Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang)

Week in Review (Feb. 5-9, 2024)

Significant Economic Indicators & Reports

Monday

The largest segment of the U.S. economy showed continued expansion in January with the Institute for Supply Management’s service index reaching its highest level since September. Based on surveys with supply managers, the index signaled growth for the 13th month in a row. Among the highlights were faster growth in new orders, employment and supplier deliveries. The trade group said supply managers reported steady business and were optimistic because of potential interest rate cuts from the Federal Reserve. Executives also expressed caution about inflation and geopolitical conflicts.

Tuesday

No major releases

Wednesday

The U.S. trade deficit narrowed in 2023 from a record high in 2022, as the value of imports declined. The Bureau of Economic Analysis reported that the 2023 trade gap was $773.4 billion, down 18% from the year before. Exports grew 1.2% in the year while imports fell 3.6%. Trade deficits detract from economic output, as measured by the gross domestic product. For the year, Mexico ranked first in imports to the U.S., displacing China for the first time in 20 years.

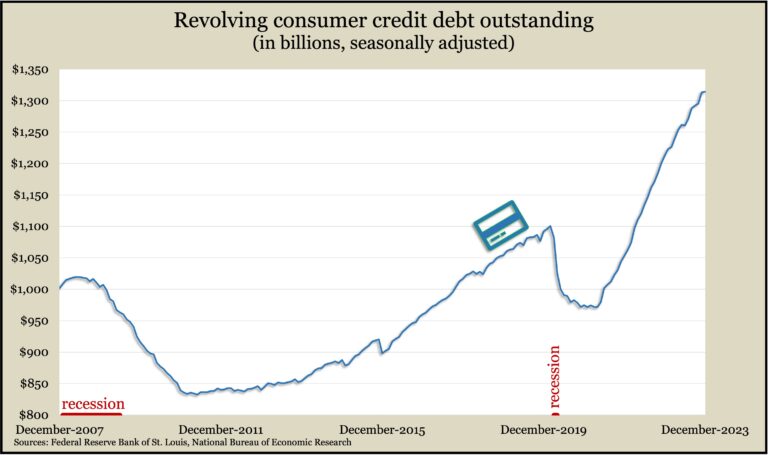

The Federal Reserve reported a slower increase in consumer credit card debt outstanding in December. So-called revolving credit debt rose at a 1% annual rate in December, the 31st gain in 32 months – and the slightest advance in that period. For the fourth quarter, credit card debt rose at a 6.8% annual rate, down from 10.1% in the third quarter. Economists look at credit card debt as a sign of consumer confidence. Consumer spending accounts for about two-thirds of U.S. economic activity.

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row, although it still reflected a historically tight hiring market. Data from the Labor Department showed the latest four-week average was 42% below the all-time average, dating back to 1967. As an early measure of layoff trends, new jobless claims have suggested employers’ reluctance to let workers. Total claims rose 6% from the week before to 2.2 million, which was 14% higher than the year before.

Friday

No major releases

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15991, up 362 points or 2.3%

- Standard & Poor’s 500 – 5027, up 68 points or 1.4%

- Dow Jones Industrial – 38671, up 17 points or 0.0%

- 10-year U.S. Treasury Note – 4.19%, up 0.15 point