Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 12-16, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

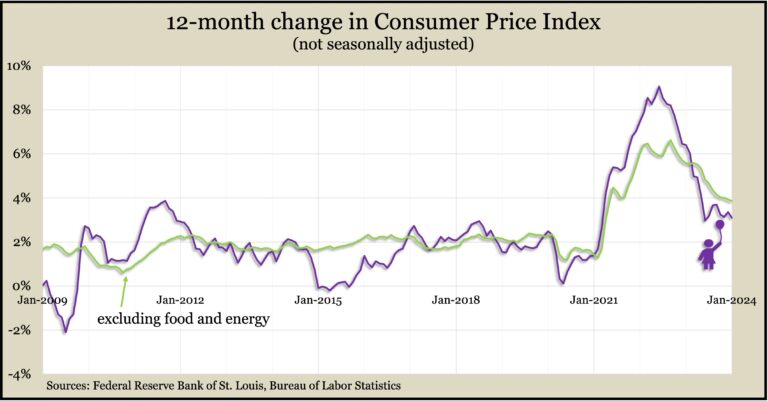

The pace of inflation continued to ease in January, though the decline was slowing. The Bureau of Labor Statistics said its Consumer Price Index rose 3.1% from January 2023. The rate was still above the Federal Reserve’s long-term target of 2%, but it was the lowest rate since March 2021 and down from a 41-year high of 9.1% in June 2022. Shelter costs accounted for two-thirds of the 0.3% increase in the index from December, the biggest monthly gain since September. A 3.3% decline in the price of gasoline helped offset higher housing costs. Excluding volatile food and energy costs, the core CPI rose 3.9% from the year before, the lowest since May 2021.

Wednesday

No major announcements

Thursday

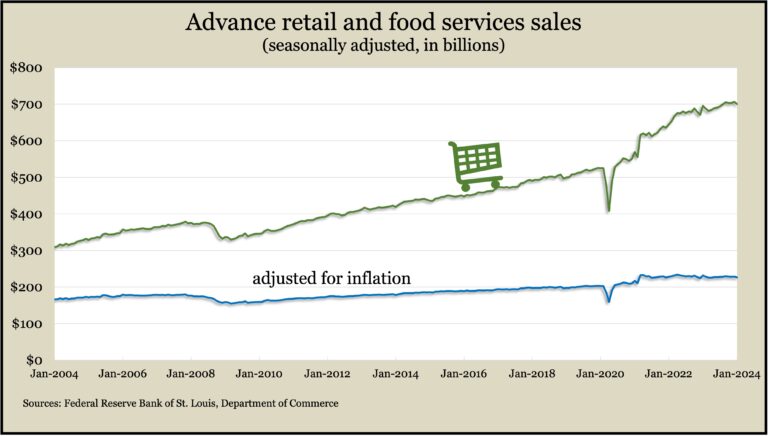

Harsh weather and a falloff from holiday shopping helped lower retail sales in January. The value of goods and services sold dropped 0.8% from December as nine of 13 retailer categories posted lower sales, the Commerce Department reported. In particular, car dealers and home-and-garden stores had fewer customers as winter storms struck various region. Sales at gas stations declined because of lower prices. Smoothing out some of the one-offs, the latest three months showed retail sales up 0.1% from the preceding three-month period. Adjusted for inflation, retail sales declined by 1.1% in January, the third setback in four months.

The Federal Reserve reported that industrial production dipped in January. The Fed cited winter storms as deterrents for both the manufacturing and mining sectors. Output for utilities expanded as a result of the extraordinary winter conditions. Lower demand overall meant industries’ capacity utilization shrank in January, down to 78.5%, the lowest in more than two years and well below the 50-year average of 79.6%. High capacity rates can indicate rising inflation.

The four-week moving average for initial unemployment claims rose for the third week in a row to the highest point since early December. An indication of employers’ reluctance to let go of workers, the rolling average stayed 40% below the long-term average. Total jobless claims dropped 2.4% from the week before to 2.1 million, which was up 10.6% from the same time in 2023.

Friday

Inflation on the wholesale level rose 0.3% in January, reversing a slight decline in December. Prices for goods sagged, especially for food and energy items, partly offsetting gains in service costs. The Bureau of Labor Statistics said the Producer Price Index increased 0.9% from the year before, down from a peak of 11.7% in March 2022. The core PPI, which excludes volatile prices for food, energy and trade services, rose 0.6% from December, the most in a year. The core was up 2.6% from January 2023.

The Commerce Department showed monthly weakening in housing in January, as the annual rate of building permits and housing starts trended lower, but remained at or above pre-pandemic levels. Indicators were stronger for single-family houses, which made up 75% of starts and 69% of permits. Single-family permits, which indicate plans for future construction, were 36% higher than the year before and the highest level in nearly two years. The annual rate of houses under construction hovered near record levels dating back to 1970.

The University of Michigan reported that its consumer sentiment index rose slightly in February, strengthening an upward trend built on reassurance from slowing inflation. The survey-based indicator was up about 30% from November, though still 6% below its long-term average, dating back to 1978. Economists see consumer confidence as a precursor to consumer spending, which accounts for about two-thirds of the U.S. gross domestic product.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15776, down 215 points or 1.3%

- Standard & Poor’s 500 – 5006, down 21 points or 0.4%

- Dow Jones Industrial – 38628, down 43 points or 0.1%

- 10-year U.S. Treasury Note – 4.30%, up 0.11 point