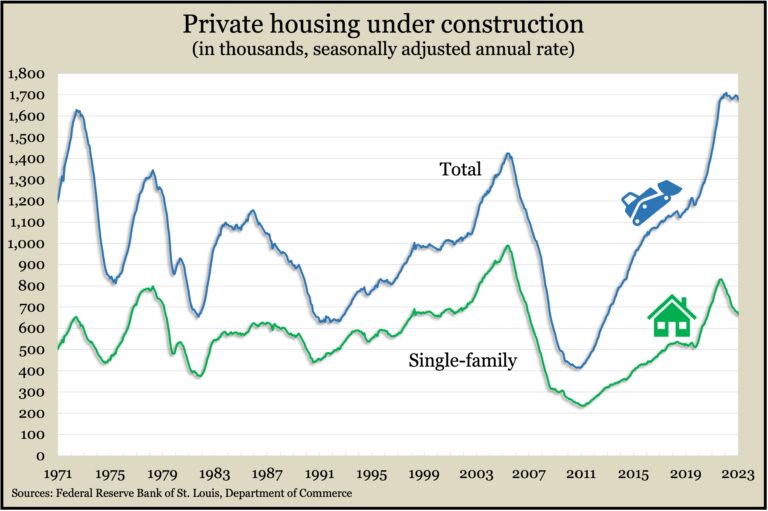

The pace of U.S. housing starts slowed while building permits rose in December. The Commerce Department said the annual rate of new construction dipped 4% from November, though it was nearly 8% ahead of the year-ago pace. Meanwhile, the annual rate of permits rose 2% from November and was up 6% from December 2022. Starts for single-family houses declined nearly 9% from November, but permits for new single-family structures rose to the fastest pace since May 2022. As new construction slowed, the level of houses being built hovered near a record high, based on data going back to 1970. The pace of single-family houses under construction was down 19% from its peak in mid-2022.

The four-week moving average for initial unemployment claims fell to its lowest level in 16 months, dropping 45% below the all-time average, which dates back to 1967. An indicator of employers’ reluctance to let workers go, the moving average was 3% below its level just before the COVID-19 pandemic, according to Labor Department data. Meanwhile, total claims for jobless benefits rose 10% from the week before to 2.1 million. That’s up 12% from the year before.

Friday

Existing home sales slowed another 1% in December and ended 2023 under 4.1 million residences sold, the National Association of Realtors reported. That’s the lowest year-end sales level since 1995. At the same time, as a result of low inventories, the median sales price hit a record high of $389,800 in 2023. The trade group said it expects sales to rebound in 2024, especially since mortgage rates have ticked down the last couple of months.

The University of Michigan said its preliminary January measure of consumer sentiment showed the strongest confidence in the economy in two and a half years. The index rose 29% from November, the highest two-month increase since the end of the 1991 recession. It was 7% below the long-term average, dating back to 1978, but it was up 60% from a record low in mid-2022. The university said consumers expressed more confidence that inflation has turned a corner, and the consensus was broad, even spanning partisan political affiliations.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15311, up 338 points or 2.3%

- Standard & Poor’s 500 – 4840, up 56 points or 1.2%

- Dow Jones Industrial – 37864, up 397 points or 1.1%

- 10-year U.S. Treasury Note – 4.15%, up 0.20 point