Podcast: Play in new window | Download

Landaas & Company newsletter February edition now available.

Advisors on This Week’s Show

Kyle Tetting

Dave Sandstrom

Mike Hoelzl

(with Max Hoelzl and Joel Dresang, engineered by Kevin Lofy)

Week in Review (Feb. 6-10, 2023)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

The U.S. trade deficit expanded to a record $948 billion in 2022, 12% wider than in 2021, the Bureau of Economic Analysis reported. In December alone, the gap grew more than 10% as exports shrank, led by declines of industrial materials and consumer goods. Imports rose in December, with U.S. consumers buying more imported automobiles and cell phones. As a share of the overall economy, the trade deficit was 3.7% of gross domestic product in 2022, up from 3.6% in 2021.

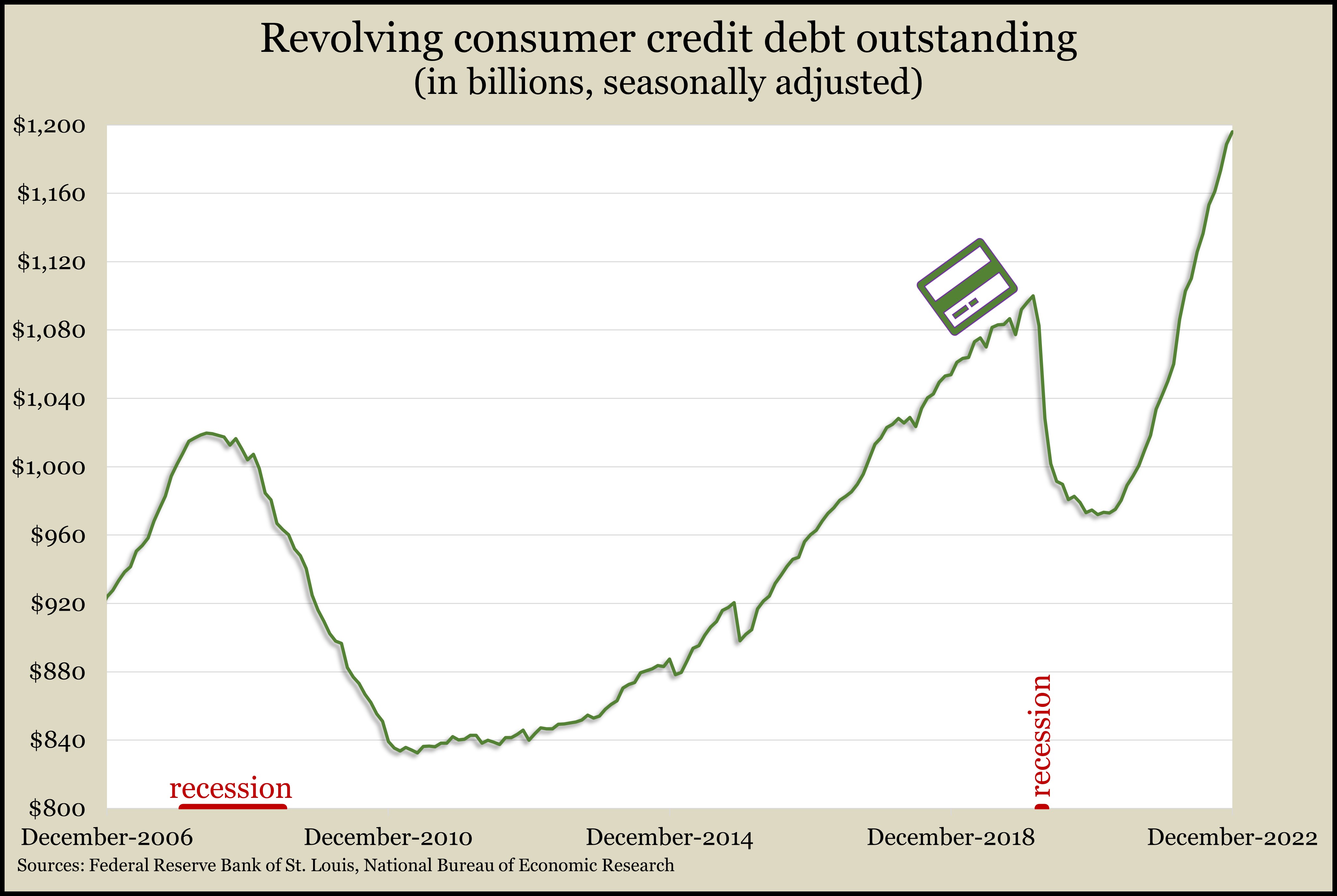

In another sign that economic growth may be slowing, the Federal Reserve reported a lower increase in consumer credit card debt outstanding in December. So-called revolving debt rose at a 7.3% annual rate in December, down from nearly 16% in November and the slowest in 17 months. The pace of consumer credit debt overall – including student loans and automotive financing – rose 2.9% in December. With consumer spending driving about two-thirds of the gross domestic product, credit card debt can be considered a gauge of spending confidence. The level in December was $96 billion or 9% above its pre-pandemic peak.

Wednesday

No major releases

Thursday

The four-week moving average for initial unemployment claims declined for the ninth week in a row, reaching the lowest level since April. Data from the Labor Department showed the latest four-week average was 49% below the all-time average, dating back to 1967. As an early measure of layoff trends, new jobless claims have suggested employers’ reluctance to let workers go in a tight labor market. Total claims rose 2.7% from the week before to 1.9 million, which was 13% lower than the year before and less than one-tenth the total at the same time in 2021.

Friday

The University of Michigan said consumer sentiment edged up from January as well as the year before, but overall it was 22% below its average since 1978. Short-term inflation continued to worry consumers as well as a concern that higher unemployment may lie ahead. University researchers said their survey results suggest consumers will be cautious in coming months.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11718, down 289 points or 2.4%

- Standard & Poor’s 500 – 4090, down 46 points or 1.1%

- Dow Jones Industrial – 33869, down 57 points or 0.2%

- 10-year U.S. Treasury Note – 3.74%, up 0.21 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.