Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 8-12, 2024)

Significant Economic Indicators & Reports

Monday

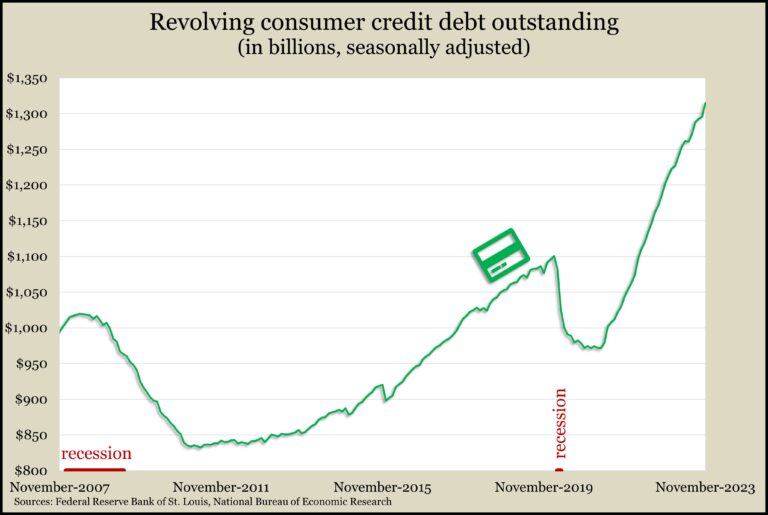

In another sign of strength in consumer spending, credit card debt rose again in November, at the fastest pace in a year and a half. The Federal Reserve Board reported that revolving consumer debt outstanding increased at an annual pace of nearly 18%, the steepest pace since May 2022. Consumer spending accounts for about two-thirds of U.S. economic output, as measured by the gross domestic product. Credit card debt partly reflects the confidence of consumers to keep spending.

Tuesday

The U.S. trade deficit narrowed by 2% in November to $63.2 billion, a result of both exports and imports shrinking. Exports declined by 1.9% from October, led by decreased sales of industrial supplies and automotive products. Imports also fell 1.9%, led by drops in U.S. purchases from abroad of cellphones and pharmaceutical preparations. Through the first 11 months of 2023, the deficit – which detracts from gross domestic product – narrowed more than 18%; exports gained 1%, and imports declined 3.6%.

Wednesday

No major announcements

Thursday

The four-week moving average for initial unemployment claims fell for the fourth time in five weeks. An indicator of employers’ reluctance to let workers go, the average reached 207,000 claims, which was 43% behind the average since 1967 and down from a record high of 5.3 million in April 2020. The Labor Department said 1.9 million Americans claimed jobless benefits in the week ended Dec. 30. That was up 3% from the previous week and more than 11% ahead of the same time in 2022.

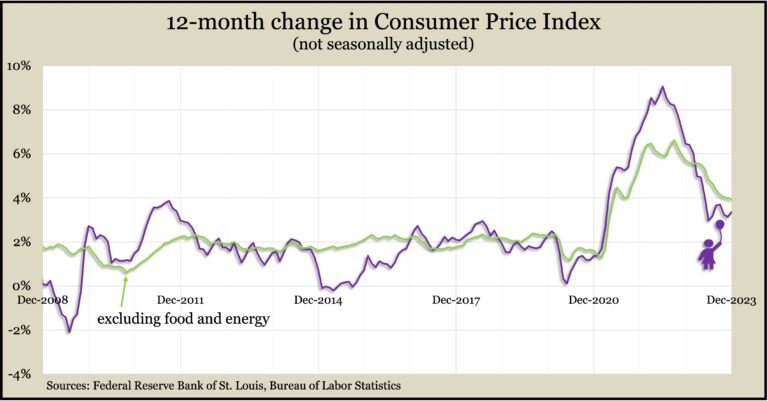

Shelter costs accounted for more than half of the quicker pace of inflation in December. The Bureau of Labor Statistics reported the Consumer Price Index, the broadest measure of inflation, rose 0.3% from November. The CPI advanced 3.4% from December 2022. That’s the highest inflation rate since September but down from a 40-year high of 9.1% in June 2022. The Federal Reserve Board’s long-range inflation target is 2%. Excluding volatile prices for food and energy items, the core CPI rose by 0.3% for the fourth time in five months. Year to year, the core measure was up 3.9%, the lowest rate since May 2021.

Friday

The Bureau of Labor Statistics reported that wholesale inflation retreated 0.1% in December, the third consecutive decline. The Producer Price Index fell because of a drop in goods prices, chiefly diesel fuel. The index was up 1% from the year before, compared to a 6.4% increase at the same time in 2022 and a record 11.7% in March 2022. Excluding volatile prices for food, energy and trade services, the so-called core PPI rose 0.2% from November and was up 2.5% from December 2022.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14973, up 449 points or 3.1%

- Standard & Poor’s 500 – 4784, up 87 points or 1.8%

- Dow Jones Industrial – 37593, up 127 points or 0.3%

- 10-year U.S. Treasury Note – 3.95%, down 0.09 point